The Music Industry’s Superfan Ambitions

Why is the industry so focused on monetizing artists' biggest fans?

If you’re not already a subscriber to Leveling Up and want to join other curious music industry professionals, creators, investors, and entrepreneurs, enter your email below and you won’t miss out on future newsletters:

GM readers 👋,

Happy April!

For the second month in a row, we have an exciting collaboration! This month we’re teaming up with Jesse Feister, Global Head of Creator Marketing at Twitch. Jesse has an impressive background that spans various roles at the intersection of music and technology. Earlier in his career, Jesse played drums and wrote songs in a rock band signed to Island Records and Warner/Chappell. Later, he co-founded a music tech startup Songspace (now a part of FUGA), managed global digital partnerships at Kobalt Music, and led the go-to-market team for Kobalt’s AWAL. At Twitch, Jesse is thinking about how to attract, retain, and help creators monetize their biggest fans on a day-to-day basis. Honestly, I couldn’t hope for a better thought partner to tackle this month’s topic.

This month we’re going to be taking a closer look at the music industry’s buzzword of the moment: “superfans”. Much ink has been spilled covering this trend over the past few quarters. Industry leaders like UMG CEO Lucian Grainge and WMG CEO Robert Kyncl made it clear in their annual letters that superfans are a priority.

In this piece, we aim to better understand why folks are so excited about the potential of monetizing musician’s biggest fans in 2024; how big the opportunity could ultimately be for the industry; what barriers stand in the way of unlocking that value; and finally, how participants are positioning to ride this potential wave. 🌊🏄

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. I’m not a licensed investment professional. This piece is for informational purposes only. None of this is tax, financial, investment, or legal advice. Do your own research!

Now, let’s get after it!

Jimmy

The Music Industry’s Superfan Ambitions

“This for every single fan that know every single line / So I'm saying thank you for loving me / For setting me free and letting me be me.” - Logic on the song Thank You

In 2007, I (Jesse here 👋) moved with my band to Chicago with the hopes of growing a fan base, getting a record deal, and taking over the world. We only accomplished 2 of those 3 goals, and I’ll leave it to you, reader, to figure out which ones. But in the process of trying, we learned a valuable lesson about fandom that’s as relevant today as ever.

Of all the possible people we could reach, we realized that by far the most valuable were a specific group of music fans who were surprisingly easy to find and connect with. They were the ones who were willing to stand in line early, waiting for venue doors to open at the concerts of larger bands on tour. There they were queued up, decked out in their favorite artists’ merch, and ready to take a burned demo CD from an unknown band. They weren’t just fans. They were what industry pundits and professionals refer to as “superfans”.

Superfans are en vogue today. They’re at the center of conversations around drivers for future music industry growth. Universal Music Group’s CEO Sir Lucian Grainge identified them as a 2024 company priority in his annual letter, and WMG is reportedly building a superfan app for likely the same reasons. That’s in addition to a broader fandom product focus driven by streaming platforms like SoundCloud, Spotify, Tidal, and Amazon Music.

Why are superfans receiving the industry’s focus now? Who exactly are they? How big, really, is the superfan opportunity? And how are participants attempting to unlock their potential? In this piece, we’re going to try our best to answer these questions. But first, let’s walk through a little industry history to better understand how technological shifts from selling physical records to selling / licensing digital tracks have impacted the monetization of music fans.

The Past – The Rise and Fall of Industry Revenue

Leveling Up has written about how the internet disrupted the music industry’s monetization model. Whereas the shift from vinyl to cassette to CD as the dominant medium of consumption did not meaningfully deter the gradual upward trajectory of industry revenues, the introduction of the mp3 and the ability to share these digital files on the internet was extremely disruptive.

Napster, the pioneering file sharing software service, launched in 1999 and made the process as simple and efficient as possible. As a result, the industry lost control of content distribution. The scarcity associated with owning physical recordings was replaced by the ubiquitous nature of content on the internet.

The impact on industry revenues was severe. Piracy contributed to the nosedive in CD sales, the dominant format by revenue at the time. The RIAA, the trade organization that represents the US recorded music industry, reports domestic industry revenues declined from a peak of $14 billion in 1999 to $6.7 billion in 2014 – an incredible 54% drop! The graph above illustrates this progression (with blue bars indicating vinyl and cassettes, orange bars indicating CDs, purple bars indicating digital downloads, and green bars indicating streaming).

The Current State of Monetization – A Standardized Model

The advent of streaming has led to a well-documented resurgence in industry revenue. Still, the shift in the dominant form of consumption from physical to digital has transformed how music is monetized. It has resulted in music becoming more and more commoditized as rights holders have effectively lost the ability to control the price and quantity of their music.

