If you’re not already a subscriber to Leveling Up and want to join other curious music industry professionals, creators, investors, and entrepreneurs, enter your email below and you won’t miss out on future newsletters:

GM readers 👋,

Happy 2025!

There’s recently been a lot of debate among investors, music industry professionals, and entrepreneurs about the future of the Major record labels. Will the Majors be able to grow streaming revenue inline with Wall Street expectations? Has the balance of power shifted away from the Majors to streaming platforms? Do artists even need Major labels to achieve superstardom anymore?

Universal Music Group (“UMG”) – the largest Major by revenue – is a company at the heart of this debate. While UMG has its critics, the company also has some savvy and well-funded backers. And its biggest investors feel that UMG remains “an attractive long-term investment.”

In my opinion, this ongoing conversation has lacked some depth and failed to acknowledge the dynamic nature of the playing field. I want to take a swing at clearing things up in this piece.

So let’s explore the following -

Why do investors believe that UMG is an attractive investment?

What’s holding back the bullish thesis?

What is UMG’s strategy to address these concerns?

Given the above, how might UMG convince the market of its investment case?

Keep in mind – I write this newsletter to learn in public, and this topic is complex. I’d love to hear your thoughts, so please shoot me a note if you have any feedback, alternative takes, or think I missed something.

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. I’m not a licensed investment professional. This piece is for informational purposes only. None of this is tax, financial, investment, or legal advice. As far as I’m aware, I don’t own any UMG stock right now. Do your own research!

Two final items before diving into the post -

I’m sure most of you saw the news of the New Year’s Day tragedy in my hometown of New Orleans a few weeks ago. If you’d like to support the families of the victims, consider donating here.

My heart goes out to everyone impacted by the fires in Los Angeles. I wanted to share links to a couple of incredible organizations – Baby2Baby and Los Angeles Fire Department Foundation – working tirelessly to provide relief and support those impacted. If you’d like to make a donation to these organizations, click here and/or here.

Now, let’s get after it!

Jimmy

UMG: The Show Me Story

“I think music is forever. Music is a many thousand year old part of the human experience. And I think it will be thousands of years from now…And [Universal Music Group] basically owns a third of the global recorded music [business]. And that’s the most dominant market share in the business.” - Bill Ackman, founder and CEO of Pershing Square Capital Management

What feels like many moons ago, I was an analyst at a firm that invested in public companies. Certain companies became unaffectionately known as “show me” stories. This typically meant that a company’s financial results had underperformed expectations and the stock price had declined. For the company’s stock price to recover, investors needed to see better results before they felt compelled to buy shares, as opposed to simply taking management’s guidance and their confidence in the business’ prospects at face value.

If you’ve been following music industry news over the past few quarters, Universal Music Group (“UMG”) seems to fit the mold of a show me story. In July 2024, UMG reported its 1H 2024 earnings, which caused analysts and investors to become increasingly concerned about the company’s future growth prospects, particularly in comparison to streaming services like Spotify. As Leveling Up has written about, UMG’s recent revenue growth has been driven by the emergence of streaming. However, the company’s growth has been decelerating over the past couple years, with its subscription streaming revenue growth decoupling from that of Spotify.

In response to UMG’s 1H 2024 results, several banks (e.g., Citi, Wells Fargo, Guggenheim, Barclays) downgraded their ratings on the company’s stock, and the company’s share price fell ~30%, erasing over €10 billion off its market capitalization.

Then in September 2024, UMG hosted a Capital Markets Day to lay out its strategy and financial outlook. At the four-hour-long event, the company’s top execs outlined UMG’s track record for identifying and developing superstars, its runway for future growth, its future capital allocation priorities, its deep bench of talented executives, and much more. Importantly, UMG guided to high single digit revenue growth and mid twenties percent EBITDA margin targets through 2028, which was in-line with its guidance before going public in 2021.

UMG’s CEO Sir Lucian Grainge summed up his pride and confidence in the company’s history, trajectory, and positioning: “Simply put, UMG is not only the most successful company in the entire history of the music business, but also the company that is the most essential in driving the industry forward.”

Wall Street analysts’ reviews of the presentation were generally positive. JP Morgan’s analysts said it was “one of the best capital markets days we have attended in the past 30 years, and it further increased our already high conviction in the UMG story.” High praise!

Nevertheless, UMG’s share price hasn’t fully recovered. It remains ~15% lower than the closing price the day before the significant 1H 2024 earnings sell-off. And unless an investor was able to participate in the stock’s 36% IPO pop, long-time shareholders likely haven’t seen their shares appreciate much, with the stock still ~5% lower than the closing price on UMG’s first day of trading publicly.

As you’ll see, this piece dives into the streaming market’s evolution and how UMG is positioning for it. Based on my research, I believe that UMG has a thoughtful and adaptable leadership team. And the implications of their current strategy will likely impact what a Major record label looks like in the future – both from a business model and a financial profile standpoint. And these are things that I don’t think are fully appreciated by the market quite yet.

But first, let’s set the foundation here and understand the bull case for investing in UMG.

Why Do Investors Believe UMG Is An Attractive Investment?

To set the foundation here, why is UMG’s existing investor base excited about its story? We can begin to get an idea by looking at Pershing Square’s original investment thesis. Yes, Pershing Square laid out this thesis almost four years ago. But the fund’s more recent commentary on UMG suggests that it believes many (if not all) of the underlying assumptions driving its positive view on the stock still hold.

As background, Pershing Square is a top performing global hedge fund, with ~$18 billion of assets under management. Shortly before UMG went public in September 2021, Pershing Square acquired a ~10% stake in UMG directly from the French conglomerate Vivendi in a negotiated transaction at a price of €18.27 per share. The fund remains one of UMG’s top shareholders, although it’s begun selling some of its UMG holdings recently.

Around the time of making its investment in June 2021, Pershing Square laid out its investment case in a presentation. The fund identified eight criteria necessary to make an investment. And felt that UMG strongly met each of these criteria.

The presentation is insightful, so I’d encourage you to watch it if you have time. But let’s quickly recap each of Pershing Square’s criteria as it applies to UMG -

Exceptional management & governance: UMG is led by Sir Lucian Grainge who has spent his entire career in the music industry, is knighted, and is regularly awarded the number 1 spot on Billboard’s “Power 100” List.

Grainge has assembled a group of talented executives, who are given autonomy to operate their businesses. UMG has acquired business and retained their founders to keep building within the wider UMG ecosystem. Examples include Monte & Avery Lipman at Republic Records and Nat Pastor & JT Myers at Virgin Music. Finally, whereas Warner Music Group’s voting control is concentrated in the hands of Access Industries, UMG’s voting control is more dispersed among shareholders (albeit still concentrated among its top four holders).

