Universal’s Push for Higher Streaming Payouts

Why & how UMG is seeking to redefine the commercial terms with streaming platforms

GM readers 👋,

Happy February!

It’s Mardi Gras season down here in New Orleans. So, I thought that it could be fun to offer a free Gambino’s Bakery King Cake to one subscriber. Fill out this form with your name and email if you’re interested. We’ll randomly draw a winner on February 27th. To participate, the only rules are that you have to be a subscriber to this newsletter and located in the United States (for shipping reasons).

For this month’s piece, we’re going to cover a hot topic in music circles – the commercial terms between music streaming platforms (e.g., Spotify) and rights holders (e.g., artists, labels). The CEO at Universal Music Group (“UMG”), the largest record label by market share, sent a New Year’s memo to employees declaring that these terms need to change. Shortly thereafter UMG formed a partnership with music streaming platform TIDAL. We’re going to analyze why UMG wants change, what adjustments to the economic model are likely being considered, and then speculate on where the industry may be headed.

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. This piece is for informational purposes only. None of this is financial or legal advice. Do your own research!

Thanks again for reading. Now, let’s get after it!

Jimmy

PS if you’re not already a subscriber to Leveling Up and don’t want to miss out on future newsletters, feel free to enter your email below and you’ll receive new posts directly in your inbox:

Universal’s Push for Higher Streaming Payouts

“I can’t think of an asset I’m more confident in being consumed over time. … You need food and water to live, but music comes next.” - Investor Bill Ackman explaining his $4 billion investment in Universal Music Group

In early January, Universal Music Group CEO Sir Lucian Grainge sent a New Year’s memo to employees. The note (which Music Business Worldwide published in full here) began by highlighting the company’s recent accomplishments and underscoring its mission to “break new artists and sustain their careers over the long run” and to “promote a healthy, sustainable, and exciting music ecosystem.” But for the bulk of the remainder, he expressed dissatisfaction with streaming platforms’ current consumption and payout design. Ultimately, Grainge concluded that “the economic model for streaming needs to evolve.”

Grainge emphasized that the solution should “support all artists – DIY, indie, and major” and that UMG intends to actively play a role in finding an updated model. To this end, UMG announced a partnership with music streaming service TIDAL just a few weeks after the New Year’s memo was sent to employees. In an interview with the Financial Times, TIDAL’s head Jesse Dorogusker said that the partnership will “enable us to rethink how we can sustainably improve royalty distribution for the breadth of artists on our platform.”

