The Contrarian: Understanding MUSIC’s $200M Raise

Matt Pincus, founder of SONGS, is building a new music investment firm.

Like all of you, my heart broke this week following the events in Nashville. My deepest condolences to those who lost loved ones. This newsletter isn’t about politics, but mass shootings in this country need to stop. Here’s one organization working to make a difference, if you’d like to get involved.

GM readers 👋,

What a March!

First off, congratulations to last month’s Mardi Gras king cake raffle winner: Mike C.!

Now, financial markets have been on a rollercoaster ride with the collapse of three US banks, a major Swiss bank, and the fear of further contagion. The flight of uninsured deposits from smaller regional banks to the “too big to fail” banks may result in interesting opportunities for private credit and private equity investors. After all, middle-market companies will still have capital needs, even if they have less access to bank credit.

At Alderbrook, we’re working on a number of exciting projects in music and gaming. Please reach out if you think that we might be able to help you and your firm! Meanwhile, Hannah and I are trying to purchase our first home 🤞. Nevertheless, we’re back in your inbox on time and with 4K+ words, which feels pretty darn good.

Back in 2016, I began my journey seeking to better understand the music industry. As I started the process, I asked my network for their take on the industry’s trajectory and for their perspective on the smartest builders in the space. At that time, folks were still somewhat skeptical about where things were headed. Streaming was helping to stabilize recorded music’s decade-plus decline, but the industry’s unique growth story wasn't a consensus opinion quite yet.

For best-in-class entrepreneurs building in the space, one name came up over and over again in my conversations – Matt Pincus, founder and CEO of SONGS Music Publishing (“SONGS”). At SONGS, Pincus developed a differentiated strategy, assembled a talented team, and executed successfully. After launching in 2004, the SONGS team demonstrated a knack for signing extremely successful contemporary songwriters – The Weeknd, Lorde, and Diplo – right as they were breaking out. After running the company for more than a decade, Pincus sold SONGS to Kobalt for an estimated ~8x return on invested capital.

Impressive! 👏

I’ve never met Pincus, but when I dedicated more time to this newsletter, I knew that I wanted to write about his next chapter – MUSIC – at some point. Well, the time has arrived.

MUSIC is an investment holding company, which is focused on investing in music businesses. As we’ll see, Pincus’ experience at SONGS will likely prove helpful when identifying and evaluating investments. At the same time, delivering private equity-type (20%+ IRR) returns investing in the music industry has proven challenging in the recent past.

In this piece, we’ll explore MUSIC’s origin story, strategy, and some potential hurdles to executing against its vision. As a reminder, these company-specific deep dives are intended to “level up” my understanding. Importantly, I’m not trying to shill any investments. This isn’t a sponsored piece, MUSIC isn’t paying me to write it, and I’m (sadly) not an investor in MUSIC.

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. This piece is for informational purposes only. None of this is financial or legal advice. Do your own research!

Thanks again for reading. If you have any feedback or ideas for future posts, please leave a comment or shoot me an email.

Now, let’s get after it!

Jimmy

PS If you like our work, please consider hitting the heart ❤️ emoji and sharing this article, because it helps more readers discover our writing and supports our growth! And if you’re not already a subscriber to Leveling Up and don’t want to miss out on future newsletters, feel free to enter your email below and you’ll receive new posts directly in your inbox.

The Contrarian: Understanding MUSIC’s $200M Raise

“You can’t make money with a consensus accurate prediction.” - Bill Gurley, General Partner at Benchmark Capital

I’ve become a pretty big podcast listener lately. One of my favorite business podcasts is The Tim Ferriss Show. In a recent episode, Ferriss interviewed Aryeh Bourkoff, the founder and CEO of LionTree. LionTree is an investment bank and merchant bank that advises and invests in many of media’s most transformational companies.

During the interview, Bourkoff launches into a fascinating discussion covering how he thinks about competitive advantage in his business and compensating employees based on this advantage: “What’s your edge? In a certain defined role like the role of finance or the role of banking, the edge really is: 1) Do you have a unique idea? 2) Do you bring unique capital? or 3) Do you have a unique relationship?”