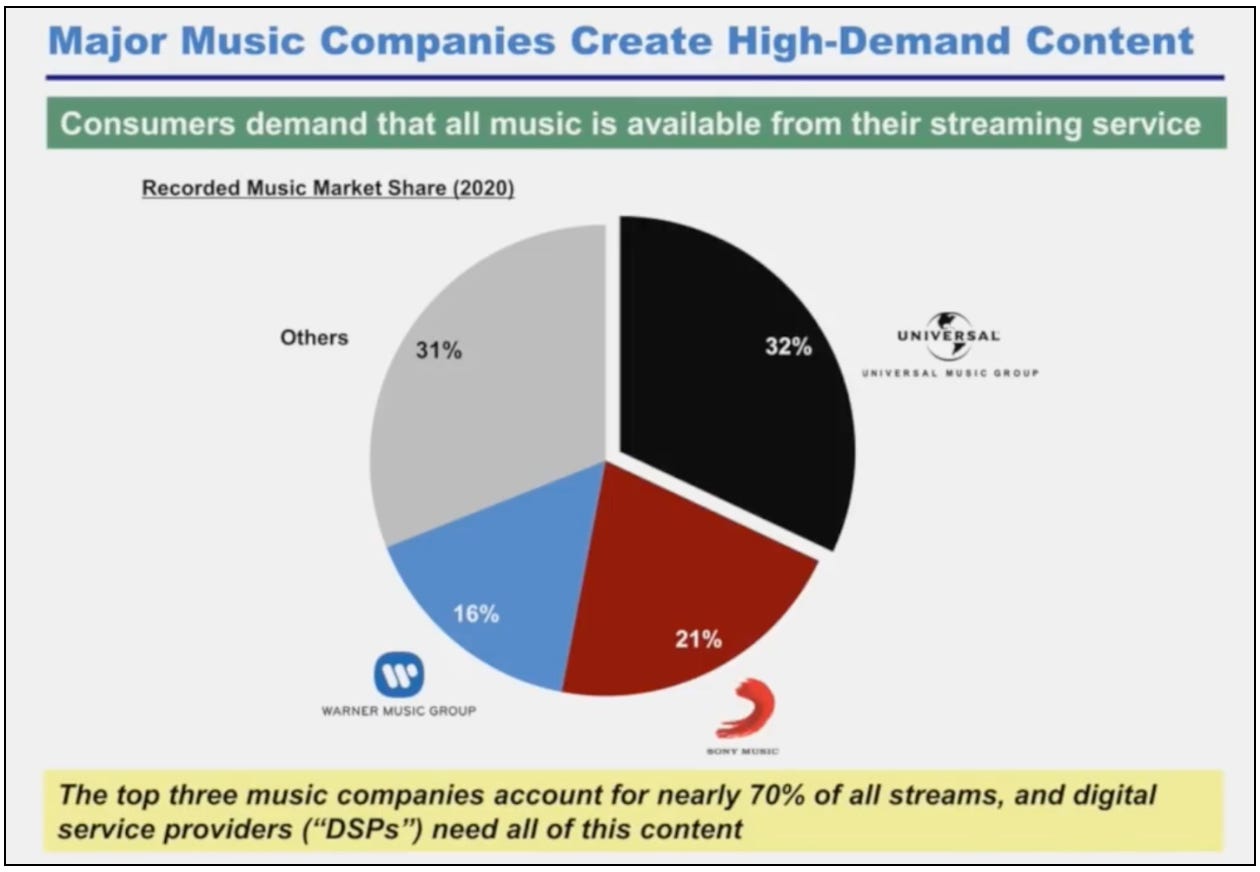

Source: Pershing Square Formidable barriers to entry. UMG is one of the three largest record labels in the world, with a ~32% recorded music market share as of 2020. As a result, streaming platforms need UMG’s content to be competitive with other services. Bullish investors argue that this gives labels like UMG enhanced negotiating leverage with the streaming platforms.

UMG is also consistently home to the majority of the top 10 selling recorded music artists in the world. According to Pershing Square, UMG is better than any other music label at making aspiring artists into global superstars given the company’s global scale, diversified services offering, and unique ability to identify future stars.

Limited exposure to extrinsic factors that can’t be controlled. At the time of its investment, Pershing Square talked about UMG’s limited exposure to macroeconomic shocks, such as a recession or pandemic. It pointed to the recorded music industry’s steady growth since the launch of streaming and UMG’s 5% organic revenue growth rate, during a COVID-19-impacted 2020. In short, the company’s business model was expected to be resilient in challenging business climates.

Strong balance sheet. UMG has an investment grade credit rating, with a relatively low ratio of debt relative to operating income.

Simple, predictable free cash flow generative business. UMG generates the majority of its revenue from streaming. Investors, like Pershing Square, viewed the business model shift – from physical (i.e. CD) sales that are lumpy and less predictable to streaming sales that are recurring and more predictable – as favorable.

This new business model, which Pershing Square called “Music-as-a-Service,” had other positive implications that supported the investment case. These included a more convenient user experience; a larger addressable market given the growing prevalence of smart phones outside of developed markets; and lower capital requirements. (In my opinion, there are implications caused by this business model shift that aren’t included in Pershing Square’s list that are impacting UMG’s results and strategy now. We’ll return to this in a bit.)

