Looking East For Music Superfan Clues

What lessons can be learned from TME’s superfan strategy?

If you’re not already a subscriber to Leveling Up and want to join other curious music industry professionals, creators, investors, and entrepreneurs, enter your email below and you won’t miss out on future newsletters:

GM readers 👋,

Happy April!

Before diving into this month’s newsletter, two quick announcements.

First, Alderbrook is heading to Music Biz 2025! We will be attending the conference Monday through Thursday (May 12 - 15) and would love to meet you. If you want to discuss ways to collaborate with Alderbrook – from investing to research to consulting to partnerships – please let us know by filling out this form.

Second, Leveling Up is looking for a few part-time writers, who are interested in business strategy, are familiar with aspects of the music industry, and have the ability to learn and share insights from a variety of companies and trends. If that’s you, please send an email to contact@alderbrookcompanies.com and we’ll be in touch!

It’s been about a year since Jesse Feister and I wrote a piece about one of the music industry’s favorite buzzwords: “superfans.” At the time, it was clear that recorded music growth was decelerating and the Majors would try to invent new pockets of growth.

A year on, industry growth has indeed decelerated, but the superfan opportunity still feels like a hand-wavy one.

You already know respected firms expect 20% of paid streaming subscribers to be superfans. You’ve flipped through UMG’s Capital Markets Day deck outlining their research about why superfans should be a significant opportunity. And you’ve read the Bloomberg article about what the Spotify “Music Pro” (i.e. superfan) tier might look like.

Still, you might be hungry for a bit more. What superfan features will Western DSPs release and at what price? What will the adoption curve of superfan tiers look like? How big of a near-term impact will new superfan tiers really have on industry revenue?

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. I’m not a licensed investment professional. This piece is for informational purposes only. None of this is tax, financial, investment, or legal advice. Do your own research!

Now, let’s get after it!

Jimmy

Looking East For Music Superfan Clues

“[World of Warcraft] was the best subscription business of all-time…We never raised the prices. My view was to come up with value added services. Come up with new things to sell. But just leave the price…It’s a prickly audience. You don’t want to do too much to agitate them.” - Former Activision CEO Bobby Kotick describing why Blizzard never raised World of Warcraft’s $15 per month subscription price

The once booming recorded music market has begun to slow down. Recent analysis by IFPI and MIDiA shows that streaming revenue growth – the driver of industry revenue over the past decade – has decelerated.

As Leveling Up has written about, the industry’s leading players are searching for the next vector to reignite growth. One of the key areas being explored is segmenting music fans in hopes of getting the most engaged, most willing-to-spend users – so called “superfans” – to open up their wallets for more stuff (e.g., special content, access, perks, etc.).

When it comes to the music superfan trend, the big burning questions that I think a lot of investors, and executives have are -

What value (i.e., products and features) will be offered to “superfans”?

What will it cost fans to access this value?

How many fans will adopt these premium offerings?

How quickly will fans adopt these offerings?

Given all of the above, what impact will superfan offerings have on industry revenue?

To kill any suspense, I have no insider knowledge or experience building and launching these types of products. Still, I think that there are likely clues to these questions by looking closer at non-Western companies that have been shipping superfan products for years.

In 2022, China-based Tencent Music Entertainment rolled out their “Super VIP” streaming tier. Since then, TME’s “online music” annual revenue, average revenue per paying subscriber, and stock price have increased ~75%, ~25%, and ~85%, respectively.

These are promising high-level signals of product and creative teams finding new ways to unlock user spend. In this month’s issue, let’s take a closer look at TME’s superfan tier experience and wrap up with some big picture thoughts on the potential lessons for Western companies readying new superfan products.