MUSIC is arguably taking this advice to heart. Matt Pincus, its co-founder and CEO, has a history of making contrarian bets. Earlier in his career, he built and sold SONGS, a successful independent publishing company, focused on developing contemporary songwriters at a time when major publishing companies were more interested in acquiring older song catalogs. That experience earned Pincus a strong network and deep understanding of the music business.

Meanwhile, after raising $200M last year, Pincus’ current firm MUSIC is focused on investing exclusively in growing music businesses. No, MUSIC isn’t participating in the recent catalog boom of purchasing cash-flowing royalties that can be levered and sold. Instead, MUSIC wants to identify talented entrepreneurs with unique, defensible business models that can generate venture-like returns.

In other words, MUSIC is hoping Pincus’ unique ideas, relationships, and capital will give it the edge needed to deliver attractive returns to its investors in an industry which isn’t historically synonymous with many unicorn exits. Perhaps it shouldn’t be surprising that Bourkoff is a partner in this investment holding company.

In this piece, we’ll take a closer look at MUSIC’s origin story and strategy. Next, we’ll speculate on where MUSIC might be headed in light of historical investment outcomes for venture-backed music companies.

What is MUSIC’s Origin Story?

Matt Pincus has spent his entire career at the intersection of business and music. In some ways, finance and entertainment are in his blood. Pincus is the son of legendary financier Lionel Pincus, who co-founded industry leading private equity firm Warburg Pincus, and Suzanne Storrs, who appeared in a number of television shows in the 1950s and 1960s.

In interviews, Pincus has talked about how music profoundly impacted his life at an early age. He discovered punk music when he was ~10 years old and credits it for giving him a sense of purpose and community. “I was not a happy kid. I got into all sorts of trouble. Got arrested, doing drugs, all that stuff. Hardcore and straight-edge [punk music] cleaned me up and put me on the right path.”

At 17, Pincus joined New York hardcore band Judge as a bass guitarist. His time with the band only lasted two years, but it sparked an interest in the music business. “I thought about whether I wanted to have a career as an artist, but I didn’t write songs, I didn’t sing, so I felt like it was a limited career path. But at the same time, I was really interested in the business side of it—our record deal, marketing the record, and guarantees at shows.” Pincus eventually went back to school to earn an MBA. Upon graduating, he pursued his passion for the music business, taking a job as a strategy associate at EMI.

SONGS Music Publishing

While working at EMI, Pincus had an insight: the major music companies were focused on buying cash flow producing music catalogs and weren’t actively signing contemporary songwriters. A little over a year after starting at EMI, Pincus left to start SONGS Music Publishing in 2004. The company’s vision was to capitalize on the insight to partner with potentially overlooked young, contemporary songwriters. To accomplish this, Pincus assembled a talented team of young music executives, including Carianne Marshall (now COO of Warner Chappell Music) and Ron Perry (now CEO of Columbia Records).

The company’s strategy to zig (signing contemporary songwriters and producers) while other major publishers zagged (acquiring older, more predictable publishing catalogs) proved to be wise. SONGS carved out a niche. After initially targeting Christian rock and hard rock musicians, the company began to form partnerships with more mainstream artists. Its catalog eventually consisted of ~16,000 songs and 350+ writers with a client base including superstar artists like The Weeknd, Lorde, and Diplo. According to Billboard, from 2015 to 2017, SONGS had a stake in at least 3.5% of the top 100 songs played by US radio stations for 10 of 12 quarters.

In interviews, Pincus has shared some of the learnings that he accumulated while building SONGS. This interview from the 2015 Sync Up Conference is particularly informative. As it relates to building an independent music publishing business, these lessons included:

Relationships are the most important thing in the independent music business. “Music publishing is a complicated business. People like to think of it as assets and cash flows. But fundamentally at the end of the day, music publishing is about relationships. It’s about relationships with people and relationships with musicians.”

Effectively and consistently making advances to artists is a key driver in building a high rate of return music content business. SONGS didn’t scale its catalog by purchasing a bunch of older, evergreen songs. Instead, the company slowly identified emerging songwriters and producers over time, gave them relatively small advances, and then shared in a percentage of the royalties generated from their songs. When done successfully, this can eventually result in what Pincus calls a “mattress made out of sheets” (i.e., a big catalog of cash flowing songs stacked on top of each other).