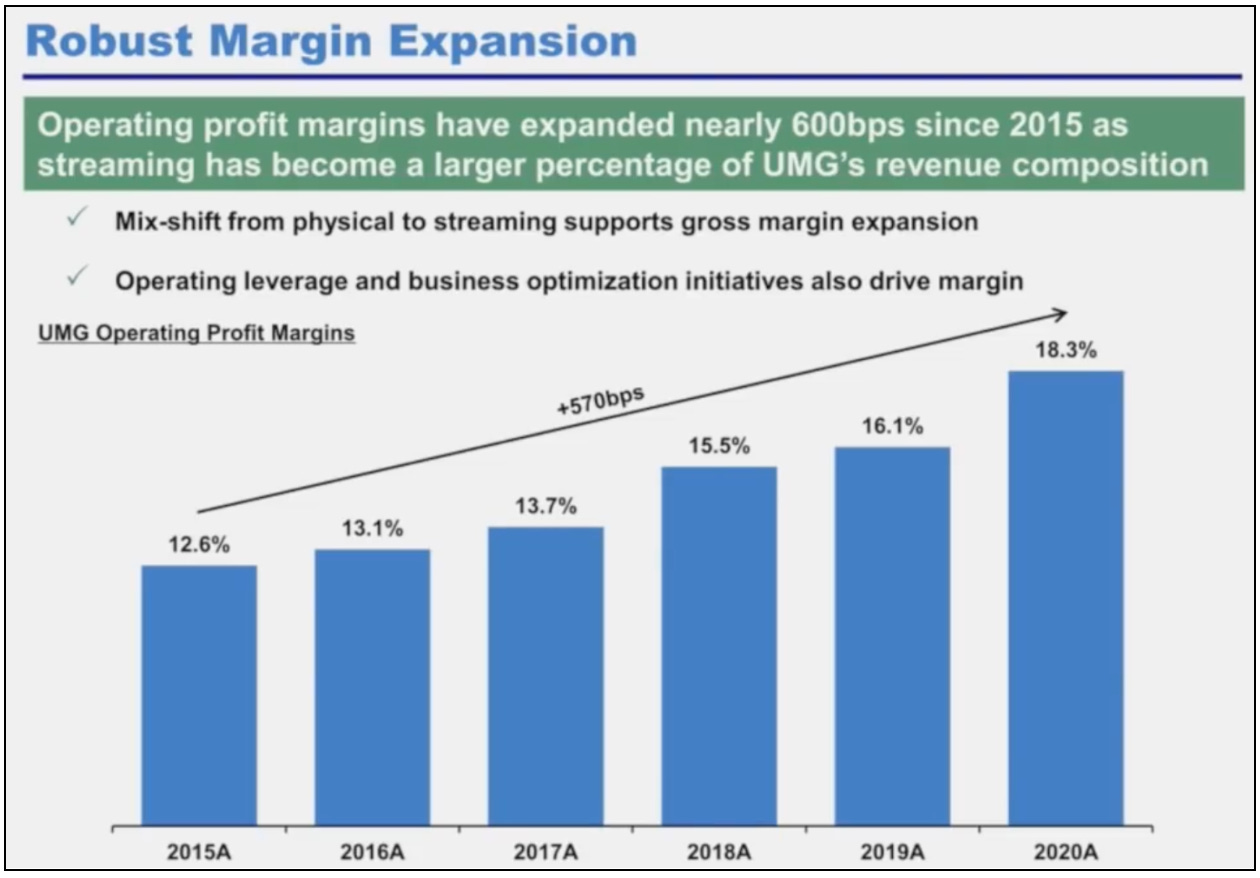

The lower capital requirements of a streaming-driven business combined with initiatives to reduce UMG’s marketing, A&R, and general overhead costs have resulted in operating profit margin expansion (i.e. more profit per dollar of revenue).

In short, Pershing Square believed that streaming would continue to drive further recorded music industry growth, with more predictable revenue and better unit economics (i.e., margins) than had been realized in the CD and download eras. It felt that UMG was the company best positioned to capture these industry tailwinds. And for UMG investors, this would lead to very attractive free cash flow generation in the future.

Minimal capital markets dependency. Given UMG’s profitability and healthy balance sheet, UMG is not dependent on frequently raising capital to sustain and grow its business.

Large market capitalization. At the time of its Pershing Square’s investment, UMG had an equity valuation of ~$33 billion.

Attractive valuation. At the time, Pershing Square primarily compared UMG’s valuation to the other publicly-traded Major label, Warner Music Group (“WMG”). It also compared its valuation to other large media companies like The Walt Disney Company; digital platforms like Spotify and Netflix; and large technology companies like Alphabet/Google, Oracle, and Adobe. The fund noted that UMG’s valuation (depicted below) was roughly in-line with that of WMG, despite having faster revenue and operating income growth with higher operating margins.

And UMG’s market capitalization at the time was a fraction of that of large media and tech companies, despite its iconic IP portfolio, high growth rate, and predictable, streaming-driven revenue profile. Finally, Pershing Square pointed out that UMG was valued at about half the multiple of Netflix, despite having a higher gross margin and requiring less capital spending to sustain growth.

In summary, certain investors argue that streaming is transforming music IP companies into fast-growing, capital-light annuities which deserve to trade at high multiples. For Pershing Square, UMG is the best positioned music IP company for this business model shift. Along these lines, it noted that the company had a strong management team; was growing faster; and had higher margins than competitors. As a result, the thesis was that it should trade at a higher valuation multiple than its peers.

Personally, I find this argument to be compelling. Let’s try to unpack why some investors might have become skeptical. And then consider if there’s anything UMG might be able to do to address potential investor concerns.

What’s Holding Back The Bullish Thesis?

In my opinion, investors like Pershing Square got a lot right at the time. It’s rare to find a business at this scale, growing at a double-digit rate despite a challenging macro environment, and with EBITDA margins in excess of 20%. And their returns bear out the thesis. UMG’s share price has increased ~30% since the fund’s investment.

Still, as noted earlier, UMG’s share price is lower now than its closing price on IPO day in September 2021. And the company’s backers feel that its stock price is “substantially undervalued”. So why isn’t the stock performing as investors and management expect?

The biggest challenge the company faces today is its struggle to meet investors’ expectations for streaming revenue growth. To be clear, UMG has delivered on its revenue guidance prior to its 2021 IPO. At that time, the company guided to a high single-digit total revenue compound annual growth rate (“CAGR”) over the medium term.

But public market investors are focused on UMG’s streaming revenues, which are a key driver of sustainable, recurring revenue. And this segment’s growth has started to decelerate. This came to a head when UMG reported its 2Q 2024 results. The company reported subscription streaming revenue growth of 6.9% year-over-year, which was well below Wall Street analyst estimates of ~11% growth and Spotify’s equivalent revenue growth of 21%.

To understand what’s driving UMG’s recent revenue results, let’s look at two things – how the global recorded music streaming market size has evolved vs. expectations and 2) how UMG’s share of the market has evolved vs. expectations.

How Has the Streaming Market Size Evolved?

A slowdown in streaming growth isn’t just a UMG issue. According to IFPI, global recorded music streaming revenues have been decelerating over the past couple of years.

If we compare the market’s recent trajectory (~10% growth) to how investors forecasted the global streaming market to grow back in 2021 (greater than ~15% growth through 2025), it appears that the market is evolving at a slightly slower pace than bullish investors were expecting.

In summary, part of UMG’s streaming revenue growth problem is a streaming market growth slowdown. As we’ll discuss, UMG is focused on addressing this issue and spent a significant amount of time during their recent Capital Markets Day talking about why they believe there is still a tremendous amount of streaming spending to unlock.