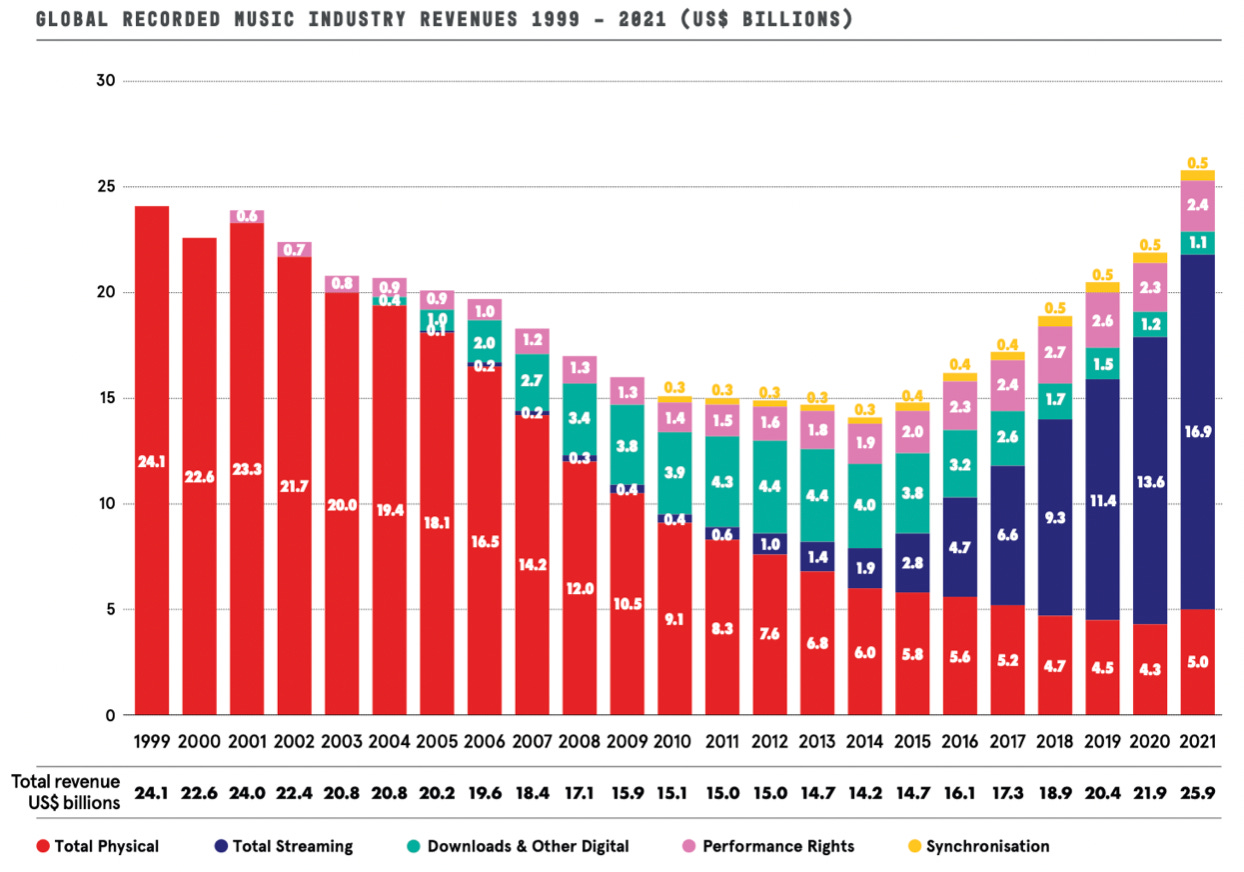

Based on UMG’s comments and moves, you might think that music streaming platforms aren’t delivering much value to record labels and their artists. But is that really the case? Consistent readers of this newsletter will know that music streaming has been the driving force behind the recorded music industry’s return to growth after roughly 15 years of declines. According to IFPI, the global recorded music streaming revenue has increased from ~$0 in 2004 to ~$17 billion in 2021, which is equivalent to the size of the entire global recorded music market in 2008. This dynamic is depicted in the navy blue bar in the chart below.

We also know that streaming’s growth has benefitted the major labels, with UMG reporting some eye-popping financial results. Through the first nine months of 2022, the company has grown revenues by 20%+ year-over-year and maintained an EBITDA margin of 20%+. For software investor nerds, these are admirable Rule of 40 type numbers!

And streaming has been a major driver of these results. UMG’s year-to-date subscription & streaming revenues grew 19% (as depicted above), making up ~70% of total revenues (as depicted below).

Given this, why is UMG working to change the terms of the trade with streaming platforms? And why now?

Why Does UMG Want Change?

We know that CEO Sir Lucian Grainge is outspoken about UMG’s desire to change the economic model for streaming services. While the impact of streaming has benefited the company historically, Grainge’s New Year’s memo suggests that he sees some key issues going forward. These likely include:

1) A Growing Volume of Music on Streaming Platforms Is Diluting UMG’s Market Share.

With the emergence of DIY distribution platforms (e.g., Distrokid), and user generated content platforms (e.g., BandLab), the barriers to creating new music and distributing it on streaming platforms are lower than ever before. As a result, some streaming platforms are adding over 100K tracks per day, which is a 5x increase from 2018.

Generative AI applications (e.g., Riffusion) will likely only exacerbate this problem further as they mature and become commercially available. With an overflow of tracks, it has become more and more difficult for UMG and other labels to deliver on what they do best – discovering and developing new superstar artists. In an interview with the Financial Times, UMG’s Chief Digital Officer Michael Nash summarized this issue succinctly, “You have a quantity over quality challenge right now. That’s making it harder for new artists to establish themselves, for new releases to come through.” In his memo, Grainge also argues that this “lower quality functional content” is creating a “less fulfilling experience for consumers.” The unbridled access to the creation and sale of music has resulted in the majors (i.e., UMG, Sony Music, and Warner Music) along with indie collective Merlin losing their market share positions over time. For example, these four entities have seen their share of music streams on Spotify decrease 12% since 2017. Meanwhile, ~20% of artists on Spotify have greater than 50 monthly listeners, with fewer than 3% of artists classified as “professional or professionally aspiring recording acts.”