The Rise of Tencent Music Entertainment’s Super VIP Tier

Tencent Music Entertainment (“TME”), referred to as the “Spotify of China” by some, is the leading Chinese music and audio platform. The company is 50%+ majority owned by Tencent and was founded in 2016 when 3 of the country’s top 5 music streaming platforms – QQ Music, Kuwo Music, and Kugou Music – joined forces. Today, the TME umbrella includes other popular apps outside of online music streaming, including karaoke (WeSing) and long-form books & podcasts (Lazy Audio). In 2018, TME went public on the New York Stock Exchange and currently has a market capitalization of $21+ billion.

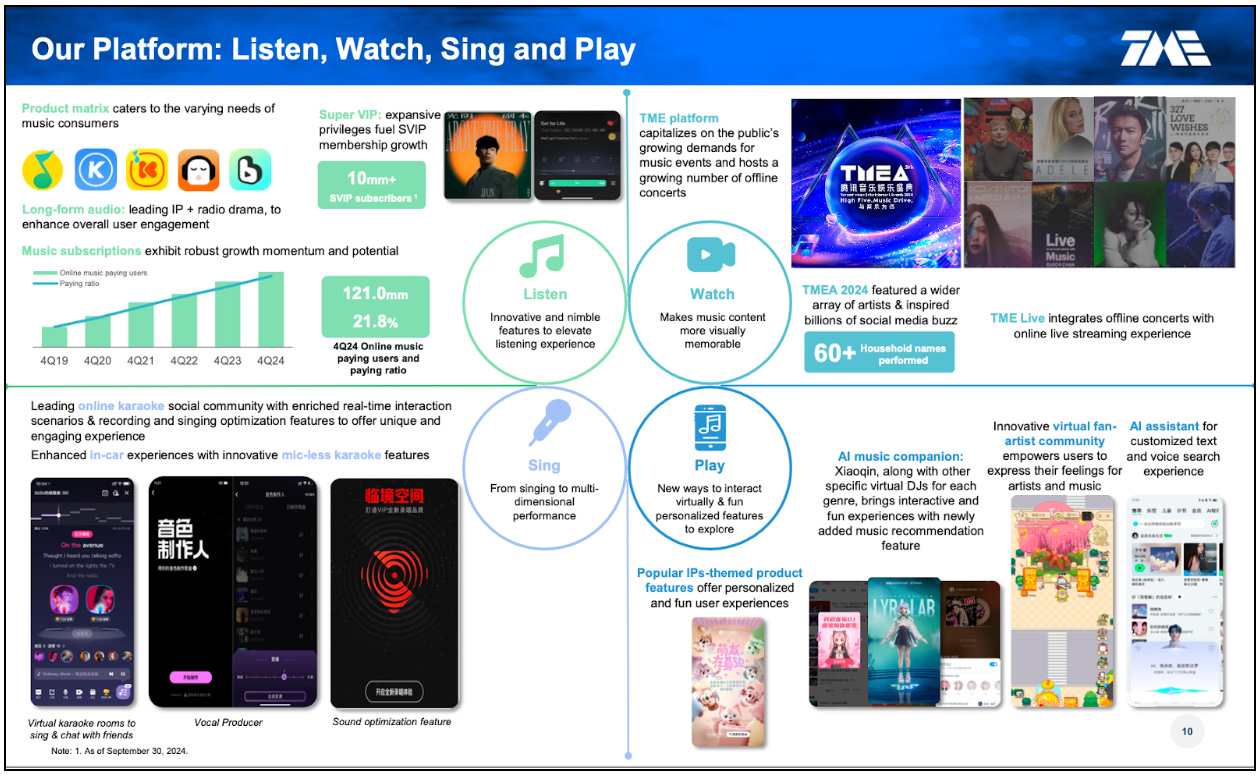

The company’s platform can be grouped in four main business lines as it relates to consumer use cases –

Listen (music streaming, long-form audio)

Watch (live events, live streaming)

Sing (online karaoke)

Play (AI music companion, virtual fan-artist communities)

Before looking closer at TME’s superfan tier, it’s important to understand how China’s music streaming market is different from that in which Western-based platforms, like Spotify, operate. Breaking this down will help us think about why TME has been pursuing a superfan tier and how applicable its strategy will be for Western DSPs.

