Music and the AI Opportunity

Which startups and investors are participating in the music AI hype cycle?

If you’re not already a subscriber to Leveling Up and want to join other curious music industry professionals, creators, investors, and entrepreneurs, enter your email below and you won’t miss out on future newsletters:

GM readers 👋,

Happy July!

I’ve been quiet on the newsletter front the past couple months. I’m excited to say that this is my first Leveling Up newsletter as a dad! Hannah and I are loving spending time with our newest family member. But the result is less time to put together the usual monthly deep dive.

To help keep the content cadence consistent, I’m hoping to collaborate more on future newsletters. I’ve met lots of folks who read Leveling Up that are incredibly knowledgeable on a variety of topics. In short, I believe this readership will benefit from greater collaboration. If you’re interested in teaming up or even writing a guest post, please shoot an email to contact@alderbrookcompanies.com! I’d love to hear from you.

Back in March 2023, Leveling Up wrote about artificial intelligence’s potential value to the music industry. We looked at barriers standing in the way of realizing that value and made some predictions on which parts of the value chain may be most impacted.

A lot has happened in this space in the year since. AI continues to dominate headlines, with the music industry remaining both excited over AI’s potential and concerned over how music AI startups are utilizing this technology.

In this month’s newsletter, we’ll analyze the music AI startups that have successfully raised venture funding over the past couple years. In doing so, we can try to 1) identify the areas that music AI builders see as the biggest opportunities and 2) observe which investors are most actively funding them.

And a quick shoutout to my friends at Naavik whose recent piece on gaming and AI served as the inspiration for this one. If you’re interested in learning more about gaming, I highly recommend subscribing to their free newsletter. It’s consistently packed with insights!

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. I’m not a licensed investment professional. This piece is for informational purposes only. None of this is tax, financial, investment, or legal advice. Do your own research!

Now, let’s get after it!

Jimmy

Music and the AI Opportunity

“AI at the service of artists is a good thing, but AI that is used to harm or prevent artists from due compensation is a bad thing. So, our approach is to embrace responsible AI technology in a way that enhances human creativity. How is this done? By letting artists lead the way.” - Sir Lucian Grainge, CEO of Universal Music Group