Data analytics can be very helpful for discovering promising artists and songs. Pincus believes that data which measures reactivity (i.e., a listener hears a song and then takes an action) to be the most helpful. For example, SONGS used Shazam data to help build conviction in signing Lorde. At the time, Lorde’s hit song Royals was the most Shazam’d song in the US, even though (and perhaps because) she was largely unknown.

BUT data can only help you up to a point! Pincus believes that data can only get you to a ~50% level of confidence about a decision, but not any higher. “Because ultimately at the end of the day music happens when music happens. Some of the greatest things that happen have no data the minute before they explode.”

After running the company for more than a decade, Pincus sold SONGS to Kobalt in December 2017. At that point, Pincus felt that changing market dynamics made it an attractive time to sell: "The price of signing songwriters has skyrocketed, and the prices of catalog are stratospheric.” SONGS was reportedly sold for ~$160M, resulting in an estimated ~8x return on invested capital. For context, publishing catalog acquisitions typically underwrite 1.5x to 2x ROIs. In short, the SONGS outcome was a financial home run for the SONGS cap table. After the sale of SONGS, Pincus quickly began to consider what might be next.

LionTree & The Making of MUSIC

In 2018 roughly six months after selling SONGS, Pincus joined LionTree, the media investment bank and merchant bank as an executive-in-residence. LionTree had advised Pincus and SONGS on its sale to Kobalt. During that process, Pincus got to know LionTree founder Aryeh Bourkoff, who was attracted to the SONGS founder’s successful track record, insights, and relationships in the industry: “Matt’s independence, track record, and relationships he’s built across the ecosystem give him a unique perspective on where music is headed.”

In a recent Bloomberg interview, Pincus explained his vision for his next chapter: “I really wanted to build an investment company that is only focused on music. I didn’t just want to work for a private equity fund.” At LionTree, Pincus began looking for investment opportunities in various parts of the music industry. Initially, he took an exploratory approach by meeting with entrepreneurs and trying to answer a few key questions that would give him greater confidence in the potential to build an investment company around music:

Question 1: Are there a sufficient number of interesting music companies to invest in?

Answer: Yes. Pincus saw opportunities in growth-stage music technology businesses, and in independent labels operating differently.

Question 2: Do these companies need capital and are they willing to take his capital?

Answer: Yes. His unique experience at SONGS was valuable to entrepreneurs looking to realize returns on their music businesses.

Question 3: How are these investments going to be funded?

Answer: For his first investments, Pincus funded opportunities with a combination of his own capital, LionTree’s capital, and other investors’ capital.

After researching the market and making a few investments, Pincus had the confidence to shift from a fundless sponsor-like approach to raising permanent capital. With the help of Bourkoff, Pincus raised $200 million to form a new company – appropriately named “MUSIC” – focused exclusively on making music investments.

MUSIC’s partners consist of Pincus, LionTree, and two family offices: Jonathan Soros’ (son of hedge fund legend George Soros) JS Capital Management and Schusterman Family Investments. The foundations were now in place for Pincus to fund companies making an impact on the evolving music landscape. In May 2022, MUSIC was born.

What is MUSIC’s Approach to Investing?

With all the above context, let’s take a closer look at MUSIC’s vision and strategy more closely. After all, this will be what Pincus and his team need to deliver on to justify MUSIC’s $200M raise – not to mention potential future capital raises, which have already been hinted at.

If you’d like to hear it from Pincus himself, check out this insightful interview on Trapital’s podcast.

Based on my research, I’d probably bucket MUSIC’s investment strategy into the following five categories, which attempt to cover the key considerations driving the future investment portfolio that MUSIC is building towards:

1) Music Sector Focus. As discussed above, MUSIC is focused on making investments exclusively in music companies. Having said that, music is a broad mandate. Within the music industry focus, Pincus has further identified three sub-categories for the types of opportunities MUSIC is making bets on:

First, MUSIC will invest in independent music labels, publishers (like SONGS), and management companies. Within this subcategory, Pincus looks for businesses: 1) with talented music executives who can find and develop talent; 2) that advance money to artists and songwriters successfully; and 3) that have unique insights and relationships to a market or with creators. An example investment is LVRN.