China’s Music Market

According to IFPI, China ranked as the fifth largest recorded music market in the world in 2024 and was the fastest growing market (+25.9%) among the top 10 countries. It is a unique market relative to several of the other largest ones. Here are some of its key characteristics -

China’s online music user base is already large and fairly well penetrated as a percentage of internet users. According to data from China Internet Network Information Center, total China music users peaked in 2021 at 729 million and currently represents a penetration rate of ~65% of China’s internet users. For context, Spotify had 675 million monthly active users (up 12% year-over-year) at the end of 2024. In other words, the potential for attracting new music streaming users in China appears to be more limited for established China-focused streaming services, like TME, than they are for global DSPs, like Spotify. Along these lines, TME has seen its online music service monthly active users (“MAUs”) slowly decline since 3Q 2019 to 556 million at the end of 2024.

Despite a large number of users, only a small fraction are currently paying to listen to music. China’s music paying ratio is relatively low compared to other developed markets. According to Universal Music Group, China’s paid music subscriber penetration rate was only 13% in 2023 as compared to the US and UK at 42% and 38%, respectively. TME’s paying ratio for its online music segment was below 10% as recently as 2020. Unsurprisingly then, TME has been focused on converting their large add-supported user base into paying subscribers in recent years. Through a combination of strategy changes, product improvements, and user education, TME has been able to increase its paying ratio to ~22% at the end of 2024. For comparison, Spotify’s paying ratio was ~39% at the end of 2024.

China’s average revenue per paying user has been increasing. As China has a large number of users who don’t currently pay for music), it shouldn’t be a shock that the country’s average revenue per user (“ARPU”) is currently well below other developed markets. Still, the focus of TME and other China-based music streaming platforms to improve monetization has caused the average revenue per paying subscriber (“ARPPU”) to increase over the past few years. For example, TME’s ARPPU has increased ~31% from RMB 8.5 per month in 2021 to RMB 11.1 per month in 2024. This ARPPU story is different for Western streaming services. Spotify’s premium ARPU has declined over the past 5-10 years, as the company has prioritized user growth over monetization.

The top music suppliers (i.e., record labels) have a much lower market share in China than in other large music markets, like the US and UK. According to MIDiA, the three Major music labels generate ~65% of recorded music revenue globally. Meanwhile, the top 5 labels in China only generate ~30% of revenue. The more fragmented nature of China’s music licensing market provides streaming platforms, like TME, with certain benefits, including more leverage to negotiate better licensing terms and the ability to act like a record label by signing independent artists and helping them create and grow their music.

Streaming platforms in China, like TME, regularly offer paying users exclusive music content. In 2021, China passed regulatory policies that reduced TME’s market dominance by requiring the company to end its exclusive label licensing deals. Still, music services in China are still permitted to enter into exclusive deals with independent artists for up to three years and to exclusively release new songs for up to 30 days. As a result, whereas Western DSPs haven’t really differentiated much (yet) from competitors via exclusive agreements with rightsholders, China-based streaming services do. For example, TME recently reported having 260+ million music and audio tracks across its streaming services, which is ~75% more than its closest competitor Netease Cloud Music’s 149+ million tracks.

Streaming platform market share is much more concentrated in China than most other large music markets. TME has a dominant market share position in China. Its online music streaming services have 556 million monthly active users or an estimated combined 60%+ of China’s music streaming market. For comparison, MIDiA estimates that Spotify’s global market share (excluding China) is ~44%, which is roughly equivalent to the combined market share of its three big tech competitors – Apple Music, Amazon Music, and YouTube Music.

In summary, China’s music streaming market is large but is still arguably quite undermonetized. It also has several unique characteristics compared to other geographic regions. The competition among music streaming platforms appears to be less fierce than other large Western markets. This is due, in part, to less reliance on a few large content suppliers (i.e., Major labels) and the inability of the West’s biggest technology companies to operate in the country. These conditions are reflected in TME’s dominant market share position and its higher gross margins (42% in 2024 vs. Spotify’s 32% in 2024).