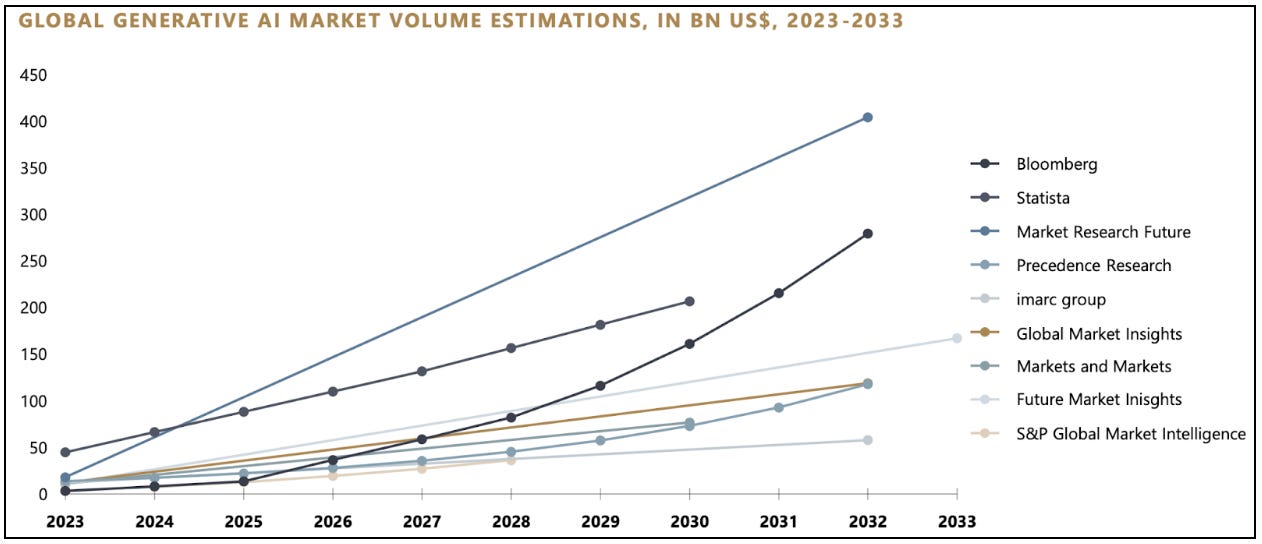

The past two years have seen the artificial intelligence hype cycle continue to pick up steam. The public launch of popular generative AI models – like OpenAI’s ChatGPT (chatbot), Midjourney (text-to-image), and Stability AI’s Stable Diffusion (text-to-image) – has driven much of the recent excitement over AI’s potential. Depending upon which firm you ask, the generative AI market is forecasted to be anywhere between $50 billion to $400 billion by 2033.

While estimates like the ones above should be taken with a large grain of salt, lots of smart folks expect artificial intelligence to have a profound impact on the way individuals live and work. For example, Microsoft founder Bill Gates wrote that “the development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone.”

Meanwhile, venture capitalists are aggressively making bets into AI startups. According to Pitchbook, investors poured $27.1 billion into U.S. AI startups in 2Q 2024, accounting for ~50% of all U.S. startup funding in the quarter. In February 2024, OpenAI reportedly completed a secondary share offering to an investor group at an implied $80 billion valuation, 3x higher than just 10 months prior.

Against this backdrop, the music industry has taken a measured approach to artificial intelligence. The chart below illustrates how interest in music AI is at an all-time high, with industry leaders seeing AI/ML’s potential to assist human artistry. But there is also concern that AI poses a threat to artists and rights holders, particularly with use cases that effectively steal copyrighted works and/or artists’ name, image, and likeness rights.

A good case in point is Universal Music Group (“UMG”). On the one hand, UMG has partnered with music AI startups – like Endel and SoundLabs – and with large technology companies developing AI products. But on the other hand, UMG is a plaintiff in lawsuits against text-to-music generative AI startups Suno and Udio, which allegedly use copyrighted works in their AI models without permission from rights holders.

In a recent post, UMG’s CEO Sir Lucian Grainge summed up the company’s approach to AI:

“Our challenge and opportunity as an industry is to establish effective tools, incentives and rewards – as well as rules of the road – that enable us to limit AI’s potential downside while promoting its promising upside. If we strike the right balance, I believe AI will amplify human imagination and enrich musical creativity in extraordinary new ways.”

Given this context, let’s take a closer look at the startups that have successfully raised funding at the intersection of artificial intelligence and music. This should provide insights into where builders and investors see the biggest opportunities and threats posed by AI.

Quick Data Note: The data in this analysis is derived from Pitchbook, Crunchbase, and public news releases. The analysis focuses on deals announced from January 1, 2022 to June 6, 2024. It also focuses on investment round sizes greater than $1M. Finally, we are relying on Crunchbase and Pitchbook’s company industry categorization methodology. This categorization may be slightly off as more non-AI companies incorporate AI technology into their workflows. As a result, some transactions (e.g., smaller and/or still confidential) may have slipped through the cracks and some companies that have a more diverse offering may be included, because they now offer AI tools (e.g., Futureverse).

Looking at Music AI Startups

As discussed above, the broader venture investment community has been over-indexing to AI startups recently. Investors in music startups appear to be following this trend too, deploying 49% of capital in 1Q 2024 into this area as compared to ~25% from 2022 to 2023. In total, 32% of total venture music / audio technology funding has gone to AI startups since 2022.

For the chart below, it’s worth noting that 2Q 2024 only captures data through June 6, 2024. Music AI funding takes such a large percentage (85%) of investments in the quarter due to two relatively large rounds from Suno ($125M) and Udio ($10M).

Shifting from capital deployed to deal count, music AI investments account for 21% of music technology transactions since 2022. This implies that music AI startups, on average, are raising larger rounds than their non-AI peers.

Notwithstanding the above, the median deal size for music AI startups is roughly inline with non-AI music technology rounds. What does that mean? Outliers (like Suno’s $125M Series B, Stability AI’s $101M round, ElevenLabs’s $80M Series B, etc.) are driving up the average investment round for music & audio AI startups.