Second, MUSIC will invest in “music tech” companies, which includes Web3 businesses. For this bucket, Pincus searches for companies with several criteria, including those: 1) built on their own technology stack; 2) serving large addressable markets; and 3) showing a defensible business model that isn’t easily replicable. Example investments include Splice and DICE.

Finally, MUSIC will invest in larger syndicated music deals. These include opportunities in either of the two buckets above that are so large that it makes sense for the private equity firm or MUSIC to seek out co-investors to help fund the investment or acquisition. An example investment includes participating in the Francisco Partners led buyout of Kobalt Music.

2) Minority Control Positions. According to Pincus, MUSIC is typically making minority (venture capital or growth equity like) equity investments in these companies. As a result, MUSIC will likely have some control rights (e.g., a Board seat and protective provisions), but isn’t seeking outright control of the companies in which it invests. That said, larger syndicated deals may result in MUSIC participating with a group of financial institutions which acquire a controlling stake in a business.

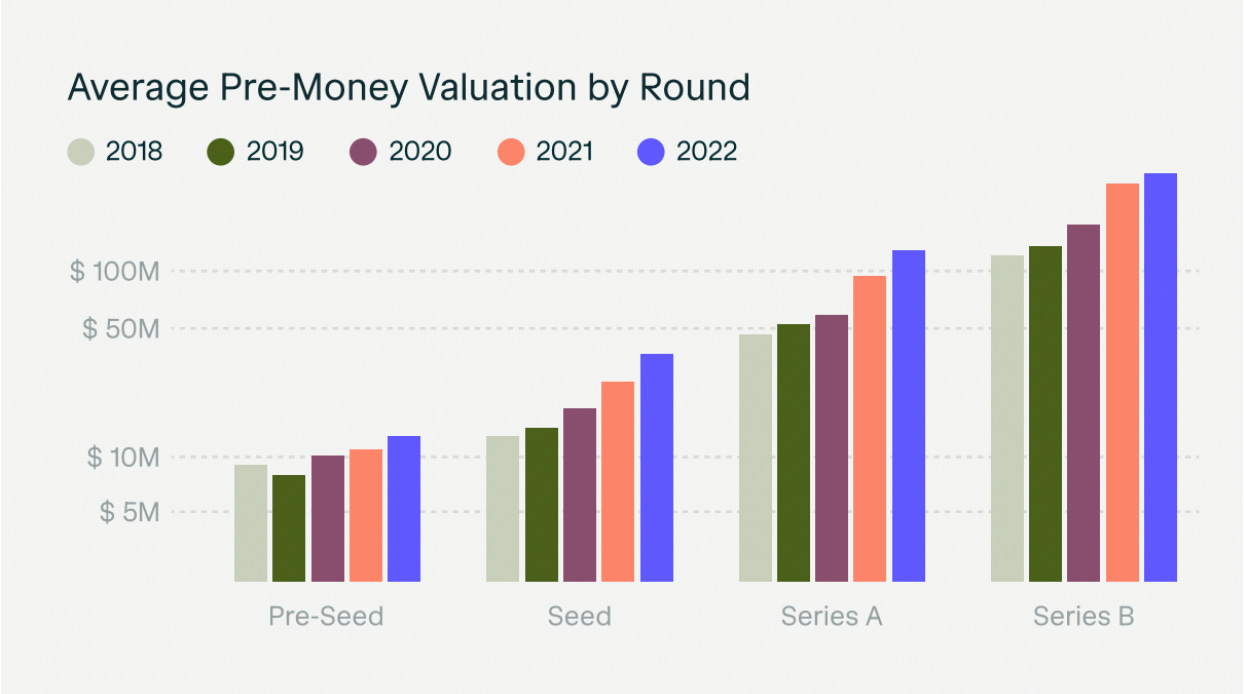

3) Preference for Series B and Later Companies. MUSIC appears to have a pretty broad mandate in terms of company stage. So far, Pincus has invested in seed rounds (e.g., HIFI) and later-stage growth rounds (e.g., Splice). That said, according to Pincus, MUSIC will target an average check size of $25 million. Given this, I expect MUSIC to gravitate towards Series B and later type opportunities with post-money valuations of ~$100M+, on average (depicted below). Of course, they may also look to participate in earlier rounds and increase their holdings over time as the company grows (via pro-rata rights). Nevertheless, MUSIC can provide growth capital at various stages of a company’s lifecycle.