How Have These Dynamics Impacted TME’s Monetization Strategy?

With a better understanding of China’s music streaming market, it makes sense for TME to be early to the superfan opportunity. To drive revenue growth, the key unlocks for the company have been 1) converting a large unpaid userbase to paying users and 2) growing ARPPU. Meanwhile, TME’s dominant market position has almost certainly helped get key rightsholder partners to go along with new pricing and product efforts aimed at improving monetization.

At first, TME sought to drive more paying subscribers via a paywall strategy. In 2019, the company began requiring users to pay to access certain popular songs. TME targeted putting 10% of songs on its services behind a paywall by the end of 2019. The company has gradually raised its target, with 20% of songs behind a paywall by the end of 2020. While TME’s team hasn’t commented on the target in recent years, some research analysts estimate that ~50%+ of popular songs on TME’s apps are currently behind a paywall.

Next, TME focused on growing its average revenue per paying subscriber. To increase ARPPU, TME has 1) raised subscription prices and 2) introduced a superfan tier (called “Super VIP”). For the former, TME has increased its premium subscription (“VIP”) prices gradually over time, including a 30% price increase in mid-2023. For the latter, the company launched its Super VIP subscription in 2022, which currently costs users 5x the VIP tier and includes several additional features and benefits.

So far, these two strategic approaches for improving monetization have worked extremely well. TME’s paying users as a percentage of MAUs increased from 4.2% in 2018 – the year before the paywall strategy was introduced – to 21.8% at the end of 2024. Meanwhile, TME’s monthly ARPPU has grown ~30% from 2021 – the year before the Super VIP tier was launched – to 2024.

Since implementing these monetization strategies, TME’s revenue from its online services segment has increased almost 4x to ~$3 billion (RMB 21.7 billion) from 2018 to 2024. It’s worth noting that TME’s online services revenue growth began to decelerate in 2022, which was the same year it introduced a superfan tier. Over the past two years, the segment’s revenue growth has reaccelerated.

Given TME’s success at driving ARPPU and revenue growth, let’s take a closer look at what the company’s Super VIP tier offers users.

What Does TME’s Superfan Tier Offer?

The table below shows how QQ Music, one of TME’s music streaming apps, offers different features to its users by tier.

For RMB 40 per month or 5x the standard paid subscription tier, QQ’s superfan (“Super VIP”) tier offers several benefits that boil down to exclusive access to content / events / merchandise in the app, a better listening experience in the app, and more content outside the app. These include -

Early access to popular new music releases [Access]

The ability to download more songs for offline listening [Access]

Full access to TME’s livestream events [Access]

Better social personalization features, such as skins, for in-app chat and comments [Access]

Exclusive access to other artist events (e.g., early access to concert tickets, meet-and-greet sessions) and merchandise [Access]

The highest quality audio experience [Listening Experience]

Free access to TME’s karaoke app (WeSing) and audiobook / podcast app (Lazy Audio) [More Content]

One of the things that I find super interesting about TME’s superfan feature set is that they largely align with a study conducted last year by Luminate of what matters most to US paid streaming users. In a survey of “up-for-grabs” paid streaming users in the US, Luminate found that the features which mattered most were access to exclusive music content, livestream performances, and non-music content.

TME’s superfan tier features also align with Universal Music Group’s (“UMG”) consumer research of what appeals most to consumers. In UMG’s Capital Markets Day presentation, the company highlighted early access to new music, high quality audio, and artist Q&A sessions as being very important to music streaming users.

For comparison, Spotify’s superfan tier (“Music Pro”) features are rumored to include higher quality audio, early access to concert tickets, and AI tools that let users remix songs. In other words, Spotify’s Music Pro tier appears to be leaning less heavily into exclusive content – at least at launch – as compared to TME’s superfan tier. To access Spotify’s Music Pro perks, the add-on is expected to cost users ~$18 per month in the US or ~50% higher than a regular premium subscription, a much lower percentage increase than TME’s 5x higher Super VIP tier.