Instead, the digital era is now marked by a standardization of pricing. Listeners typically pay $10 per month and then receive all of a music streaming platform’s available content. Juxtapose this monetization model with free-to-play video games, where the majority of revenue comes from in-app purchases with some of gaming’s biggest spenders shelling out $35 to $70 per day. In other words, music streaming currently doesn’t segment users by their willingness to pay beyond a simple freemium model.

Further aggravating this price challenge is that streaming platforms have been focused on growing their user bases over monetization. Music DSPs have been much slower than TV/film subscription services (e.g., Netflix) to raise prices and offer “family” and “student” plans to incentivize users to become subscribers. As a result, the average revenue per user (“ARPU”) on paid streaming services has declined significantly over time. According to ex-Spotify Chief Economist Will Page, the U.S. average monthly retail price of a streaming account has declined 25%, from $8.78 per account holder in 4Q 2016 to $6.58 in 3Q 2023. Along these lines, Euromonitor estimates that music spend as a percentage of entertainment spend has declined precipitously from ~8% in the late 1990s to ~5% in 2023. And this is at the heart of the opportunity the industry is trying to address.

The shift has created a gap between how much fans value music and what they’re paying for it. This is the essence of the superfan opportunity and, to describe it in detail, we need to lean on some concepts from microeconomics: willingness to pay and pricing optimization. It starts with a hypothetical. Imagine we asked every single music consumer how much they loved music, and how much they’d be willing to pay for the experience of listening and/or engaging with it. The price someone would be willing to pay is a function of how much they value music and their budget, or how much they can afford.

If we undertook this hypothetical “willingness to pay” survey experiment across the entire music consumer market, we’d end up with a graph that looks something like this:

We would expect there to be a wide range of “willingness to pay” across the entire music consumer market. At the high-end to the left of the chart there are die-hards like “Consumer A” and “Consumer B” who would pay a lot for their favorite music content. At the bottom-end to the right, there are consumers who are relatively indifferent and are willing to pay very little. In between, there are a range of propensities. This creates what microeconomists call a demand curve.

Since digital music scales infinitely, there are no supply constraints. Within this hypothetical, the industry would love to charge each consumer a different price that corresponded with how much they individually valued music (this is called price discrimination - consider how airlines price tickets). But of course, that’s much more controversial and complicated in practice than in theory. So, instead, the aim for music owners (and services providers) is to define a price for music on the demand curve that maximizes the total value captured across the entire base of consumers.

This is called pricing optimization. We can identify this optimal price by finding the price point on this demand curve where value capture is optimized across the entire consumer base. This is where total revenue is maximized for the product or service, which in our case is music streaming subscriptions.

As we know, the industry has landed on a general streaming price point of around ~$9.99 per month in developed markets. In theory, this should be the optimal price where # of subscribers x price = maximum possible revenue. There’s a valid debate around whether $9.99 is actually optimized, because competition across services may be keeping prices artificially low. This is a fair critique we’ve repeatedly heard from label heads and industry advocates. But for the purpose of this hypothetical, let’s take the current price.

We end up with a graph that looks something like the one below, where the music industry is able to capture the value in the green portion of the consumer base by charging full price, and then create alternate offerings (e.g., bundles, ad-supported tiers, etc.), represented in the blue quadrant, in an attempt to sell to the bottom of the market where consumers have a lower willingness to pay for music.

As you can see, there’s a huge triangle to the top left on this graph representing consumers who are willing to pay more than the $9.99 price for streaming subscriptions! But without the ability to monetize different customer segments in different ways, this is the best we can do. With a commoditized product, it makes sense to optimize prices to maximize revenue across the entire consumer base, even if some consumers are getting more than what they’re paying for, or what economists call a consumer surplus.

The gap of uncaptured value above the green quadrant exists because streaming services all offer a similar product at the same price. As a result, the industry isn’t fully accessing those fans’ willingness to pay.

Why Does The Superfan Opportunity Matter Now?

The uncaptured value marked in the chart below has existed for some time. So why is it becoming markedly more interesting to the music industry’s biggest companies now? As we’ll explain, it’s likely driven by a desire to find the next growth vector after streaming has driven incredible growth.

Industry revenues have exploded as streaming subscriptions became mainstream. The RIAA chart above illustrates how streaming has driven recorded music revenue from its nadir in 2014 to an all-time high of ~$16 billion in 2022. As a result, the major streaming platforms and music rights holders have benefited significantly. For example, Spotify’s premium subscriber base has grown 13x+ from ~18 million users to ~236 million users between 2015 and 2023!