The range of startups building AI music products is vast. In total, they have raised ~$700 million in disclosed funding since the start of 2022. To better understand the music AI surface area, I grouped startups that have raised funding since 2022 into four categories: efficiency tools for artists & songwriters, enabling new listening experiences, protecting IP rights, and other.

Efficiency Tools for Creators

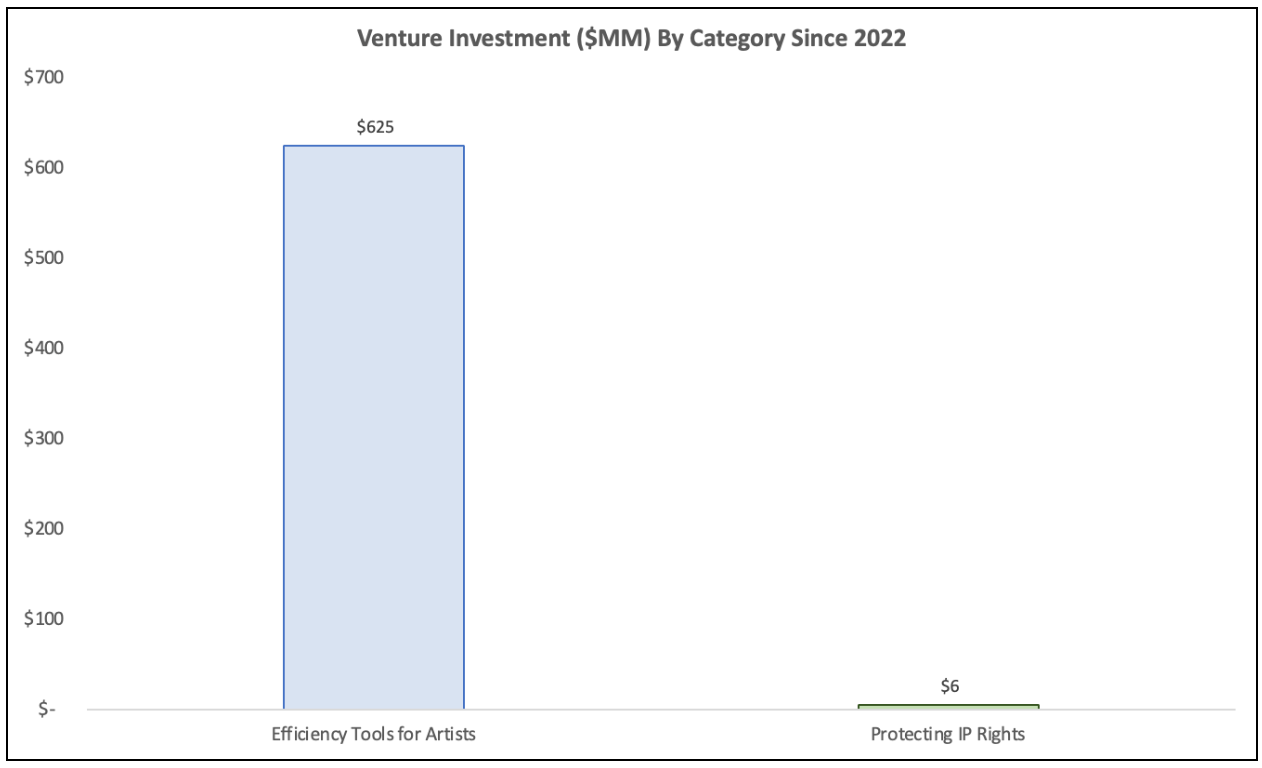

Startups building AI tools to improve efficiency for creators – whether they be professional artists / songwriters or everyday consumers – have far and away raised the most funding, with $625 million or 90% of total music AI funding invested in this category. Within this category, we can look at different subcategories (illustrated in the chart below).