So how many folks have sprung for TME’s superfan tier in order to enjoy its benefits?

In 3Q 2024, the company announced that its Super VIP subscription had reached the 10 million MAU milestone. In other words, over 8% of TME’s paying users subscribe to its superfan tier since it launched two years ago. While meaningful, this figure is still significantly below the 20% - 30% figure that UMG and Goldman Sachs forecast.

What Can TME’s Experience Teach Us?

The largest thread in TME’s monetization strategy tying things together appears to be exclusive access for each subscription tier.

TME’s regular paid subscription tier plays on this exclusivity trend by keeping a meaningful portion of its song library behind a paywall. Paywalls have popped up from time to time among DSPs in the West. For example, SoundCloud’s subscription tiers embrace this pricing strategy. But since the company is private, we don’t know how it’s going (my DMs are open!).

Notwithstanding the SoundCloud example, music streaming paywalls haven’t really caught on at scale in Western markets yet. Spotify and UMG signed a licensing agreement in 2017 that gave UMG the ability to put major new releases behind a paywall. Still, there have only been a couple examples over the past 10 years of big albums placed behind a paywall on Spotify.

Given TME’s success in driving premium subscribers from its paywall strategy, why aren’t paywalls a bigger part of streaming platform pricing plans in the West? The answer is most likely a combination of a different competitive environment and piracy. In the West, there are easy substitutes to paywalls, such as YouTube where fans can consume free music, both officially and via user uploads. Similarly, exclusive song releases in the West have often driven people to piracy websites. For example, TIDAL’s exclusive release of Beyonce’s Lemonade album and Kanye West’s The Life of Pablo album drove listeners to download TIDAL’s music streaming app and to illegally download the albums on torrent sites.

Similarly, TME’s superfan tier introduces an add-on for users to opt into even more exclusive features. From early access to new song releases and concert ticket pre-sales; to full access to livestream concert events; to unique skins for socializing in-app, the company has seemingly honed in on the features that matter most to music’s biggest fans and made them exclusive to the superpremium tier.

I wouldn’t be surprised to see DSPs based in the West incorporating more exclusive access features (e.g., exclusive early song releases, exclusive livestreams, etc.) in-app as well as providing “free” access to content outside of the music app (e.g., video streaming subscriptions) into their superfan tiers over time. In doing so, DSPs should offer a more attractive value proposition to users, thereby gaining greater pricing power over time – albeit probably not 5x the regular paid subscription price.

When it comes to adoption timelines, TME’s experience suggests that meaningful superfan tier adoption will likely take several years to play out. Even with a lot of exclusive features available for Super VIP users, TME’s superfan tier launched two years ago but still remains below the 20% - 30% paid subscriber goal shared by some industry executives and analysts. With Western streaming services operating in a more competitive environment, I have a hard time seeing how they will outperform TME’s timeline. Simply put, the 20%+ goal seems potentially plausible, but it’s probably going to take longer than executives are going to want.