In short, an accelerating influx of new content uploaded to music streaming platforms has eroded the major labels’ share of total streaming payouts over time. This trend is especially concerning for the majors, because most streaming services (e.g., Spotify, Apple Music) pay labels and artists based upon their share of streams. Unless the streaming payout system changes, UMG and other major labels will likely continue to see dilution of their share of streaming volume and revenue on these platforms. Over a long enough time horizon (albeit not likely any time soon), this may impact industry power structures, with the major labels ceding negotiating leverage to the streaming platforms.

2) Bad Actors May Be Gaming Streaming’s Payout Model.

As mentioned earlier, most music streaming platforms calculate creators’ payouts based upon their share of total streams. This means that every stream within a pricing tier counts the same regardless of how many streams that user listens to. Let’s consider an oversimplified example to illustrate the potential effects of this economic model. John pays $10 per month and streams Taylor Swift 10 times, while Susan pays $10 per month and streams the band Pintopia 100 times. With the current streaming payout model in our fictional example, Taylor Swift would only receive 9% of payouts, even though 50% of users listened to her music.

As you can likely see, the current payout model creates an arbitrage opportunity for bad actors (e.g., bots, promotional sites, etc.) who want to game the system. When I google “Buy Spotify Streams”, I receive over 36 million search results with curated lists for “The Best Sites to Buy Spotify Plays”. Meanwhile, if we pull out our trusty Microsoft Excel spreadsheet and model this opportunity for fraudsters, we see that the potential returns are attractive and incentivize uploading extremely short duration tracks. On large platforms, like Spotify and Apple Music, a stream is counted when a user listens for 30 seconds or more. The example below compares the monthly return at a $9.99 per month subscription under a few scenarios. First, the bot is programmed to listen to a 3 minute track on repeat for 3.8 hours per day, the amount of time spent by the average US user. Second, the bot listens to 30 seconds of a track on repeat for 3.8 hours per day. Finally, the bot listens to 30 seconds of a track on repeat all day.

Streaming platforms have published educational content warning artists against hiring companies offering this service and have said that they are tracking unusual listening patterns to identify and remove fake streams. Regardless, between the number of companies offering “fake streams as a service” and our back of the envelope returns math, it appears that streaming fraud is likely still a big business. Third party estimates seem to confirm this hypothesis. The Centre National de Musique estimates that at least 1% to 3% of music streams in France are fraudulent. Meanwhile, fraud detection software company Beatdapp estimates that at least 10% of music streams are fraudulent. If we apply the lower estimate – 1% to 3% – to the $16.9 billion of global recorded music industry streaming revenues, it implies that streaming fraud could be a $169M to $507M problem (ignoring publishing revenue), with this total going to “bad actors” who are gaming the streaming payout system instead of professional / aspiring artists.

3) Music Streaming Platforms Have Prioritized Subscriber Growth Over Monetization.