The largest subcategory – a whopping two-thirds of the total – went to startups building generative music creation tools. These AI products encompass different steps of the creation process – from composition to recording – and can target a diverse set of user types – from casual users to professional musicians. Three of the largest music / audio AI transactions occurred in this space:

The $125 million Series B round for Suno, which provides a text-to-music model.

The $101 million round for Stability AI, which has built models to generate images, music, and video from text prompts.

The $54 million Series A round for Futureverse, the company building a variety of products including a text-to-music generative model named “Jen”.

Other startups that have raised sizable funding rounds in the music creation subcategory include LifeScore (~$14M Series A round), which helps artists to create AI generated remixes of their original tracks with or without the help of their biggest fans, and Udio ($10M Seed round), which has developed another model that produces music from simple text prompts.

In addition to music creation, other subcategories of efficiency tools that received funding include voice tools (e.g., ElevenLabs), stem separation & production (e.g., Audioshake, Moises), mixing & mastering (e.g., LANDR), sheet music (e.g., Enote), and sound tagging & search (e.g., Cyanite).

After researching this category, I am walking away excited about the vast number of use cases for AI efficiency tools. At the same time, the landscape already appears crowded, and I can envision someone consolidating the vast number of tools into a one-stop shop solution as time passes. Along these lines, startup Kits.AI appears to be creating a platform with a diverse number of features, including voice cloning, AI mixing & mastering, stem separation, and more.