4) Long-Term Investment Time Horizon. As opposed to a traditional venture capital fund structure, Pincus has talked about how MUSIC is structured as a holding company. One potential benefit of this decision is that Pincus won’t be constrained by typical fund life constraints on selling investments (typically 10-12 years after forming the fund). Therefore, MUSIC will be able to take a longer-term investment horizon than most typical venture capital or private equity funds. As a reminder, Pincus spent just short of 15 years building SONGS before selling it. In order to meet its likely return targets (discussed below), this likely means an expected hold period of 10+ years for venture stage (Seed to Series A) investments 5 to 7 years for growth stage (Series B and later) investments.

5) PE / VC Investment Return Targets. We don’t know the exact returns MUSIC is seeking to achieve for its partners. That said, my experience working with venture and growth equity investors suggests that the company will be seeking 15% to 20%+ annual rates of return (“IRRs”), on average, when making an investment. For investments with a potential 10+ year hold period, this implies that MUSIC will need to realize 5x+ their money per investment, on average. For growth-stage investments with a shorter expected hold period, MUSIC will likely be targeting 2x+ their money per investment. In short, MUSIC’s underwritten returns will vary depending on a company’s stage and the expected holding period. Along these lines, it would be interesting to learn more about MUSIC’s portfolio construction plans. For example, the percentage of investments that will be early-stage (Pre-Seed to Series A) versus the percentage that will be growth-stage (Series B and later).

What Investments has MUSIC Made So Far?

Now that we have a high-level idea of MUSIC’s strategy, let’s take a look at what Pincus has invested in so far. Given that MUSIC is investing in private companies, we don’t have a ton of access into how these initial investments are performing. That said, we can get a sense for general momentum via subsequent funding announcements, hiring trends, etc.

One important note: my understanding is that of the three investments highlighted below, HIFI and Splice were made prior to forming the $200M MUSIC holding company. However, I still believe that they’ll give us a sense for the types of investments the company will make going forward.

So, let’s take a closer look at a few of Pincus’ initial investments to get a sense for what these companies do and how they’re performing so far.

HIFI: This music tech platform provides creators with financial education, products, and services to help them manage their careers. For example, HIFI leverages its data to provide “members” with insights on their finances as well as offering faster royalty payouts. According to Crunchbase, Pincus invested in HIFI’s first two funding rounds in 2020 and 2022 and currently serves on the company’s board of directors. The company hasn’t released much data on its performance but it’s positive (albeit unsurprising given the fundraises) to see that its headcount appears to have grown rapidly over the past two years.

Splice - This music tech platform allows artists to access royalty-free music via a marketplace. Splice also provides collaboration tools to create new music. The company charges a monthly subscription fee of $12.99 to $39.99 which grants access to a certain number of sounds. In 2021, the company announced that it had over 4 million users – up from 1.5 million in 2018. According to Crunchbase, Pincus and LionTree participated in the company’s $57.5M Series C round that was led by Union Square Ventures and True Ventures. Two years later in 2021, Pincus and LionTree led Splice’s $55M Series D round alongside Goldman Sachs’ Growth Fund. Its user growth and ability to raise subsequent funding suggests that this investment is marked higher than MUSIC’s initial investment. That said, Splice’s slightly declining headcount over the past two years suggests that growth may have stalled somewhat recently.

LVRN: This Atlanta-based record label, publisher, and management company has helped develop several successful artists, such as Summer Walker, D.R.A.M., Boogie, and Grammy-nominated 6lack. Founded in 2012, LVRN’s – full name “Love Renaissance” – artists have generated more than 30 billion streams and sold more than 175 million singles. In January 2023, MUSIC made a $25M+ investment in the company to enable the company to “expand [its] operations globally.” Given that this investment was made a couple of months ago, it’s far too early to tell how things are going.