Meanwhile, music’s largest labels and publishers have seen their revenues and profits accelerate. For example, Universal Music Group – the largest of the three “major” labels and publishers by revenue – has seen its revenue grow to €11.1 billion or at a 13% compound annual growth rate (“CAGR”) between 2018 and 2023. The company’s adjusted EBITDA has increased to €2.4 billion or at an impressive 19% CAGR over the period with UMG’s EBITDA margins expanding from ~16% to 21%!

During this period, streaming has been a major driver of UMG’s results and the broader industry’s results. For example, UMG’s recorded music streaming revenue has grown to €5.7 billion or a 17% CAGR – higher than total company growth – between 2018 and 2023. Meanwhile, recorded music streaming’s share of total UMG revenue has increased from 43% in 2018 to 51% in 2023.

Similarly, Will Page estimates that streaming made up 55% of global recorded music and publishing revenue in 2021, up from only 30% in 2017.

In these heady times for the industry, a number of rights holders and music streaming companies have gone public, including UMG, Warner Music Group, Reservoir Media, Believe, Deezer, and Anghami. Simply put, few were focusing on potentially under-monetized superfans when times were good, growth was strong, and the industry’s largest players were diving Donald Duck-style into their gold-coin filled swimming pools. (Only kidding. Well, partially.)

However, after roughly 10 or so years of rapid subscriber and revenue growth, several large streaming markets – like the US and UK – appear to be reaching a point of saturation. This deceleration is an inevitable result of the streaming format’s wild success. The product life cycle adoption framework and a subscriber growth graph depicted below illustrate this dynamic.

There are several signs of this playing out in real-time. For example, Spotify’s premium subscriber growth has slowed from the typical 30%+ year-over-year quarterly increase in the 2018-2019 period to mid-teens growth in recent years.

Meanwhile, recorded music streaming revenue growth has also started to slow down. According to MIDIA Research, streaming revenue grew slower than the recorded music industry market for the first time ever in 2023! (It’s worth noting that IFPI’s 2023 figures suggest that streaming growth of 10.4% year-over-year ever so slightly outpaced the global recorded music market growth rate of 10.2%.)

Finally, Universal Music Group’s recent results provide further evidence of this trend. In years past, streaming drove the company’s revenue growth. But that’s not been the case for the past two years. UMG’s recorded music streaming revenue grew 19% in 2022 and 7% in 2023 compared to total company revenue growth of 22% and 7%, respectively. As a reminder, UMG laid out a medium-term outlook when it went public in 2021 that included high single-digit percentage revenue growth and a mid-20% EBITDA margin.

In short, from our perspective, the timing for focusing on superfans by UMG, Spotify, WMG, and other key industry players is driven by the need to provide shareholders with a consistent growth story. As streaming revenue decelerates, the industry’s largest players want to find new growth opportunities that enable them to continue on a strong trajectory.

Enter Music Superfans: An Under-Monetized Segment

Investors still want growth, but where is it going to come from? There are several opportunities that the industry is targeting to keep the growth train rolling, ranging from emerging music markets (e.g., India, Sub-Saharan Africa) to price increases (which have already begun) in developed markets. Another one of the industry’s most widely cited growth strategies today is focusing on so-called “superfans”.

I’ll (Jimmy here 👋) admit that the “monetize superfans” discussion point feels played out at the moment and has reached meme status. But if you’re newish to this trend, let’s try to define what a superfan actually is.

From our perspective, superfans are simply the most engaged segment of an artist’s audience. Returning to our Fan Economics 101 discussion, they represent a segment of the consumer base whose economic value is not fully captured under the current subscription model.

Meanwhile, other industry participants define superfans based on particular metrics. For example, Luminate defines a superfan as those fans that engage with a favorite artist and their content in 5+ ways. Luminate’s research suggests that 15% of the U.S. population can be defined as a superfan! Spotify defines a “super listener” as an artist’s most dedicated listeners in the last 28 days. Per Spotify’s data, super listeners make up only 2% of an artist’s monthly listeners but 18% of an artist’s monthly streams, on average.

Even with all these definitions, there are many types of “super” music consumers who are willing to pay more than the average streaming subscription price. To understand the opportunity and serve them, we need to define them in terms of their behaviors. One of the most obvious ways to do this is segmenting by different types of listening habits, but how fans engage with artist content across social platforms is also a useful indicator. There are many other possible considerations as well – a topic for another piece.

In an attempt to better understand audience types by activity level, the graphic below showcases different streaming listener types as a function of their engagement with an artist’s music. This is one obvious starting point for identifying this segment of music fans. Whereas the programmed audience only listens to an artist’s music via a programmed source (e.g., editorial playlist), superfans are actively seeking out an artist and doing so more frequently than other listeners.