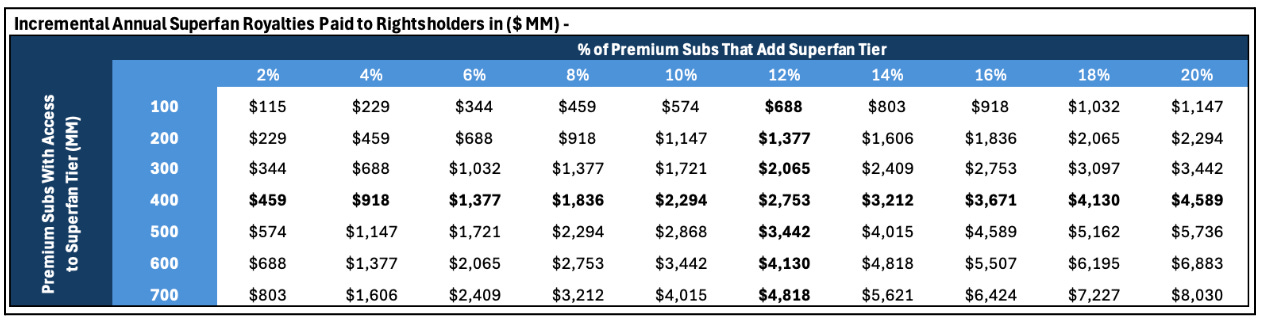

With the above in mind, I estimate that the financial impact of music streaming superfan tiers on industry revenues will likely be in the low-single digit percentages over the near to intermediate term.

However, as the number of premium subscribers with access to superfan tiers grow, and if penetration rates reach 20%+, the percentage increase could be quite substantial.

Closing Thoughts

I’m excited to see how DSPs, like Spotify, go about rolling out their superfan tiers. A lot of questions remain.

What value will be offered to “superfans”? In addition to the features reportedly being released at launch, I expect that we’ll see more exclusive early song releases, more exclusive livestream content, exclusive merchandise, and bundles with non-music apps integrated into music streaming superfan tiers over time.

How receptive will industry partners be to these tiers’ features? There is a lot of complexity to navigate with these partnerships but it appears many key partners, particularly large rightsholders, are ready to deal.

How quickly will fans adopt these offerings? I expect that meaningful adoption will take a while, given TME’s experience in China’s seemingly less competitive market.

What impact will superfan offerings have on industry revenue? If superfan tiers rolled out by DSPs based in the West see similar success as TME in China, I’d expect that industry revenues should experience a low single digit percentage increase.

In short, I believe that Tencent Music Entertainment’s superfan tier could offer helpful clues into how things will go for DSPs in the West getting ready to launch superfan tiers. Regardless, based on recent reports, it sounds like we might not have to wait too much longer to find out.

Thanks to Maxime and Adam for the feedback, input, and editing!

Leveling Up’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. In addition, our work may feature entities in which Alderbrook Companies, LLC or the author has invested and/or has provided consulting services.

📚 Music Business, Tech, and Investing Content Worth Consuming

Here is some of the best content that I consumed over the past month or so –

Fred Wilson and Brad Burnham (The Slow Hunch: link)

The Major Record Companies Lost Market Share On Spotify Again Last Year (MBW: link)

SoundCloud’s First Ever Music Intelligence Report (SoundCloud: link)

Rob Stringer In Conversation with Tim Ingham (Sony: link)

A Model For A New Music Streaming Industry (MIDiA: link)

WMG CEO Says ‘Building’ an Indie Distributor ‘Might Be Better’ Than Buying One (Billboard: link)

How Empire’s Ghazi Brought The Music Business To San Francisco (Billboard: link)

Why Major Labels Are Snapping Up Stakes In Indies At a Breakneck Clip (Billboard: link)

Per Sundin on Pophouse’s $1BN+ Ambitions In Music Rights (MBW: link)

🤝 Want to Work Together? Get in touch!

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with labels, publishers, music technology companies and investors on a range of projects.

Our Investment Consulting Services -

Over the past few years, we’ve had the privilege of supporting several great investment firms. Our team is available to provide market and investment research, due diligence, and advisory support. Whether you invest in public markets, venture capital, private equity, or are a business or investment bank facilitating deals, we’d love to help you meet and exceed your investment goals.

Our Early-Stage Investment Focus -

In addition to our consulting services, we make early-stage investments, with a focus on companies building in media and government technology. If you’re a founder who is raising, please reach out to us!

To get in touch, you can either reply directly to this email or click the link below to fill out our contact form. We’ll be back in touch soon!

📭 Share Leveling Up with a friend!

If you enjoy Leveling Up, please consider sharing it with friends and colleagues (link to share)!