At SONGS, Pincus was able to identify a market opportunity, assemble a talented team to build a business, and identify and structure deals with emerging artists. His efforts led to a successful outcome, in which ~$20M of invested capital turned into a ~$160M exit. In many ways, his next chapter at MUSIC will aim to leverage many of these same relationships and insights. However, the key question is whether MUSIC can deliver on its plans. So, let’s try to evaluate that.

Will MUSIC’s $200M Raise Live Up to Expectations?

MUSIC’s high-level vision and strategy sounds exciting. But will its $200M raise be successful? Obviously, it will take time to know this answer with certainty. That said, we can try to better understand the likelihood of success in the context of how MUSIC fits into the broader music investing landscape.

To do that, let’s take a look at the size of MUSIC’s capital raise in the context of successful music venture exits. Is the opportunity big enough to justify a $200M+ holding company?

The reality is that there have been very few large exits in the music industry over the past 10 to 15 years. The data suggests that there have been 11 PE / VC-backed music companies that have exited for more than $500M since 2010. 8 of these deals were music tech deals and 3 were content deals (i.e., music labels / publishers). Since 2010, only 9 companies have exited for $1B+, with 3 of these companies – Spotify (backed by Founders Fund, Accel, and others), Tencent Music Group (backed by Balyasny, Northern Light Venture Capital, and others), and Warner Music Group (backed by Access Industries) – exiting for $10B+ over the period.

What are some takeaways from this analysis in the context of MUSIC’s raise?

The margin for error is going to be low and finding one exceptional company will likely make the difference. MUSIC will invest ~$25M and likely own somewhere between 20% to 30% of each investment. Of course, some of these investments won’t pan out. If MUSIC hopes to generate a 2x to 3x+ type of return (~$500M) for its partners, it will need to own a meaningful stake(s) in companies worth $2B+ ($500M/.25) in aggregate. Based on our research, 1,000+ music companies have raised venture capital since 2010 and only 9 (less than 1%) have reached an exit valuation of $1B+. In short, if history is any guide, Pincus and his team will need to identify a needle in a haystack.

MUSIC is smart to expand its investment surface area. While Pincus built a content company, the data suggests that he is wise to pursue music tech opportunities too because the vast majority of large venture-backed exits since 2010 have been in music tech. Expanding the search filter will enable the company to have a better chance of investing in a $1B+ type opportunity.

In addition to the above context, it’s also worth considering the number of music venture investors. How competitive is the playing field?

Based on my research, there have only been a handful of funds or investment platforms raised recently that are dedicated exclusively to investing in early-stage and growth music companies. Of course, there are also generalist investors that are investing in the music space. Regardless, this supply of growth capital from music focused investors is quite different than in other entertainment verticals, like video gaming, where a plethora of industry specific venture funds have popped up in the past few years (check out this great piece by my friends at Naavik on this dynamic here). Simply put, it looks like MUSIC will be offering capital from a unique source – a music focused growth investor – at least for now.

Along these lines, MUSIC’s vision appears to contradict several current investment themes.

First, MUSIC intends to invest in music businesses; not in music catalogs. In the past few years, there have been billions of dollars raised to purchase music catalog assets due to their relatively high cash flow yields and low correlation to the broader economy. But Pincus isn’t interested in following that trend: “The one thing that I don’t like about the recent music business is that somehow we all slipped into talking about music as assets, fraction finance, and cash flows and securitization…the music business is moving and motivating people to want what you make.” Instead, MUSIC is interested in supplying capital to “talent, creativity, repertoire, and innovation” that enables growing businesses.