The early evidence of superfans’ monetization potential is exciting. Consider the following observations:

Music superfans spend significantly more than the average listener. Luminate estimates that superfans spend 80% more on music each month than the average U.S. music listener. Meanwhile, Spotify’s data shows that, on average, 2% of artists’ monthly listeners account for 50%+ of artists’ merchandise purchases.

Music superfans are loyal. Spotify’s data suggests that an artist’s most active listeners demonstrate high retention rates. On average, ~66% of an artist’s most active listeners will still be listening to the artist 6 months after a new release.

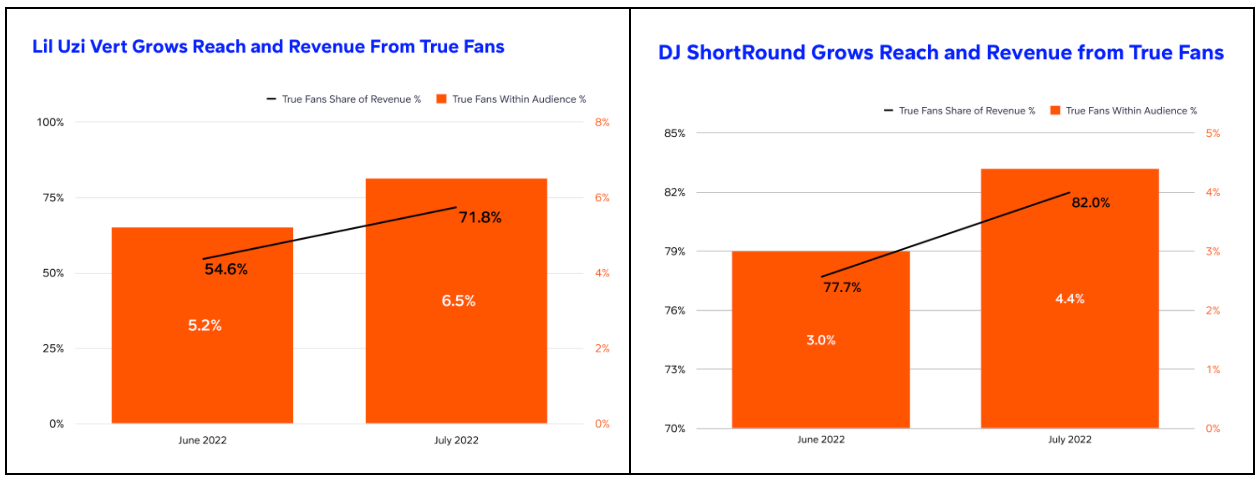

Superfans exist for artists across different stages of success and may have a bigger economic impact for emerging ones. SoundCloud’s data illustrates how both superstar and emerging artists can generate a significant share of their digital revenue from less than 5% of their monthly listeners.

Given the context of slowing streaming growth and superfans’ engagement and spending data, it makes sense for the industry to focus on providing an artist’s biggest fans with new offerings on digital platforms. There is academic research showing that, when executed properly, a considerable portion of revenue can come from a small fraction of consumers (e.g., Wharton professor Peter Fader’s work).

Are There Potential Superfan Lessons From Gaming?

Along these lines, other entertainment verticals have demonstrated that the approach of targeting the most engaged users can be effective. For example, the mobile free-to-play video game industry has shown that monetization strategies targeting a game’s largest spenders (so-called “whales”) can be quite lucrative. Leveling Up covered the gaming industry’s growth in our March 2022 newsletter. To recap, whereas the recorded music industry has struggled to grow revenues amidst technological shifts over the past 20 years, the video gaming industry has gone from strength to strength. According to Newzoo, the gaming industry generates $184 billion annually (4.5x that of the global music industry).

The growth in gaming over the past 10 years has been driven by mobile gaming, which increased at a 25% CAGR between 2013 and 2019. The majority of games on mobile with substantial revenues implement a free-to-play (“F2P”) revenue model. Before the internet, video games, like music, were primarily sold as boxed products. The introduction of smartphones and mobile app stores allowed F2P games to take hold. This flipped the traditional gaming model on its head. Rather than an upfront purchase for content, gamers can download and play a game for free with developers monetizing via advertising and in-app purchases (“IAP”) of virtual items. In this way, video game developers effectively shifted from designing boxed products to service-based products.