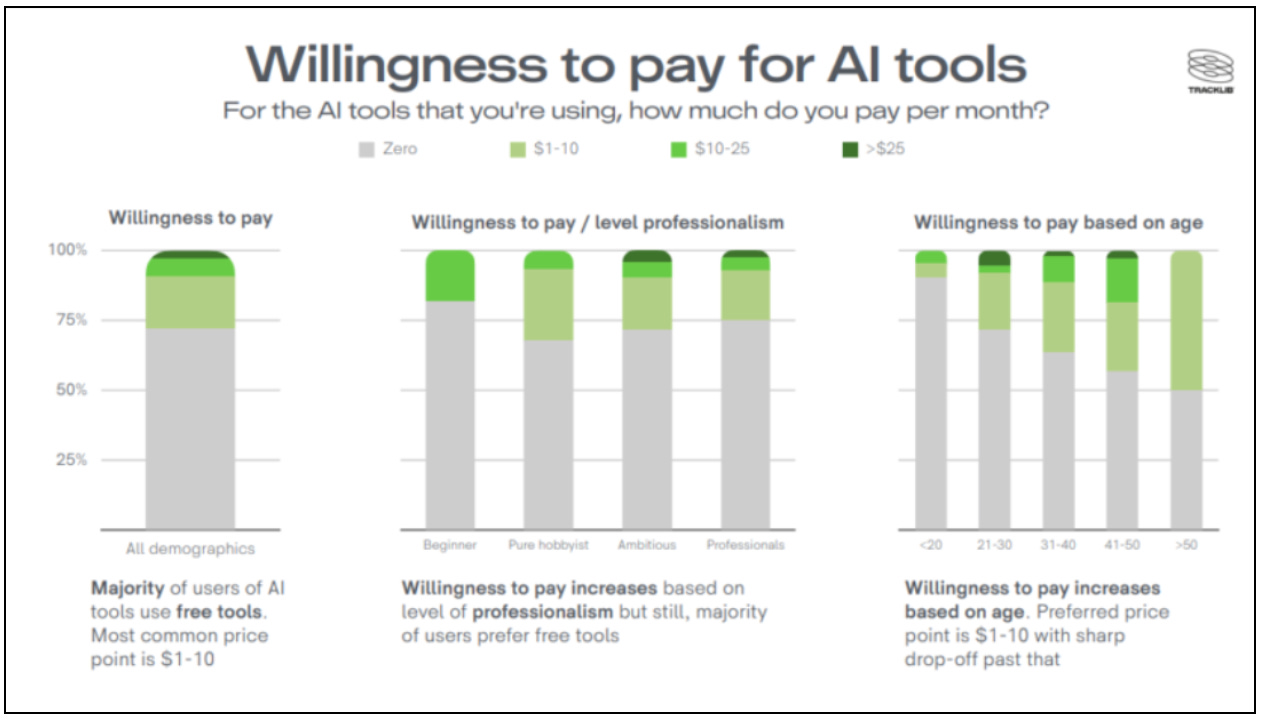

Another observation is that while interest in music AI tools is quite high, there doesn’t currently appear to be the same degree of use or willingness to pay among creators — at least not yet. For example, a survey of 14k+ GEMA and SACEM members in 2023 found that 66% of respondents use music AI tools in their creative process quite rarely or once. Meanwhile, 84% of members said that music AI tools contributed to less than 25% of their work product, on average. Similarly, a Tracklib survey of ~1,100 music producers found that only ~25% were willing to pay anything to access music AI tools.

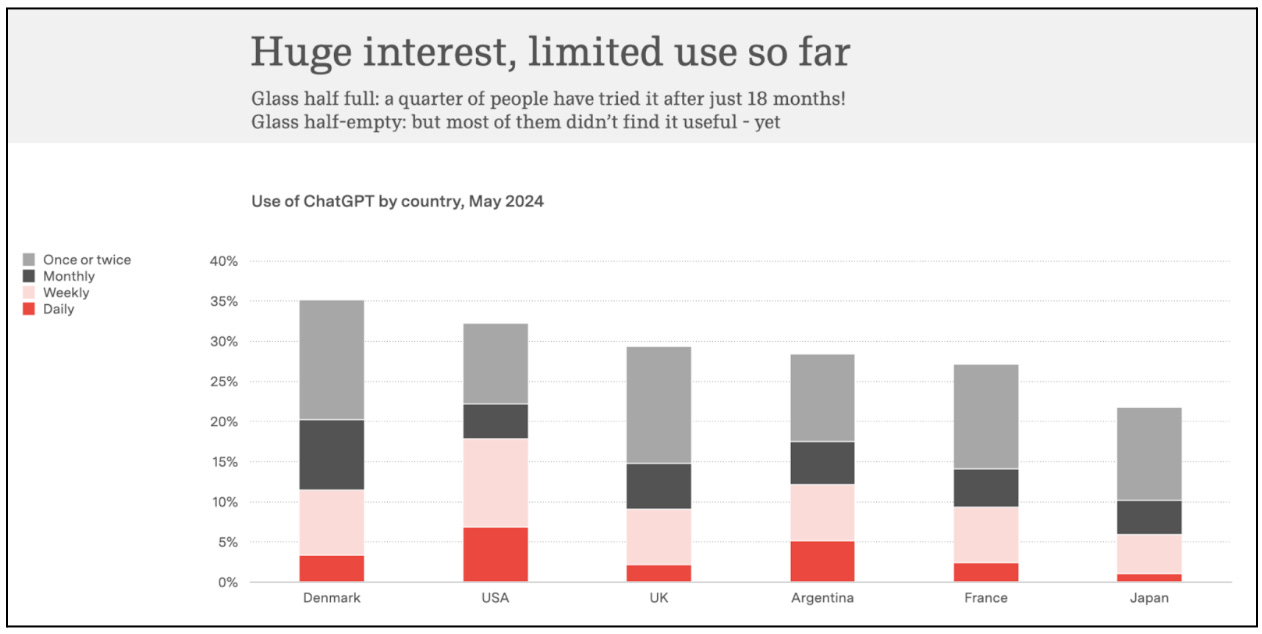

This music AI interest versus usage dynamic is seemingly similar to that of ChatGPT. According to Reuters, a meaningful percentage of people have tried the popular generative model, but most of them don’t use it on a regular basis yet.

Enabling New Listening Experiences

The second highest funding amount went to startups leveraging AI to enable new listening experiences. In a growing sea of content, AI-powered recommendation and discovery tools seek to provide listeners with greater personalization.

