SoundCloud: Understanding Music Streaming’s Dark Horse

Amidst acquisition talk, what is SoundCloud’s strategy for the future?

If you’re not already a subscriber to Leveling Up and want to join other curious music industry professionals, creators, investors, and entrepreneurs, enter your email below and you won’t miss out on future newsletters:

GM readers 👋,

Happy (belated) January!

I hope your 2024 is off to a great start. In my hometown of New Orleans, folks are celebrating the city’s next holiday – Mardi Gras. If you’re a veteran of this newsletter, you know what that means…

It’s time for our Second Annual Mardi Gras King Cake Raffle! We’ll be sending one subscriber a free Gambino’s Bakery king cake. Last year had a solid turnout with Mike C. winning the grand prize. If you’re interested, fill out this form with your name and email. We’ll randomly draw a winner on February 27th. To participate, the only rules are that you have to be a subscriber to this newsletter and located in the United States (for shipping reasons).

This month we’re going to study a company that I’ve wanted to write about for some time. SoundCloud is one of the most unique companies in music technology that I’ve come across. Fans use it to discover and interact with their new favorite artists. Artists use it to experiment and build their careers while staying independent. Labels use it to find and sign the next Chance the Rapper, Lorde, and Billie Eilish. It’s a music discovery and streaming company, an artist services company, and a social media company all rolled into one.

Despite its undeniable cultural capital and a dynamic value proposition, SoundCloud seems to receive less attention than other streaming juggernauts like Spotify and Apple Music. More recently, the company has been grabbing headlines for strategic reasons, as it’s reportedly going to hire investment bankers to run a sale process in the coming months.

With some of my favorite things – music, technology, finance, and strategy – intersecting, the timing feels perfect to cover this fascinating business.

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. I’m not a licensed investment professional. This piece is for informational purposes only. None of this is tax, financial, investment, or legal advice. Do your own research!

Now, let’s get after it!

Jimmy

SoundCloud: Understanding Music Streaming’s Dark Horse

“Maybe he’s an enigma. A riddle wrapped inside a mystery.” – Seinfeld’s Elaine Benes describing Newman

I was in New York this past month for a handful of meetings. In a few, I mentioned that I was thinking about covering SoundCloud for this month’s newsletter. Each time, I got a quizzical look. The responses from music industry professionals were more or less the following –

“Why?”

“What do they do again?”

“It’s always a Re- with them. Restructure. Reorganize. Re-something.”

These quips – even though delivered with a pinch of humor – surprised me and reflect a view that SoundCloud’s best days are behind it.

I’ve wanted to write about the company for a while. I’m a semi-active user. And more importantly, the platform’s track record is impressive in my opinion. Consider the following milestones:

More than 40 million creators or 4x+ more than competitors.

Over 375 million tracks or 3x+ more than other popular streaming platforms.

A history of breaking music megastars, including the likes of Billie Eilish, Chance the Rapper, Lil Uzi Vert, Lorde, Post Malone, and many more.

An artist-friendly brand, as the only technology company I’m aware of that has been thanked by an artist during a Grammy speech.

An innovative approach to paying rights holders via its fan-powered royalties program.

When reports surfaced that the company is being shopped at a $1+ billion valuation by investment bankers, it felt like the right time to go deeper.

As I’ve researched SoundCloud’s history and vision going forward, I’ve realized that there is so much to learn from it. The company has been a high flying start-up that grew quickly and raised a lot of (maybe too much) funding from top VC firms. It has struggled to monetize its large user base and been forced to recapitalize and restructure. And through it all, it’s still standing and has an ambitious, thoughtful, and differentiated strategy for the future.

So which is it? Are SoundCloud’s best days in the past, or is the future brighter than ever?

In this piece, I’ll do my best to answer these questions. I’ll explore how SoundCloud rose to prominence; its value proposition; how it’s currently faring; its unique strategy among music streaming companies; and finally, my quick take on the likelihood of a $1 billion valuation in the context of its historical financials and its publicly-listed peers.

Grab a cup of coffee! We’re about to go deep on a fascinating company.

Where Did SoundCloud Come From?

To understand where SoundCloud is headed, it’s helpful to explore the company’s origin story. Launched in 2007 by Alexander Ljung and Eric Wahlforss, SoundCloud’s mission is to “empower artists and fans to connect and share through music.” Alexander and Eric, both amateur musicians, met while studying engineering at the Royal Institute of Technology Sweden.

Back then, both found the experience of sharing audio files online to be cumbersome. Their idea was to create a tool where creators could easily upload an audio clip, share it, and then receive feedback from other artists and listeners. At the time, companies like YouTube and Flickr were making it easy to share videos and images on the internet. But nothing similar existed at scale yet for audio, with artists sharing files over email or clunky file sharing websites.

During a 2010 interview, Alexander described his entrepreneurial journey and the motivation for starting SoundCloud.

“The point of [SoundCloud] is to give great tools to artists but also to have an influence on how the web can be useful for creators and artists… if that happens, that ends up changing how people create music in some ways, how they share [music], and how they make meaning out of [music].”