The F2P business model is centered around concepts including digital scarcity, community building and management, and ongoing user monetization. It focuses on turning attention into revenue and works so well for several reasons, including:

It maximizes the number of users who will try the game since it’s free

It designs moments of scarcity to incentivize purchasing

There is no cap on the amount a user can spend

It fosters community so that users have less of an incentive to churn

What’s interesting about F2P games is that a small number of users account for the lion’s share of F2P gaming revenue. According to Wappier, fewer than 2% of mobile F2P users actually make in-app purchases, with some so-called “whales” spending upwards of $35 - $70 per day. In other words, a project’s most profitable users, while small as a % of total users, can contribute a meaningful amount to total revenue. The below chart is illustrative and represents spending in one F2P gaming project. 5% of players generated 50% of the revenue and 20% of players generated 75% of the revenue. Sound familiar 😉?

Over time, the F2P business model has expanded beyond mobile with many traditional publishers adopting F2P monetization practices for their key franchises and acquiring mobile F2P companies to take a share of this fast growing market segment. Indeed, the sale of virtual items has been extended to premium titles too, resulting in the percentage of game revenues derived from virtual items growing from 20% in 2010 to 75% in 2020.

Gaming has figured out how to monetize digital fandom at scale and (so far) music hasn’t. The F2P gaming industry successfully created digital scarcity, built communities, and monetized the biggest spenders. Unlike gaming, the music industry is still figuring out how to monetize digital fandom. But, as we have discussed in this piece, the winds appear to be changing with major music rights holders, music technology companies, and the broader industry becoming more engaged. In our view, the music industry would be wise to study F2P game design best practices and how the F2P business model developed over the past 15 years as it creates new digital products for music’s biggest fans.

What is the Size of the Music Superfan Opportunity?

But how big of an opportunity is targeting music superfans with products and services? It’s too early to say for sure but some broad strokes can help us paint a picture.

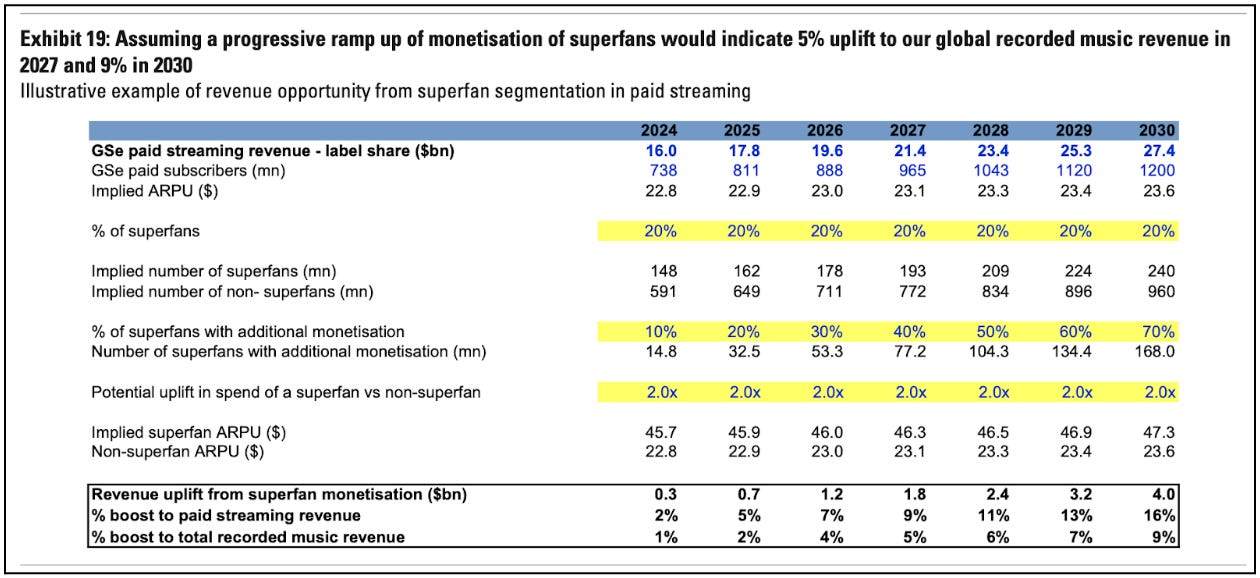

The oft-cited Goldman Sachs Music In The Air report estimates that superfan monetization on streaming platforms could reach $4 billion by 2030, driving a 9% increase in recorded music revenue in 2030. However, we wonder if Goldman’s underlying assumption that 14% of global paid streaming subscribers will be superfans by 2030 is a touch aggressive. Then again, we also wouldn’t be surprised if the bank’s 2x superfan vs. non-superfan spend assumption is too conservative. Nevertheless, the investment bank sees superfandom being a meaningful opportunity for the industry over the next five years.