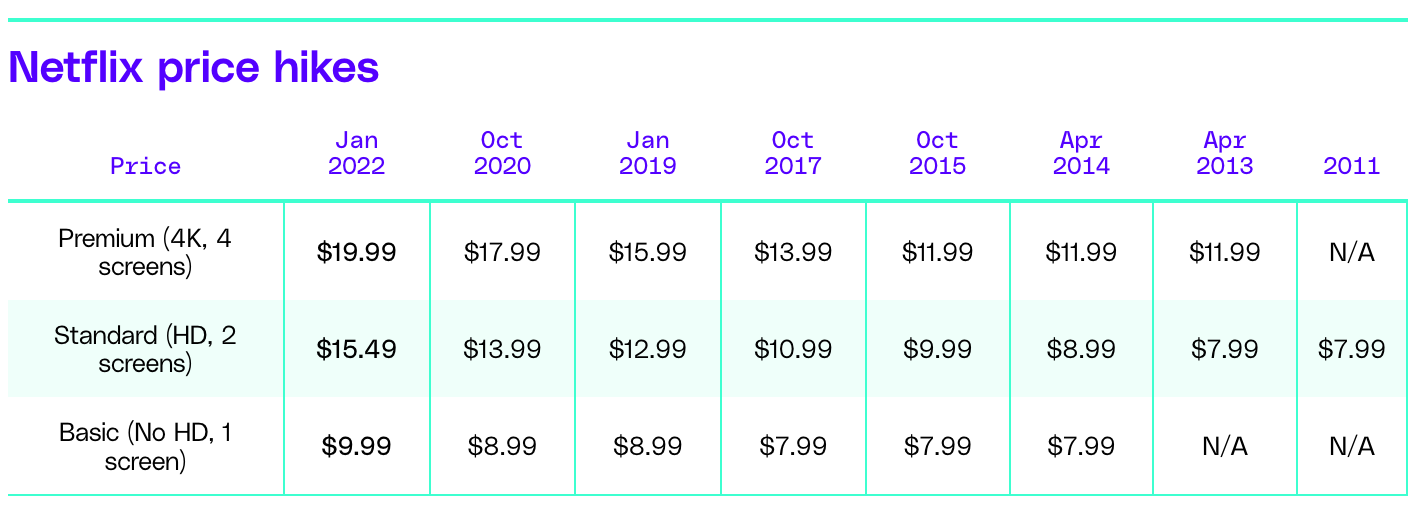

While Apple Music and Amazon Music recently increased subscription prices ~10% in the US, Spotify hasn’t increased their $9.99 premium subscription price since launching in the country in 2011. For comparison, video streaming service Netflix has increased their Standard US membership ~2x since 2011 from $7.99 to $15.49 per month. Meanwhile, Netflix’s average revenue per membership was ~$12 in 2022, whereas Spotify’s average revenue per Premium subscriber was less than $5 in 2022.

Major music streaming platforms have seemingly prioritized growing their subscriber counts over monetizing artists’ biggest fans when making product and financial strategy decisions. As a result, the value generated from music streaming users is materially below that of video streaming.

In summary, streaming has been a boon to the recorded music industry. Large music rights holders have benefited as their cash flows and the value of their catalogs grow. However, the influx of new content onto streaming platforms, the incentives to game streaming’s payout model, and streaming platforms’ focus on growth over monetization has caused tension in the relationship between platforms and rights holders.

Of course, these concerns aren’t new. These cracks that have been forming for some time. For example, Warner Music’s former CEO Stephen Cooper publicly criticized music streaming’s monetization practices as early as 2019. So, why is the CEO of the world’s largest record label trying to orchestrate change now?

We know that streaming growth is starting to decelerate in certain developed markets, like the UK. This could start impacting the major labels’ financial results. Along these lines, in its fiscal 1Q results, Warner Music Group reported that its Recorded Music revenue dipped 8% year-over-year with streaming revenues declining 4%. We’ll have to see how UMG’s results compare when the company reports earnings on March 2nd. But as a reminder, UMG laid out a medium-term outlook when it went public in 2021 that included high single digit percentage revenue growth and an EBITDA margin in the mid-20% range. Bill Ackman at Pershing Square Capital underwrote his ~$4 billion investment in the company with a slightly higher 10%+ revenue growth outlook. In short, UMG may be feeling pressure to provide shareholders with more growth and a consistent story. This may require pulling new levers that enable the company to continue on its recent growth trajectory as the broader streaming market growth decelerates.

What Changes Might Be Considered?

From my perspective, it appears that UMG and other rights holders can consider a number of options to reset streaming’s commercial terms. I’d categorize these options into four broad buckets:

1) Changing the Payout Model: Under the current payout model, music platforms pay royalties based upon a creator’s total share of all streams on a platform. As discussed, this can incentivize “bad actors” to game the system. Several industry pundits, such as Chris Castle, argue that platforms should adopt a “user-centric” payout system, which involves dividing the revenue generated by individual subscribers according to what they listen to. This reduces the financial incentive to manufacture fake streams, because royalty payouts are no longer tied to market share. A few streaming platforms, such as SoundCloud and TIDAL, have experimented with this payout approach for certain artists. It remains unclear how a user-centric payout system will actually impact income concentration on music streaming platforms.

However, the studies released so far suggest that major label artists may not be positively impacted by user-centric royalty payouts. For example, a Finnish Musicians Union academic study suggests that top-tier artists would not receive higher payouts, and in general, lower earning creators would receive more income. Another study by the Centre National de la Musique and Deloitte found that streaming revenues for classical music would rise 24% with a respective drop in rap and hip-hop revenues of 20%+. Other ideas for changing the payout model include setting up a bonus royalty pool for artists that are driving the most engagement from new users on platforms, or paying a higher per stream rate for “active streams” where a user searches for a specific artist or song versus “passive streams” where a user listens to an algorithmic playlist. In summary, this potential change is likely medium risk, low cost, and medium upside for UMG. As a result, I expect UMG to experiment with various payout models, but the company will likely want to see a favorable impact on its own results before advocating for industry-wide adoption.