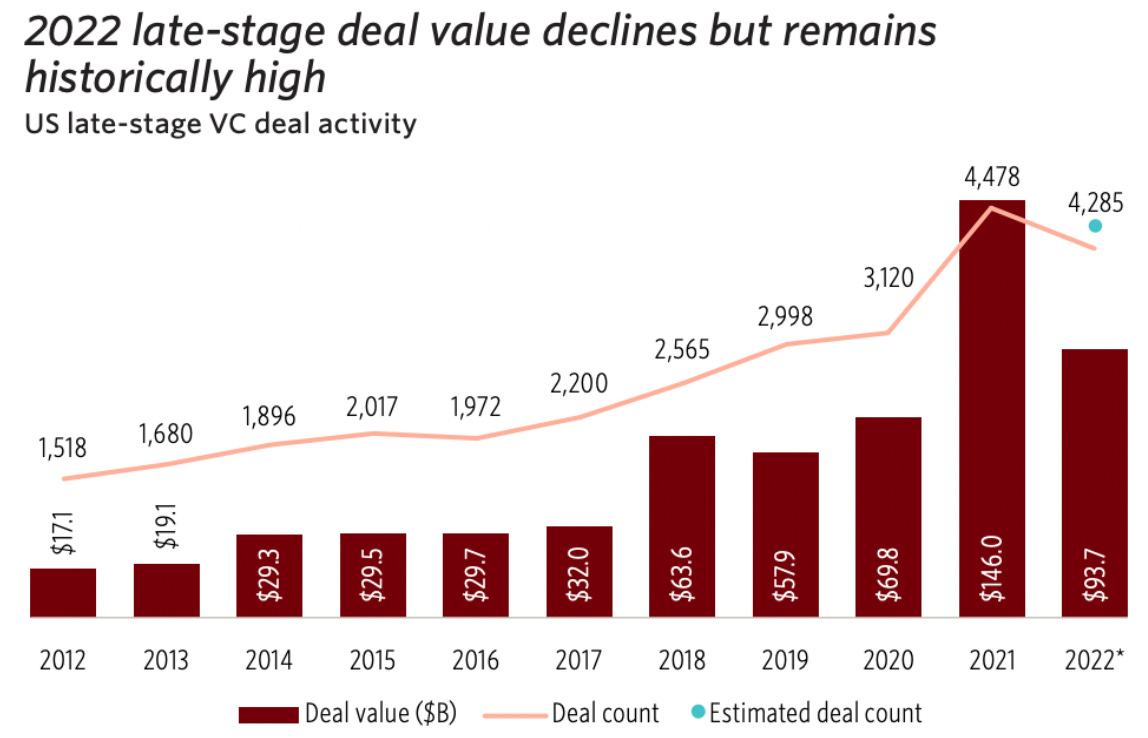

Second, MUSIC is investing in later-stage music tech companies at a time when deal activity and valuations are falling across the broader tech landscape. Falling public market valuation multiples have impacted private market valuations, especially at later-stage rounds. According to Pitchbook-NVCA Venture Monitor, late-stage VC-backed company valuations declined ~35% in 2022. This dynamic could create a funding gap opportunity for MUSIC to fill.

Finally, many venture investment professionals currently believe that a music-focused investment strategy isn’t a smart one. Given the data on VC-backed music exits discussed above, many venture and growth investors think that music isn’t worthy of a sector-focused fund. Here’s an article covering that point of view, which highlights how most music tech start-ups never reach profitability even at scale. There’s certainly an analysis to be done about music tech companies that are valued above $500M+.

Taking a step back, we can see that MUSIC’s strategy is unique in the current environment. Music-focused funds are not large compared to typical generalist or technology-focused growth equity funds. Given the historic returns in the category, that’s probably a good thing. At the same time, the music industry is growing at a healthy rate, with technology impacting how music content is valued. Perhaps the next decade will be brighter than the recent past for companies building in the space.

Closing Thoughts

Like many great investors, MUSIC is taking a unique approach to investing in the music industry. Rather than joining the dozens of other funds participating in the music catalog boom, MUSIC wants to provide growth capital to promising entrepreneurs building transformative content and technology businesses.

Will it be successful? While it’s made a few investments over the past couple years, it’s still far too early to predict. If history is any guide, it won’t be easy and MUSIC will need to be an extremely shrewd investor. But then again, perhaps the next decade will be better for the industry and produce more unicorn music businesses than the past 10+ years.

I’m excited to follow MUSIC’s story over time. With $200M of capital to invest, MUSIC has the opportunity to transform how many in the investment community view backing entrepreneurs building high growth music businesses.

Thanks to Henry, Hannah, and Adam for the feedback, input, and editing!

If Alderbrook can provide you with consulting services or if you are raising capital in this space, please reach out!

Great piece, Jimmy!