Meanwhile, MIDIA estimates that the industry’s “expanded rights” revenue, which includes merchandise and branding (i.e., broader IP monetization than Goldman’s market sizing), grew 15.5% to hit $3.5 billion in 2023. The research firm believes that “expanded rights are one of the main building blocks of tomorrow’s music business.”

Finally, when compared to the heyday of U.S. music industry revenue in the late 1990s, it’s clear that we’re nowhere close to a high water mark on an inflation adjusted basis. Whereas the RIAA estimates that the U.S. recorded music industry now exceeds its prior-1999 peak in nominal dollars, the chart below illustrates that the industry is still ~35% below its pre-Napster heights in real terms.

When we compare the difference between the $250 average recorded music spend (adjusted for inflation) per U.S. household in 1999 to the $130 average spend per U.S. household in 2023, the difference suggests that there is potentially a ~$16 billion gap in what U.S. consumers were willing to pay for recorded music in the pre-internet era versus what they are currently paying today!

We’re not suggesting that all of this gap is driven by the industry’s inability to monetize fandom on digital formats. If anything, it reaffirms what most folks already believe – streaming provides incredible value for consumers and monthly music streaming prices likely have meaningful room to run higher over the next 5+ years.

In summary, the superfan opportunity appears to be a sizable one for the industry. Despite the bullish superfan market size forecasts highlighted above, the ability to realize this trend isn’t guaranteed. It will be dependent on overcoming several adoption barriers, which we’ll explore in the next section.

Key Drivers for Music Superfan Market Growth

Right now, the “superfan” trend is all the rage and is seemingly creeping towards the peak of the Gartner Hype Cycle but there are still several challenges that must be overcome.

Let’s unpack some of the key adoption barriers facing different stakeholders that need to be addressed to unlock rapid adoption of new products and services targeting this segment of listeners.

For artists and their teams -

Burnout risk from the ongoing “content treadmill.” There’s a limit to how much time an artist can commit to individual artist/fan experiences, and, at its worst, can lead to parasocial dynamics and burnout. At the same time, releasing new content can be crucial to acquiring new fans, retaining existing ones, and monetizing content. In video games, developers run “live operations” to continuously deliver new features and updates that keeps the game fresh for users. We’re skeptical that a continuous service-based model is feasible for most musicians, with the time, energy, and capital that this requires potentially leading to burnout. Along these lines, a lack of artist engagement appears to have been a major contributor to the downfall of Apple Music’s direct-to-fan social tool “Connect”, Spotify’s artist/fan messaging feature, and Taylor Swift’s fan app “The Swift Life”. Water & Music recently published a great piece about this issue, particularly for artist subscription offerings. That said, emerging AI tools could potentially enable creators to become more efficient, mitigating this risk somewhat.

Specialized skill sets are required. If music technology developers and product teams are still figuring out best practices, most artists probably aren’t going to have this knowledge. Along these lines, it doesn’t seem realistic for an artist to have the capacity and skills necessary to constantly plan and manage these ongoing individual fan interactions. As a result, ensuring artists are surrounded by a talented and diverse team will be important. In our opinion, this could be a real opportunity for labels to offer their artists the teams and infrastructure necessary to meet the potential demands of continuous content.

Learning best practices for monetization design. While targeting superfans presents a lucrative opportunity, it also poses certain challenges and risks, including the potential alienation of certain listener segments and the need to balance exclusivity with accessibility. Music isn’t a commodity. This kind of consumption isn’t analogous to crops, energy, etc. There is more complexity (and risk) with these consumers because their attachment to the product is more personal and emotional. Along these lines, not all superfans are going to be motivated by / interested in the same things. Just as video game developers classify players via frameworks like the Bartle Player Types or Quantic Foundry’s Gamer Types, it will be important for music rights holders and product teams to understand their biggest listeners' different motivations and goals (e.g., access, status, socializing, etc.). To that end, it's arguably easier to monetize video game superfans, because publishers can sell cosmetics that are usable (and visible) in-game and/or enable faster progression. For artists and rights holders, we’d argue that it’s harder to manufacture progression and there are more limited opportunities to show off your fandom to others. Though certain artist’s, like Taylor Swift, ability to “gamify” their relationship with fans is worthy of a case study to uncover potential insights other artists can apply.

Fragmented Distribution. The distribution of superfan content and offerings is fragmented, creating more friction for artists who want to engage and/or monetize their biggest fans. For example, there are several music streaming services, numerous social media platforms, and a handful of emerging music superfan apps. How is the average artist or rights holder meant to understand best practice across all of these efficiently? Given this dynamic, it’s no surprise that Warner Music CEO Robert Kyncl wants to develop a cross-platform solution, “Music is omnipresent, it’s everywhere. Artists want to work with every single platform. They don’t want to optimize just for one platform over another…So a solution like this for superfans has to be a cross-platform solution. We, as a record label, are in a perfect position to do that because we work with all of the platforms. Historically, we haven’t had the technology talent to do this, but now we do.”