How Has UMG’s Market Share Evolved?

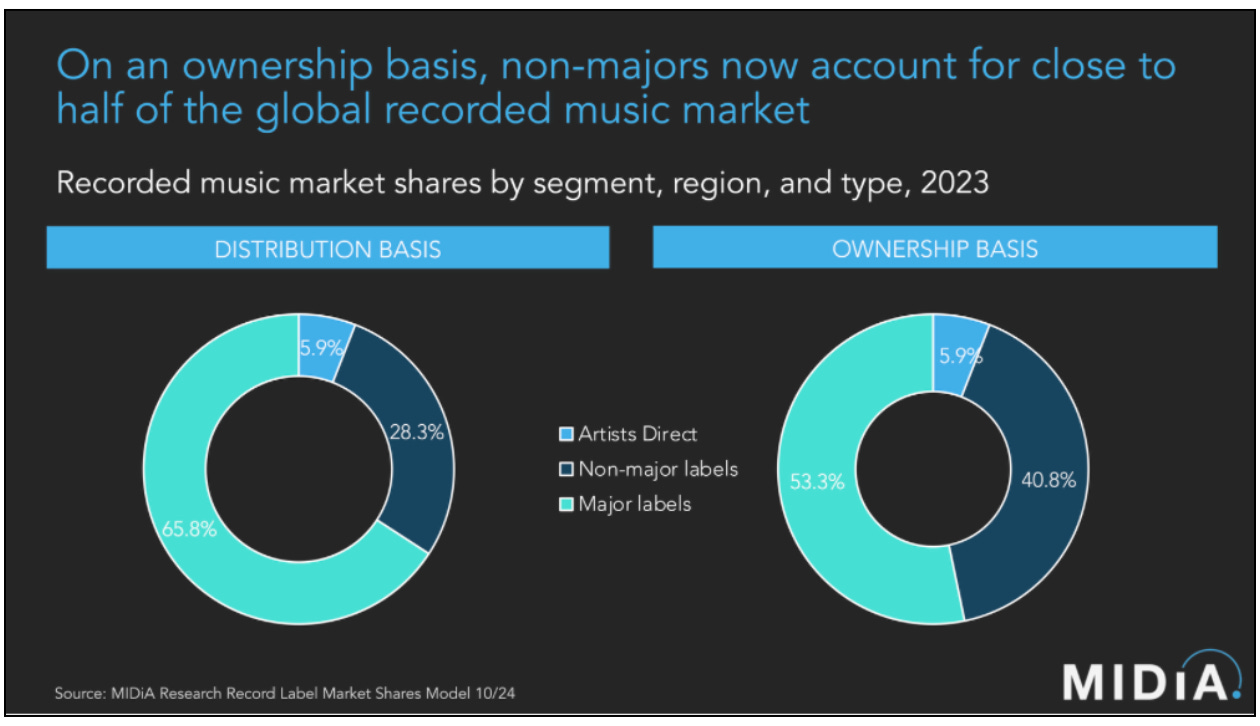

In addition to the global streaming market slowing down, UMG appears to be struggling to maintain its recorded music market share. According to MIDIA, non-Major labels have grown their recorded music revenue faster than UMG and the other two Majors from 2018 to 2023 (~15% CAGR vs. ~12% CAGR).

And this is reflected in UMG’s declining market share over the period.

If we look at market share on an ownership basis instead of a distribution basis, this picture is even worse for Major labels like UMG. As a reminder, the Majors own artists’ copyrights in exchange for capital and services (their longstanding business model). However, they are also increasingly servicing copyrights (such as providing distribution) and not requiring artists to give up ownership of their copyrights into perpetuity in return. According to MIDIA, the Majors only accounted for ~53% of the recorded music market on an ownership basis versus upwards of ~65% on a distribution basis. This implies that ~20% of the Majors 2023 recorded music market share is derived from revenue in which they don’t own the copyright!

A similar market share dynamic seems to be occurring on large music streaming services. The three Majors – UMG, Warner Music, and Sony Music – and Merlin have gradually lost music streaming volume market share on Spotify over the past 5+ years. In 2017, their collective share was 87% but it declined to 74% in 2023.

Bullish investors likely weren’t expecting this dynamic back in 2021. For example, Pershing Square’s CEO Bill Ackman summarized how he contextualized UMG’s valuation at the time, “What’s [UMG] worth? … If you came to me and said, ‘What would you pay to own a third of the world’s music content? And an engine or a platform to identify the best artists in the world, so that you can keep taking more and more market share over time?’”

In other words, many investors were probably thinking UMG’s formidable barriers to entry would not only enable the company to enjoy the tailwinds of streaming market growth but also allow it to continue to gain market share over time. However, the opposite appears to have taken place over the past several years.

The key drivers of UMG’s declining market share include:

UMG currently has a lower market share in geographic regions driving recent streaming market growth. Markets outside of North America and Western Europe are driving streaming growth in recent years. Several large Western streaming markets – like the US and UK – appear to be reaching a point of saturation. Meanwhile, countries in Asia, Eastern Europe, and Latin America are driving the growth in premium streaming volumes. But Western rightsholders, like UMG, have a lower market share in these regions. For example, UMG derived ~51% of its revenue from North America in 2023, with Asia, Latin America, and the Rest of World contributing ~20% of its revenue. In comparison, ~35% of Spotify’s premium subscribers are in Asia, Latin America, and the Rest of World regions.

UMG’s catalog has to compete with a flood of new content being uploaded onto streaming platforms. As investors have pointed out, the cost of distribution in a streaming world has decreased significantly. While this provides better unit economics for music IP companies like UMG, a trade-off is that the Majors have lost significant control over distribution practices. With the emergence of DIY distribution platforms and UGC content platforms, the number of tracks being uploaded via independent distribution to music streaming services has increased exponentially in recent years. According to Luminate, in 2024, only ~8% of music content uploaded onto streaming platforms came from the Majors. In short, an accelerating influx of new content uploaded to music streaming platforms has eroded the major labels’ share of total streaming payouts over time.

The music industry value chain has become more competitive. UMG may be the best at finding and making an artist into one of the Top 10 selling global superstars. But artists have more choices to build their career than ever before. Everyone can now access a global audience by uploading their content to streaming services (even if it’s harder than ever to scale an audience in a sea of content). And a growing number of companies offer record label tools and services without requiring a traditional Major label deal of giving up copyright ownership into perpetuity.