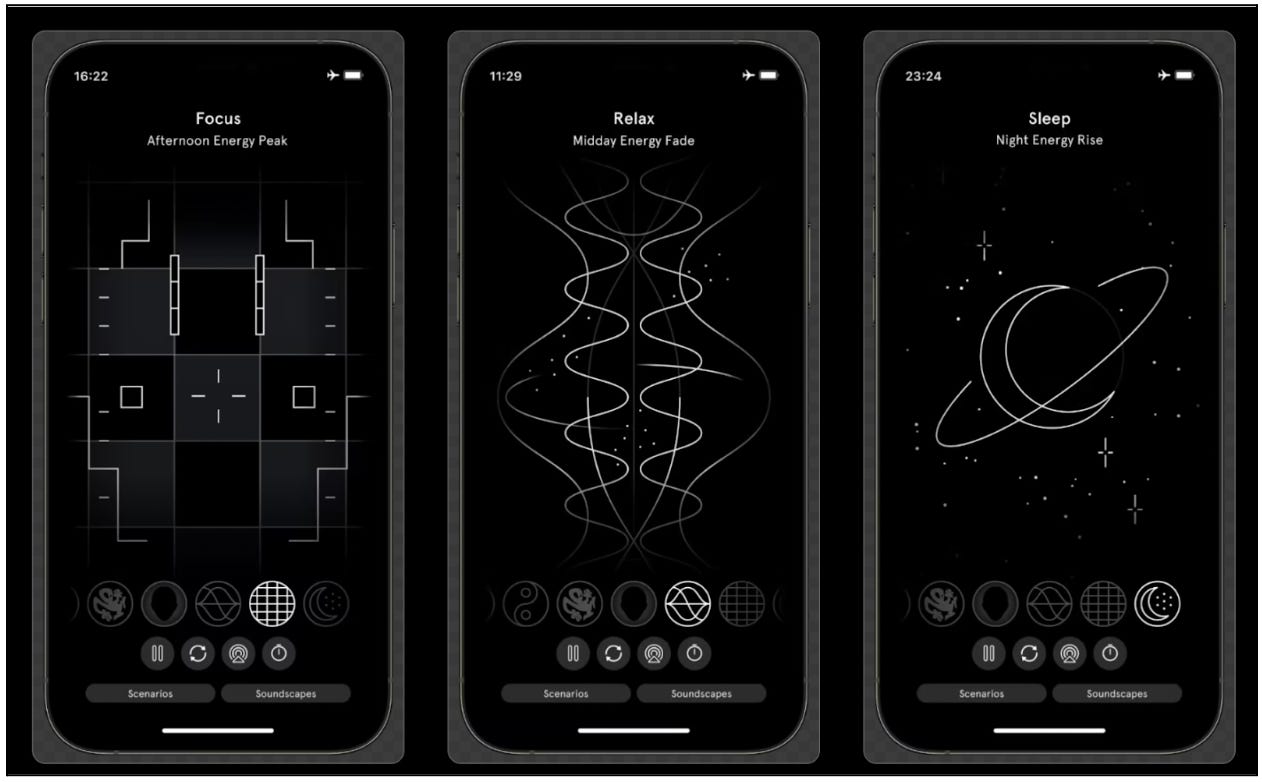

For example, Berlin-based Endel ($15 million Series B investment round) is developing a mobile app which offers AI-generated soundscapes designed to help people relax, focus, and sleep better. The app takes inputs from a user’s movement, weather, location, time of day, and other factors to generate these personalized listening experiences. Interestingly, whereas music rights holders are suing text-to-music generative companies, large rights holders appear to be embracing Endel. In May 2023, the company announced a partnership with Universal Music Group to enable UMG artists to create new soundscapes on the app.

Another interesting startup in the category is PlusMusic (~$2.5M Seed round). The company aims to provide developers with a cheap and quick solution to integrate music into their video games. In addition, its technology provides gamers with the ability to change in-game soundtracks based on their preferences. This music then adapts to real-time gameplay. If you’re interested, here’s a YouTube video walking through how it works.

In addition to the startups seeking to enable new listening experiences, the larger streaming platforms are also rolling out new AI products / features. For example, Spotify has introduced a number of AI features, including an AI playlist tool that lets users enter a text prompt from which music suggestions are generated. YouTube Music is also experimenting with giving users the ability to create AI playlists (among several other AI tools in development). Meanwhile, Tencent Music Group is developing a chatbot to help users discover new content.