For music superfans -

Improving the user experience. As discussed above, the digital superfan market landscape is currently quite fragmented. Fans are potentially required to have an account on a number of platforms in order to engage with their favorite artist. This may be exacerbated by the fact that the industry will need to develop a robust ecosystem of innovation, where different offerings are tailored to different fan segments. However, as the ease of use improves and the ecosystem becomes more streamlined, it should support further growth in the number of music fans monetizing these individual experiences.

For music tech companies and start-ups -

Music IP licensing is complex and expensive. For companies innovating in the space, it can be difficult and expensive to procure the necessary rights from rights holders to launch new products. Music streaming platforms, for example, send 60%+ of their revenue to licensors. Those fees make the unit economics for technology entrepreneurs relatively less attractive. Meanwhile, labels and publishers often only own IP associated with the music rather than an artist’s name, image, and likeness rights, creating an additional layer of complexity.

Superfan best practices still largely remain unclear. There is a graveyard of companies who have tried to build superfan features and products over the years. For example, here’s a link to a great (nearly 10 year old) presentation by TIDAL’s former CIO at MIDEM 2015 where she explains how TIDAL’s business model is centered around artist’s biggest fans and growing the artist/fan relationship by offering differentiated superfan products. It’s one thing to have a great idea, but executing it successfully can be elusive. It reminds us of a Steve Jobs interview where he explains what’s required for successful product development, “There is just a tremendous amount of craftsmanship in between a great idea and a great product. And as you evolve that great idea, it changes and grows … because you learn a lot more as you get into the subtleties of it … and it’s that process that is the magic.” Until product teams figure out best practices, it is difficult to see digital superfandom taking off.

Building superfan products have relatively high economic and opportunity costs. For established technology companies, there is a cost associated with developing and maintaining new superfan offerings. And with best practices still being understood, it seems practical for companies, such as Spotify, to put more resources behind “less risky” trends like audio books, new high-growth international markets, etc. This is especially true when Spotify is focused more and more on profitability with CEO Daniel Ek highlighting this mindset on the company’s recent earnings call: “The hurdle rates for any new type of investments will be much higher than what [they have] been. And more importantly, I think you’re going to see us be more diligent in shutting down things that perhaps have sort of worked, but may not work as well going forward into the future.”

In summary, the music superfan market is forecasted to grow quickly and contribute meaningfully to the music industry over the next 5 years. This growth vector is encouraging against the backdrop of slower streaming growth. But, at the same time, there are several barriers that companies must work to overcome to realize the superfan opportunity. For example, the best practices for sustainably targeting, managing, and monetizing music superfans still largely remain a mystery, in our opinion. In addition, artists and rights holders will likely want to find ways to streamline the distribution of these artist/fan products and exclusive experiences. Despite the hurdles which may take more time than currently anticipated to overcome, we believe that the superfan trend is an exciting and necessary opportunity to tackle.

The Future of Monetizing Music Superfans

While the industry is still figuring out how to scale new superfan experiences and monetization strategies, it’s becoming clearer that participants are taking varied approaches.

In terms of the major music rights holders, Universal Music Group is arguably leading the charge. UMG has made minority investments and strategic partnerships with companies of various sizes. For example, earlier this year, Universal made a minority investment in South Korean-based label HYBE’s superfan app Weverse, which has ~10 million monthly active users. UMG has also announced strategic partnerships with Spotify and Roblox developer Supersocial. This approach enables UMG to spread its bets, experiment with and learn from these companies, and wield its influence on how the superfan economic model ultimately unfolds.

On the other hand, Warner Music Group seems to be prioritizing the development of their own superfan app rather than investments and partnerships with other companies. That said, WMG did recently invest in superfan social network Fave alongside Sony Music. In our opinion, the WMG leadership team, several of whom previously worked at Google, are tech savvy and we’re excited to see their first-party app in the wild. If successful, it should go a long way toward helping artists and their fans navigate a currently fragmented distribution environment for superfan experiences.

Sony Music has been relatively quiet in relation to the other two majors with regards to their superfan plans. It will be interesting to see if the company makes any announcements on this front in the next few quarters.