In summary, the other part of UMG’s streaming revenue growth problem is that the company’s slice of the market appears to be gradually shrinking. Again, UMG is focused on addressing this issue too and has adopted a range of strategic approaches to reverse this trend.

UMG’s Strategy To Accelerate Growth

Now that we have identified the obstacles impacting UMG’s streaming revenue growth. Let’s look at some of the ways the company is attempting to overcome them. After researching this piece, this is one area where I have been particularly impressed with UMG’s leadership.

Not only does UMG’s management team see how the market is evolving, they are taking aggressive actions. In my experience, not every large public company would be so adaptable – particularly when some of the decisions will likely have a negative impact on profit margins. Maybe UMG’s leadership believes that there is simply less time to waste, as others may soon find out.

Actions to Accelerate Streaming Market Growth

UMG spent a significant amount of time at its recent Capital Markets Day talking about the untapped growth potential of the streaming market. I agree with the company and have already written extensively about it, so I’ll refer you to that piece if you’re interested in learning more.

To briefly summarize, UMG is targeting an 8% to 10% paid subscription streaming revenue growth CAGR through 2028 via a mix of subscriber growth and improved monetization (i.e., Average Revenue Per User aka “ARPU” growth).

For subscriber growth, UMG expects paid streaming subscribers to grow from 670 million in 2023 to 1+ billion by 2028.

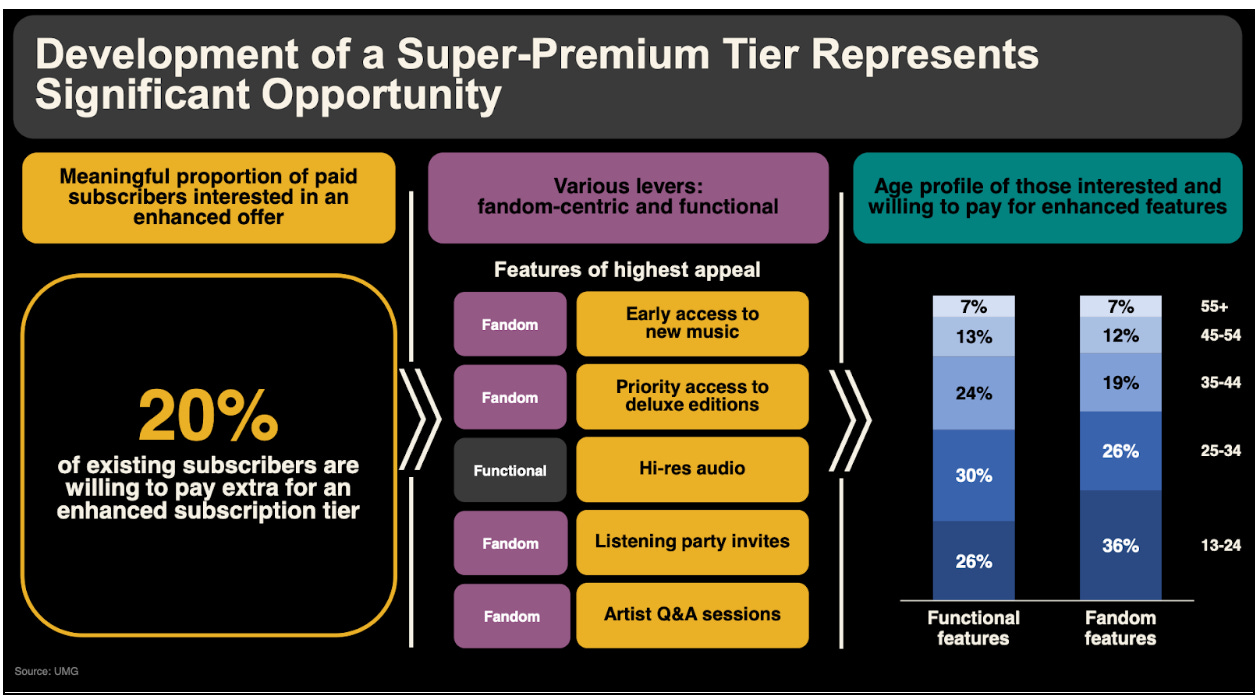

Regarding monetization, UMG notes how undermonetized music is relative to other forms of entertainment and what consumers spent in the CD era. The company expects streaming services to gradually increase prices over time and is working with streaming platforms to roll out new features and pricing tiers that better monetize artists’ biggest fans (or “superfans”).

While overall streaming market growth is an important value driver for UMG, it is somewhat out of the company’s control. Ultimately, the streaming platforms likely have the most control over the levers that will determine industry growth. As bullish UMG investors note, the DSPs (e.g., Spotify and Apple Music) control the monthly subscription price increases; decide when to roll out premium superfan tiers and features; and so on. The growth of the overall streaming market is mutually beneficial for DSPs and music IP companies, like UMG. But all else equal, it’s important to acknowledge that UMG only has so much control over this growth lever.

Actions to Grow UMG’s Market Share

Increasing market share is another key lever to accelerate UMG’s streaming growth. And the company has relatively more control over this one than driving overall market growth. Along these lines, the company is taking aggressive action across several key vectors:

Scale quickly in “High-Potential Markets”. As discussed, UMG currently has a lower market share in regions driving recent streaming market growth. As a result, the company is focused on “aggressively investing” in these markets to grow its presence by building local A&R teams to identify local talent, providing services to local independent labels, and acquiring local labels and catalogs. Examples of this strategy in action include launching EMI Records in the Philippines; UMG’s global distribution deal with China’s TF Entertainment; Virgin Music’s global distribution deal with India’s Hungama Digital Media; UMG’s acquisition of a majority stake in Nigerian label Mavin Global; and its acquisition of the recorded music catalog of Thailand’s RS Group.