Protecting IP Rights

Given the industry’s concerns around AI’s potential for misappropriation, I was surprised to only find two startups – MatchTune and Whitebalance – that have successfully raised funds in this category since 2022.

There are other companies policing music AI training data and online works. Some of these (e.g., Audible Magic, Pex) haven’t raised funding the past couple years. Others (e.g., Deezer, Believe) are more mature businesses that are building detection tools that aren’t a core part of their business model today.

It’s also probably worth noting that I classified Beatdapp’s $17 million Series A round as a non-AI investment, because my understanding is that the company has focused to date on hijacked user streaming accounts and bot activity. While the company’s offering protects IP rights, it isn’t focused on AI-specific issues, such as auditing AI model training data, detecting AI-generated music, etc. However, Beatdapp could certainly add AI services in the future.

Given music rights holders’ focus on “ethical AI”, I’d expect to see continued (and, frankly, increasing) investment – from both startups and established distributors / streaming platforms – on protecting IP rights over the coming years. Along these lines, there appears to be a disconnect between the venture dollars flowing to creator efficiency tool startups versus those focused on protecting IP rights, with ~100x more invested in the former since 2022. One explanation could be that once the efficiency tools scale, they will focus on solving IP issues. Even if that’s the case, it’s surprising to see so little venture capital focused on protecting IP rights given the music industry’s concerns.

Other

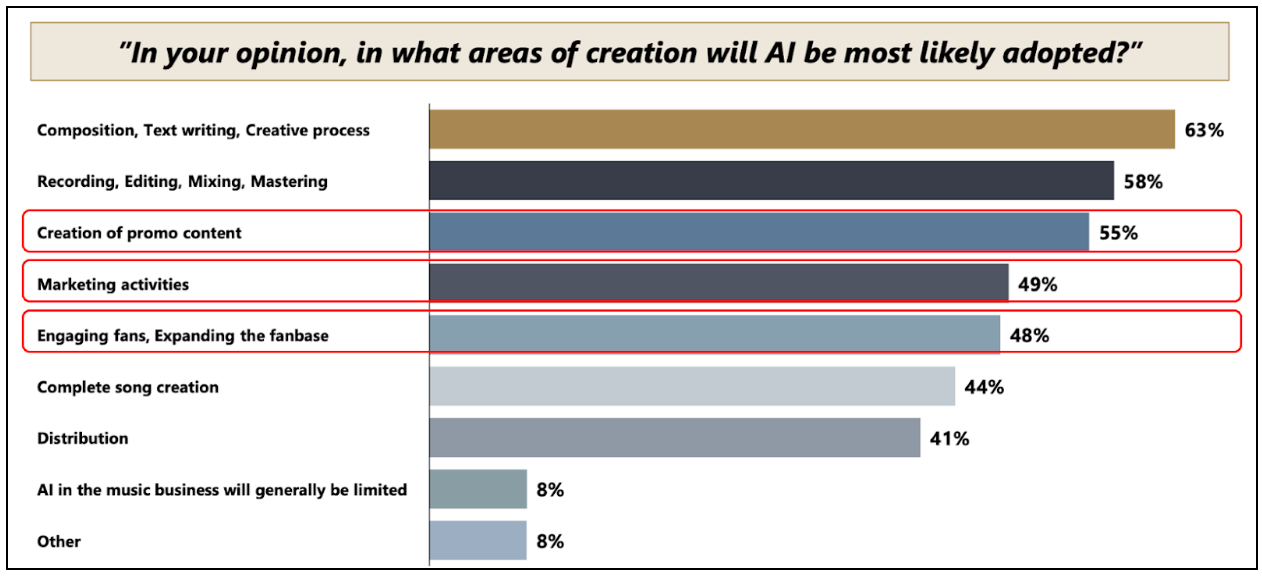

There are several startups that fall outside the three categories listed above. Most of these provide business services to independent artists, labels, and/or publishers. For example, Songistry uses an AI-powered search engine to connect buyers and sellers of music on TV, advertising, and video games (i.e., synchronization licenses). Meanwhile, SymphonyOs is providing an AI marketing tool to help independent artists grow their fanbases. The company’s focus aligns with a survey from Goldmedia’s recent AI report, in which marketing is a top area creators expect to see AI adoption.