2) Limiting Access to Streaming Platforms: Streaming services can allow only a limited number of vetted rights holders / creators to have access to platforms. This is a similar concept to Apple reviewing developers’ applications against certain technical, content, and design criteria before being allowed onto the Apple App Store. This process could help ensure only “high quality” content is allowed on streaming platforms. At the same time, this won’t encourage true market competition and could significantly restrict independent and DIY artists if the approval process is poorly designed. For UMG, this potential option is likely low risk, low cost, and high upside. As a result, I could see UMG lobbying for streaming platforms to add approval mechanisms aimed at limiting new content.

3) Incentivize Market Competition by Introducing New Monetization Mechanisms: Instead of trying to limit the quality and quantity of new music content, streaming platforms can introduce new ways for artists to monetize their biggest fans. Some of the examples mentioned by industry pundits include a new pricing tier for super fans that provide extra perks and access to artists and introducing more opportunities for superfans to make in-app purchases for items, such as digital/physical merchandise, live stream tickets, and virtual tips/gifts. For UMG, this option is likely low risk, low cost, and high upside. As a result, I expect UMG to spend a lot of time trying to introduce new ways for artists to monetize their biggest fans on streaming platforms.

4) Bringing the Tech (i.e., Streaming Platforms) In-House: In video games and film/tv, we’ve seen technology companies with subscription services pursue large scale investment and M&A to build their content portfolios. Examples include Microsoft trying to acquire Activision Blizzard for ~$70 billion, Netflix spending $15+ billion annually on content, and Amazon acquiring MGM for $8.5 billion. We haven’t seen that trend in music. Unlike IP owners in other entertainment mediums, music rights holders license their content across various major streaming platforms, seemingly benefitting from no single platform having exclusives and dominating the market. Perhaps the rights holders are concerned that consumers won’t subscribe to multiple audio platforms if they begin offering exclusives (unlike video). That said, the flip side is that rights holders aren’t controlling strategy at streaming companies. They can try to collaborate with and complain to the platforms. But at the end of the day, record labels and publishers don’t have autonomy over disallowing tens of thousands of low quality songs being uploaded each day; or developing tools and policies that eliminate streaming fraud; or introducing new features that monetize an artist’s superfans. For UMG, combining with a music streaming platform of meaningful scale is high risk, high cost, and high upside. As a result, I don’t expect UMG or another major to make this kind of large-scale strategic move in the near-term, but I also wouldn’t rule it out completely over the longer term. The partnership with a smaller streaming platform (by users), like TIDAL, could allow UMG to mitigate some of these risks, while still experimenting and demonstrating what works to other music streaming services.

Closing Thoughts

The team at Universal Music Group is focused on shaking up the commercial terms between music rights holders and streaming platforms. Between bad actors gaming streaming’s payout models, a constant influx of new content – which is likely going to increase as access to AI grows – diluting major labels’ market share, and streaming platforms’ historical focus on subscriber growth over monetization, UMG is now prepared to put together strategies to adjust to the potential impact of decelerating streaming revenue growth.

The partnership with TIDAL is a first step in solving some of streaming’s current shortcomings. It’s a low risk one too given TIDAL’s relatively small share (likely less than 1%) of the global streaming subscriber base. When collaborating with TIDAL, I’d expect UMG to prioritize new monetization mechanisms and potentially lobby for greater vetting/gating of new content before being allowed to upload onto streaming platforms. While UMG could eventually support a new payout system, I expect that this will take meaningful time / experimentation and likely not result in a user-centric approach. I’m excited to follow the partnership’s experiments and UMG’s journey as it seeks to successfully adjust a key revenue driver, while navigating its relationships with various industry stakeholders.

Thanks to Hannah and Adam for the feedback, input, and editing!

If Alderbrook can help you build or fund companies in this space, please reach out!

UMG's Recorded Music results in Q4 was definitely superior to WMG, which experienced a revenue decline over the same period. Having Taylor Swift, Drake, The Weeknd and BTS definitely helped, as did Tay Tay selling 1mn+ units of her Midnights in vinyl format. Enjoyed reading your write-up. I am a music fan myself, and even read Don Passman's book last year