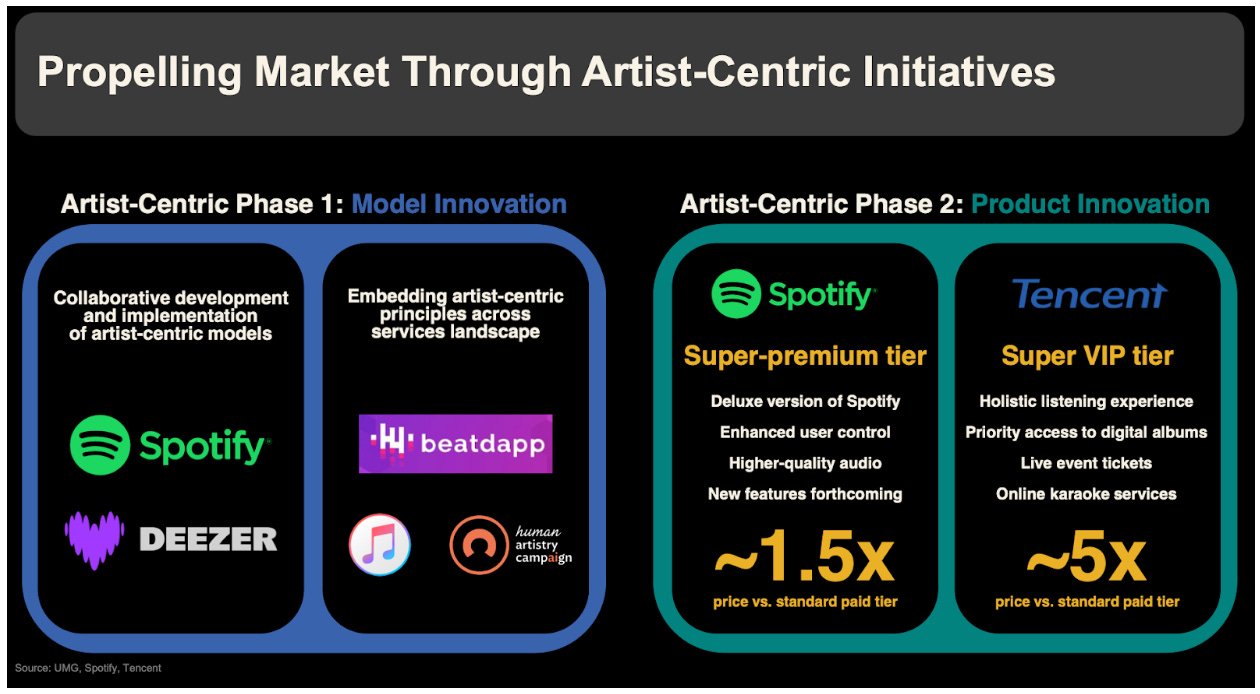

Restructure streaming’s payout model via “artist-centric” initiatives. Leveling Up has written about how UMG has taken several approaches to address the volume of new content on streaming platforms that is slowly eroding the Majors market share. First, the company worked with Spotify and Deezer to adjust the royalty payout model, so that a greater percentage of a platform’s royalty pool goes to “professional artists”. Second, UMG is working with streaming platforms to develop a “super-premium tier” that will look to monetize artists’ biggest fans, so that its artists receive a new pocket of revenue. Third, UMG has seemingly attempted to limit the flood of new content by suing digital distributors that allegedly enable uploads of unauthorized copies of copyrighted recordings.

Strike “better than market” licensing agreements with streaming platforms. The terms of the agreements between the Majors and streaming platforms aren’t public. But UMG has sought to strike direct deals with the DSPs that provide better economic terms for their artists. For example, UMG reportedly struck a direct licensing deal with Spotify that sees the royalties paid to its publishing company and songwriters avoid the DSP’s bundle-related discount. Offering artists and songwriters access to better DSP royalty payouts is another way to ensure UMG’s market share is maintained.

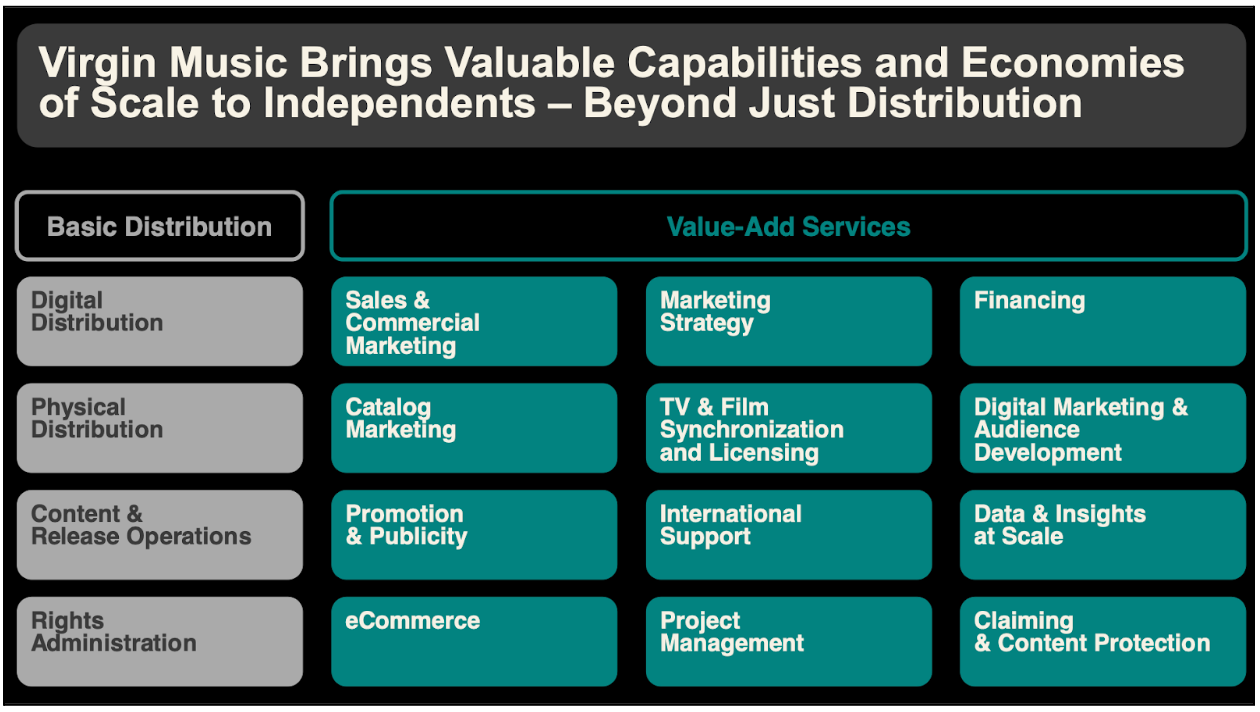

Expand within the independent music sector. As discussed, the independent sector is growing faster than the Majors and has gradually gained market share over the past several years. In 2022, UMG acquired mtheory’s label division and put its co-founders in charge of a new division within UMG called Virgin Music. Virgin Music is focused on building the company’s label and artist services business, seemingly serving as a beachhead in the fast-growing independent segment. Going forward UMG has made it clear that it intends to expand this business. UMG has partnered with a number of independent labels – such as Partisan Records, 3AM Entertainment, and Sumerian Records – by providing global distribution, marketing support, financing, and other services. And in December 2024, Virgin Music acquired leading artist services company Downtown Music for $775 million, which further enhances Virgin Music’s capabilities.