Looking at Music AI Investors

There has been a wide variety of investors, ranging from angels to institutional venture firms, investing in music AI startups. Based on our analysis, with five deals, VC firm Andreessen Horowitz (“a16z”) has participated in the most investment rounds. Angel investors Daniel Gross, former head of Apple’s artificial intelligence efforts, and Nat Friedman, former CEO of GitHub, have also been quite active in music AI startups, investing in four and three rounds, respectively. A brief list of the top investors in the space is copied below.

One thing that stands out is the dearth of investment funds, corporate venture funds, and angel investors that come from the music / audio industry. In other words, generalist VCs and technology entrepreneurs have been the most active investors in the space over the past few years. That said, I’d argue that some music industry expertise on a startup’s cap table is important, because the industry has a unique set of challenges, including complex licensing rules, fragmented ownership of rights, a general wariness of tech disruption, etc. It will be interesting to see if this dynamic shifts at all during the next 12 to 24 months.

Closing Thoughts

The interest in artificial intelligence technology is growing among founders, investors, and music industry rights holders. Over the past few years, dozens of music and audio startups have successfully raised funding to come up with creative solutions using AI.

As discussed, the vast majority of investment has focused on efficiency tools in the creative process. These AI tools should enable creators to reduce the barrier between an idea and finished piece of musical content, enabling more artists to produce a growing amount of content. Meanwhile, consumers will hopefully have more enjoyable listening experiences from more personalized AI playlists, thereby creating deeper engagement. Investments in AI business tools should help lower the costs of reaching audiences and building a career.

At the same time, Leveling Up has written about the lack of large exits in the music industry over the past decade. Music AI companies are still subject to meaningful risks, including regulation, a seemingly low willingness to pay for tools, rapid commodification, and the need to appease powerful rights holders in most use cases. This is a fascinating space that we’ll be watching closely!

Thanks to Maxime and Adam for the feedback, input, and editing!

Leveling Up’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. In addition, our work may feature entities in which Alderbrook Companies, LLC or the author has invested and/or has provided consulting services.

📚 Music Business, Tech, and Investing Content Worth Consuming

Here is some of the best content that I consumed over the past month or so –

Roger Federer Commencement Address at Dartmouth (Dartmouth: link)

Music In the Air: Focus on monetisation, Emerging Markets, and AI (Goldman Sachs: link)

Why every video game company needs a music strategy (GXM Podcast: link)

How Artists Can Transition into the Business World (Harvard Business Review: link)

The state of the attention economy: why don’t fan first platforms work? (MIDiA: link)

Did Charli XCX go mainstream, or did the mainstream just go niche? (MIDiA: link)

How music AI content and copyright detection actually works (Water & Music: link)

TikTok is forming an investment team to acquire music content and companies (MBW: link)

When Do We Stop Finding New Music? A Statistical Analysis (Daniel Parris: link)

How Asset-Backed Securities Are Changing the Music Catalog Market (Billboard: link)

Mobile Gaming Post-IDFA Deprecation (Konvoy: link)

🤝 Want to Work Together? Get in touch!

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with labels, publishers, music technology companies and investors on a range of projects.

Our Investment Consulting Services -

Over the past few years, we’ve had the privilege of supporting several great investment firms. Our team is available to provide market and investment research, due diligence, and advisory support. Whether you invest in public markets, venture capital, private equity, or are a business or investment bank facilitating deals, we’d love to help you meet and exceed your investment goals.

Our Early-Stage Investment Focus -

In addition to our consulting services, we make early-stage investments, with a focus on companies building in media and government technology. If you’re a founder who is raising, please reach out to us!

To get in touch, you can either reply directly to this email or click the link below to fill out our contact form. We’ll be back in touch soon!

📭 Share Leveling Up with a friend!

If you enjoy Leveling Up, please consider sharing it with friends and colleagues (link to share)!

A very interesting deep dive into AI in the music industry- keep up the great work, Jimmy!