Meanwhile, several of the largest music streaming platforms are incorporating superfan features into their broader offering. Streaming services’ large active user bases make them obvious candidates to facilitate the superfan economy. To that end, Spotify has introduced features such as countdown pages for new releases, the ability for artists to sell merch, and is beta testing a short-form video “Clips” product. Despite its previously mentioned struggles with artist/fan direct messaging, Spotify is also reportedly developing “superfan clubs” that enable artists to communicate directly with their biggest fans. SoundCloud plans to continue rolling out superfan products over the next 12 months (check out Leveling Up’s recent article on the company for more details), but unlike Spotify and HYBE, it hasn’t announced partnerships with major labels yet.

Finally, there are a growing number of tech start-ups building products for artists to connect with and ultimately monetize their biggest fans. These include companies like Laylo, Vault.fm, Medallion, Stationhead, Fave, TRAX, EVEN, and others. I (Jesse here 👋) am especially intrigued by the teams building ways for superfans to create together using components of the artist’s music, like Splash, and Mayk.it.

While the streaming model has thrived for the past decade, growing the pie further requires monetizing beyond the industry’s most popular consumption format – subscription streaming. The strategic focus on superfans is a natural evolution that can expand and sustain the music industry's revenue streams in the face of changing consumer behavior and economic challenges. Indeed, the future outlook of superfan monetization strategies points towards a material impact on the music industry's economic model.

Unsurprisingly, superfandom has a lot of momentum right now. The industry’s biggest players are allocating talent and resources towards developing products around the opportunity. VCs are funding startups to build for music superfans. And artists are experimenting with new ways to digitally monetize their relationships with their biggest fans.

Having said that, we expect the superfan trend to roll through its current hype cycle, taking many years before best practices are learned and projects are able to thrive. As we have discussed in this piece, the superfan effort is not without risk, as attempts to monetize music superfans to date have largely ranged from abject failure to middling success. The realization of music superfandom’s benefits, then, is a story about the future.

It still feels so early for music superfandom. After researching this piece, we think that building successful products in the space will require a range of diverse assets and skills – ranging from popular music IP, technology talent, strong product professionals, and experienced community managers.

Ultimately, maximizing the value of the superfan opportunity will require a diverse ecosystem of innovation that serves various sub-segments of fans across genres and geographies through appropriately diversified offerings. Put more simply, the industry needs new ideas. While there are opportunities for scaled, agnostic platforms to emerge, the most successful ones will empower stakeholders closest to the fans (artists, managers, etc.) to tailor products and services to meet the unique preferences and expectations of their own markets.

Thanks to Hannah and Adam for the feedback, input, and editing!

Leveling Up’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. In addition, our work may feature entities in which Alderbrook Companies, LLC or the author has invested and/or has provided consulting services.

📚 Music Business, Tech, and Investing Content Worth Consuming

Here is some of the best content that I consumed over the past month or so –

Global Music Report 2024 (IFPI: link)

Interview with Sam Duboff, Global Head of Spotify for Artists (The Price of Music: link)

Loud & Clear: Annual Music Economics Report (Spotify: link)

Pophouse Buys Rights to KISS – Here’s What They Have Planned (Billboard: link)

Bifurcation Theory – How Today’s Music Business Will Become Two (MIDIA: link)

Artist Subscriptions and the Myth of a Silver Bullet (MIDIA: link)

Record Companies Are Better Placed Than Streaming Platforms To Monetize Superfans (MBW: link)

With Major Label Deals Expiring, Will Beloved Alt Bands Go Indie Again? (Billboard: link)

Only 1 of the Top 20 Best-Selling Albums Globally Last Year Wasn’t By a K-Pop Act (MBW: link)

🤝 Want to Work Together? Get in touch!

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with record labels, music publishers, music technology companies, and investors on a wide-range of projects.

Our Investment Consulting Services -

Over the past few years, we’ve had the privilege of supporting several great investors in and around music. Our team is available to provide market and investment research, due diligence, and advisory support. Whether you invest in public markets, venture capital, private equity, or are a business or investment bank facilitating deals, we’d love to help you meet and exceed your investment goals.

Our Early-Stage Investment Focus -

In addition to our consulting services, we make early-stage investments, with a focus on companies building in media and government technology. If you’re a founder who is raising, please reach out to us!

To get in touch, you can either reply directly to this email or click the link below to fill out our contact form. We’ll be back in touch soon!

📭 Share Leveling Up with a friend!

If you enjoy Leveling Up, please consider sharing it with friends and colleagues (link to share)!

Jimmy, Thanks for all your effort on this content. It is amazing and insightful.

Love to be connected with you. Founder&ex-CEO@Weverse Company.

https://www.linkedin.com/in/wooseokseo/

The best content I've read in recent months about superfans. Elite!