Scale complementary businesses to streaming. UMG is leaning into the superfan opportunity outside of streaming as well. For example, the company is developing premium physical collectibles and expanding its merchandise business. As a result, UMG’s physical and merchandise revenue has grown at a 19% CAGR between 2021 to 2023.

In summary, UMG’s leadership appears to be well-aware of the latest trends impacting an evolving music streaming market. And more importantly, the team is taking aggressive action to position the company to benefit from these emerging waves. With a sense of UMG’s strategy in hand, it’s worth considering the potential implications of these various approaches.

Potential Implications of UMG’s Strategy

Strategy comes down to choices. Here are a few of the potential financial implications that UMG may face in the future as a result of their strategic approach.

Faster revenue growth. The efforts (e.g., price increases, super-premium tiers, etc.) of streaming platforms to grow the overall market combined with UMG’s execution to increase market share should reaccelerate the company’s paid streaming revenue growth.

A business model shift from copyright ownership to servicing copyrights. A traditional label deal saw artists giving away copyright ownership and a large percentage of future royalties into perpetuity. In today’s streaming world, artists have other options that often allow them to retain these rights but still access label services. Major labels, like UMG, are adapting to the shifting landscape and investing more heavily in artist services. As discussed, MIDIA estimates that ~20% of Major label revenue was distribution service revenue in 2023. For labels, these contracts typically have much shorter duration, less control, and lower unit economics than that of a traditional label deal. All else being equal, this shift will likely make UMG’s revenue less predictable and lower margin. For example, if we look at the financial profile for artist services companies (Believe and Kobalt), we see strong growth but much lower profit margins than UMG has historically realized. As artist services revenue becomes a larger share of UMG’s total revenue, investors may weigh whether the sustainable, recurring nature of streaming revenues is a strong enough argument for a premium valuation multiple given the nature of service contracts being less favorable/profitable. As a result, I’d expect that investors will eventually want UMG to disclose revenue on a more granular basis (i.e., services vs. ownership) in the future.

Lower gross margins in the future. While UMG’s adjusted EBITDA margin has trended higher over the past few years, its gross margin has declined. I wouldn’t be surprised to see this trend continue, given the company’s shift from copyright ownership to artist services and its focus on growing merchandise and physical collectibles sales.

Heightened importance of realizing operating cost savings. Despite the decline in gross margin, UMG has done an impressive job of growing its EBITDA margin over time. It’s delivered these results through the effective management of its operating costs. With the investments being made into opportunities with potentially lower margins, it becomes even more important for UMG to execute its €250 million cost savings plan. It will also be interesting to see how UMG balances operational efficiencies without compromising on the quality of its service in an increasingly competitive market.

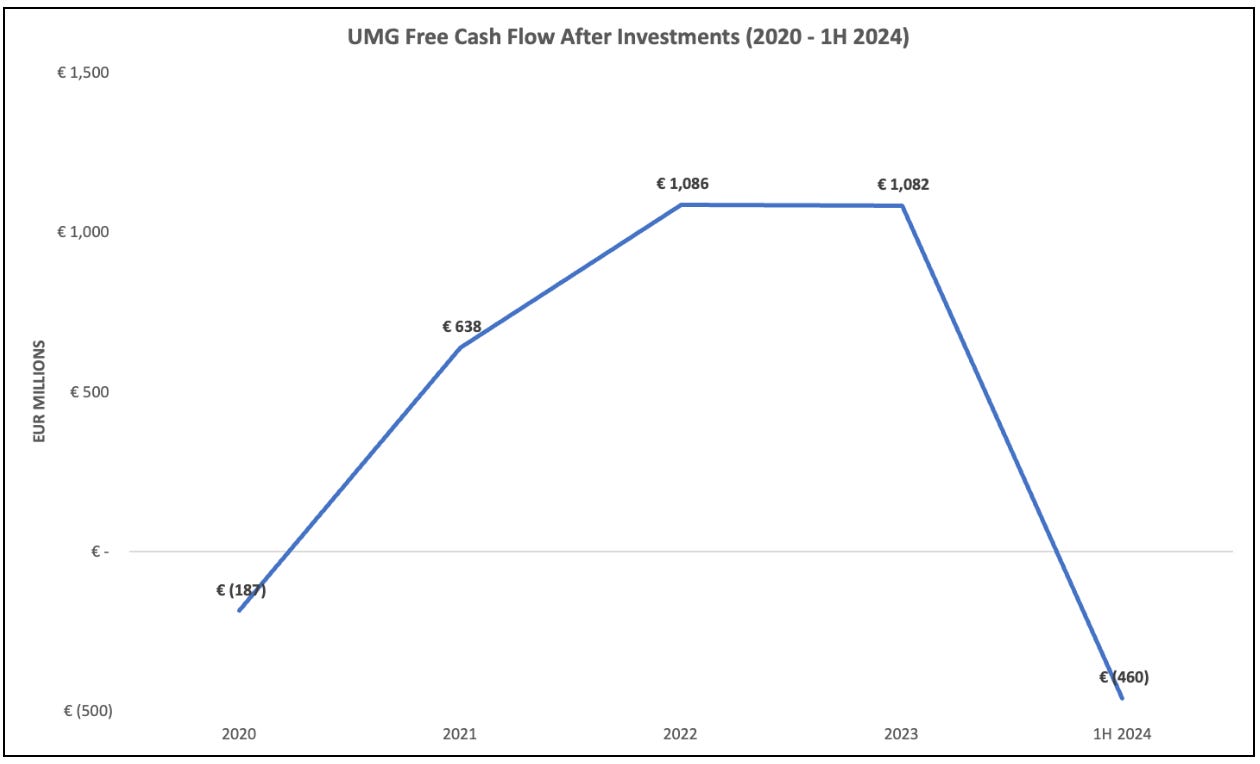

Lower free cash flow (after investments) profile over the near-term. UMG expects free cash flow before investments to continue growing through 2028. But in my experience, this metric is more akin to the company’s cash from operations than traditional free cash flow which can take into account capital expenditures. And given that the company has spent $500 million to ~$1 billion annually since 2020 on investments, these expenditures should probably be included in the free cash flow calculation. In order to navigate an evolving music market, I expect that we’ll see spending on growth investments (e.g., $775M Downtown Music acquisition) towards the higher end of that range over the next several years.

Higher leverage over the intermediate-term. UMG has been allocating ~100% of its free cash flow on growth investments and the dividend. If the company expects growth investments and the dividend to continue to increase, it wouldn’t be surprising to see leverage move up a bit over the next few years. That said, the company has a very healthy balance sheet right now, so it shouldn’t be a big deal.

In summary, UMG appears to be making smart choices that will ultimately enable the company to grow market share and accelerate its revenue growth. My biggest concern is that these choices will negatively impact its margins. To be clear, UMG’s management team is not guiding to that outcome – it sees EBITDA margins continuing to expand through 2028. And there are several moving parts (e.g., success of super-premium tiers, growth in artist services revenue, growth in merchandise revenue, growth in high-potential markets, success of UMG’s cost rationalization plan, etc.) that will determine this outcome. I haven’t been able to find detailed assumptions behind UMG’s EBITDA growth/margin guidance, so it seems difficult to understand what an investor needs to believe for management’s vision to be realized. Simply put, we’ll see.

Can UMG Convince Investors that It’s Undervalued?

I don’t intend to go deep into UMG’s valuation. The purpose of this piece is meant to be more strategy-focused. But I still feel like we need to at least touch upon UMG’s current valuation in order to consider any potential options for how to get its share price to start “working”.

I analyzed UMG’s valuation over time and against competitors. As a quick disclaimer, I’m using Capital IQ to source this data. I didn’t build it up from scratch using the financials. So this analysis should be taken with a grain of salt.

Looking at UMG’s valuation over time, we can see how its multiples (on a Enterprise Value to NTM EBITDA and Price to NTM Earnings Per Share basis) are trading at or around all-time lows. For example, UMG’s share price is down ~19% from its all-time high at the time of writing this newsletter, whereas its EV / EBITDA multiple is ~31% below its all-time high. In other words, UMG has shown strong EBITDA growth over time, but it isn’t being reflected in value.

Next, we can review UMG’s valuation relative to its competitors, it trades at a premium to music IP companies like Warner Music Group and at a discount to technology companies like Spotify and Netflix. Bullish investors who believed that UMG should trade at a premium to WMG around the time of the IPO appear to have been proven correct. Obviously that relative trade outperformance wouldn’t have mattered for investors who only bought UMG shares and have seen little-to-no growth.

Putting these two analyses together, I think that one issue for the UMG bull case appears to be where to anchor its valuation on a relative basis. It already trades at a premium to the other Major label that is publicly traded. Its forecasted growth rate isn’t as high as the technology companies that trade at a premium. And this doesn’t take into account some of the potential headwinds that the company may face as it looks to accelerate revenue growth by increasing investments in potentially lower margin opportunities.

So are there any other potential strategic approaches that the company could consider?

One idea being led by Pershing Square is to improve access for investors to buy UMG shares. Pershing Square wants to list UMG on a US stock exchange, so that – in theory – certain investors (who are unable to own an Amsterdam Stock Exchange listed company) have access to buying the company’s stock.

Another idea might be communicating a new valuation approach to the market. In my experience, investors typically see EBITDA as the key cash flow metric for public music companies, given all the costs associated with operating the business. Meanwhile, investors see Net Publishers Share (“NPS”) or Net Label Share (“NLS”) as the key metric for valuing music catalogs. Currently, it’s difficult to estimate the value of UMG’s catalog from publicly available information. That said, I’ve attempted to do a very rough example below (note that this is meant to be illustrative and small tweaks to the assumptions can have a big impact on the valuation).

In other words, a sum-of-the-parts valuation approach might enable UMG to demonstrate that its shares are currently priced below the estimated value of its back catalog, meaning no value is being attributed to its merchandise business or its label & artist services business.

Closing Thoughts

Universal Music Group’s share price has struggled to increase since the company went public 3+ years ago. A lot of the recent weakness stems from the investors’ concerns over UMG’s decelerating revenue growth, particularly its streaming growth. From my perspective, the UMG team is making several smart bets to reaccelerate growth in an evolving music streaming landscape.

However, this strategy will likely impact the company’s business model and financial picture beyond higher revenue growth. For example, a greater share of revenue will likely be derived from servicing copyrights rather than owning them; gross margins may be pressured due to the shift to artist & label services and focus on merchandise and physical collectibles; and free cash flow may decline over the next few years as more capital is allocated to investments that enable UMG to execute its vision.

So with these various crosscurrents can UMG convince investors that it’s undervalued?

I think so, but it will probably require a creative approach. A US stock exchange listing seems like an interesting option. Providing investors with enough data, so that they can build a valuation for UMG’s various businesses might be another one.

Again, this isn’t investment advice or a bet in favor of / against the company’s ability to create value from here. I write these pieces to learn in public, so please reach out with alternative takes. I’m excited to follow what the company and its investors come up with over the next 12 to 24 months!

Thanks to Hannah and Adam for the feedback, input, and editing!

Leveling Up’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. In addition, our work may feature entities in which Alderbrook Companies, LLC or the author has invested and/or has provided consulting services.

📚 Music Business, Tech, and Investing Content Worth Consuming

Here is some of the best content that I consumed over the past month or so –

Spotify’s Road to $100B and Profitability (Trapital: link)

2035: An Allocator Looks Back Over the Last 10 Years (AQR: link)

2024 Year-End Music Report (Luminate: link)

What Got You Here Won’t Get You There: How Spotify Built A New Business (MIDIA: link)

Reserves, Recycling, and Returns (AVC: link)

The State of Video Gaming in 2025 (Matthew Ball: link)

Influencer Culture is Creating Big Opportunities for Music Licensing (Billboard: link)

🤝 Want to Work Together? Get in touch!

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with labels, publishers, music technology companies and investors on a range of projects.

Our Investment Consulting Services -

Over the past few years, we’ve had the privilege of supporting several great investment firms. Our team is available to provide market and investment research, due diligence, and advisory support. Whether you invest in public markets, venture capital, private equity, or are a business or investment bank facilitating deals, we’d love to help you meet and exceed your investment goals.

Our Early-Stage Investment Focus -

In addition to our consulting services, we make early-stage investments, with a focus on companies building in media and government technology. If you’re a founder who is raising, please reach out to us!

To get in touch, you can either reply directly to this email or click the link below to fill out our contact form. We’ll be back in touch soon!

📭 Share Leveling Up with a friend!

If you enjoy Leveling Up, please consider sharing it with friends and colleagues (link to share)!

Great insight ! Thanks for sharing !

Fantastic discussion of the myriad of changes at UMG. Thank you for the solid effort!