From my perspective, there are a few points about his and Eric’s journeys that distinctly stand out:

First, he is extremely passionate about music and the problems that SoundCloud is solving. At the time of the company’s formation, this was essential, because the music industry was in a very tough spot. Recorded music revenues (depicted below) were still plummeting due to the impact of piracy and consumers shifting consumption to digital downloads. Despite a passion for music, obvious intelligence, and desire to build an impactful business, neither founder had scaled a music technology start-up previously.

Second, Alexander and Eric wanted to build an open platform. This means that other applications and services would be able to integrate with SoundCloud, allowing new music to be uploaded without going to SoundCloud’s website. For example, a music creation software service could integrate directly into SoundCloud enabling users to easily upload their unique sounds directly onto the platform.

Third, SoundCloud was founded on a different premise than other major streaming companies. Whereas Daniel Ek has talked about founding Spotify with the primary objective of solving the music industry’s piracy problem, Alexander and Eric were most focused on providing helpful tools to artists. From the start, the Spotify founder was asking himself very user-centric questions like “how do we get people to pay for music again?” Meanwhile, SoundCloud was prioritizing artist-centric questions like “how do we make the web a more friendly place for creators?”

Fourth, Alexander and Eric prioritized growing SoundCloud as quickly as possible rather than achieving profitability. This wasn’t dissimilar to many other VC-backed technology companies at the time.

In short, Alexander comes across in the interview as a highly thoughtful, ambitious, albeit somewhat inexperienced entrepreneur at the time. His and Eric’s approach to tackling the internet’s impact on music was different from other entrepreneurs – like Daniel Ek – who also wanted to build massive music technology businesses. SoundCloud is obviously bigger than its two founders – and both are no longer involved day-to-day at the company – but I believe that the four points above contributed to what SoundCloud has ultimately become.

SoundCloud’s Journey to Today

Since Alexander and Eric met at university and sought out to build digital tools for artists, a great deal has happened. In a 2015 interview, Alexander described SoundCloud’s journey in three chapters:

Chapter 1: Build great tools to attract artists.

Chapter 2: Attract listeners, so that artists can build their audience.

Chapter 3: Facilitate ways for artists to monetize their audience.

The above characterization of SoundCloud’s story paints a much simpler picture than reality. Here is a non-exhaustive timeline below of several key milestones over the last 16 years.

The timeline offers five observations.

First, SoundCloud’s supply of content and user base – both creators and listeners – grew rapidly. Within five years of launching its website and mobile apps, SoundCloud reached tens of millions of registered users and over 175 million monthly listeners, making it the second largest music streaming service at the time behind YouTube. Today, the company reports 375 million tracks uploaded to its platform, which is 3x+ Spotify’s 100 million track catalog. On the creator side, SoundCloud has grown to serve more than 40 million artists.

The company has also served as a home to unsigned, independent artists as well as megastars who want to easily share new material and experiment with their sound. Artists like Lorde, Billie Eilish, and Post Malone literally went from unknowns when they uploaded new material onto SoundCloud to superstars with record label deals. Eilish has acknowledged SoundCloud’s beneficial impact on her career in interviews. I also highly encourage you to watch this 2:30 minute clip from a Post Malone interview on Howard Stern’s radio show. He credits SoundCloud for enabling his discovery. Meanwhile, established artists like Drake and Justin Bieber have also debuted new content onto SoundCloud. The platform even ushered in a new hip-hop movement dubbed “SoundCloud Rap”, which is associated with several commercially successful artists – including XXXTentacion, Juice WRLD, Lil Uzi Vert, and Fetty Wap – in the mid- to late-2010s.

A clear peak in SoundCloud’s journey occurred at the 2017 Grammys. Chance the Rapper thanked SoundCloud during his acceptance speech for Best Rap Album of the Year. I don’t know too many music streaming platforms or social media companies getting that type of love from artists. For example, I don’t ever remember hearing an artist or actor thanking God, family, and Instagram while accepting a major industry award. From my perspective, the moment is clear evidence that SoundCloud has delivered on its original vision. The platform has provided many of the ingredients for artists to build a sound and following without already having a major record deal in place.

Second, despite its impressive growth, SoundCloud has faced many of the same challenges as other technology start-ups building in the music space. For example, SoundCloud chose to scale its user base prior to securing licenses from major rights holders. It took almost ten years after the company’s formation for it to sign licensing deals with all three major record companies. Over the course of that period, Sony pulled its catalog from the platform, with at least one major (Warner) negotiating for an equity stake in SoundCloud along with its initial licensing deal. In addition to giving up equity, SoundCloud’s gross margin decreased dramatically – from 40%-50% to 25%-35% – once it started legitimately licensing rights holders’ catalogs in 2016.

Presumably, rights holders now receive a majority share of the platform’s revenue. That said, it’s worth noting that SoundCloud’s gross margin is still higher than Spotify’s current ~25%. Regardless, SoundCloud is another example of the challenges facing music technology companies that seek to innovate at scale while protecting and satisfying music rights holders. This dynamic shouldn’t be a surprise to regular readers of this newsletter. We’ve written in the past (linked here) about the dearth of venture-scale music technology exits over the past 15 years.

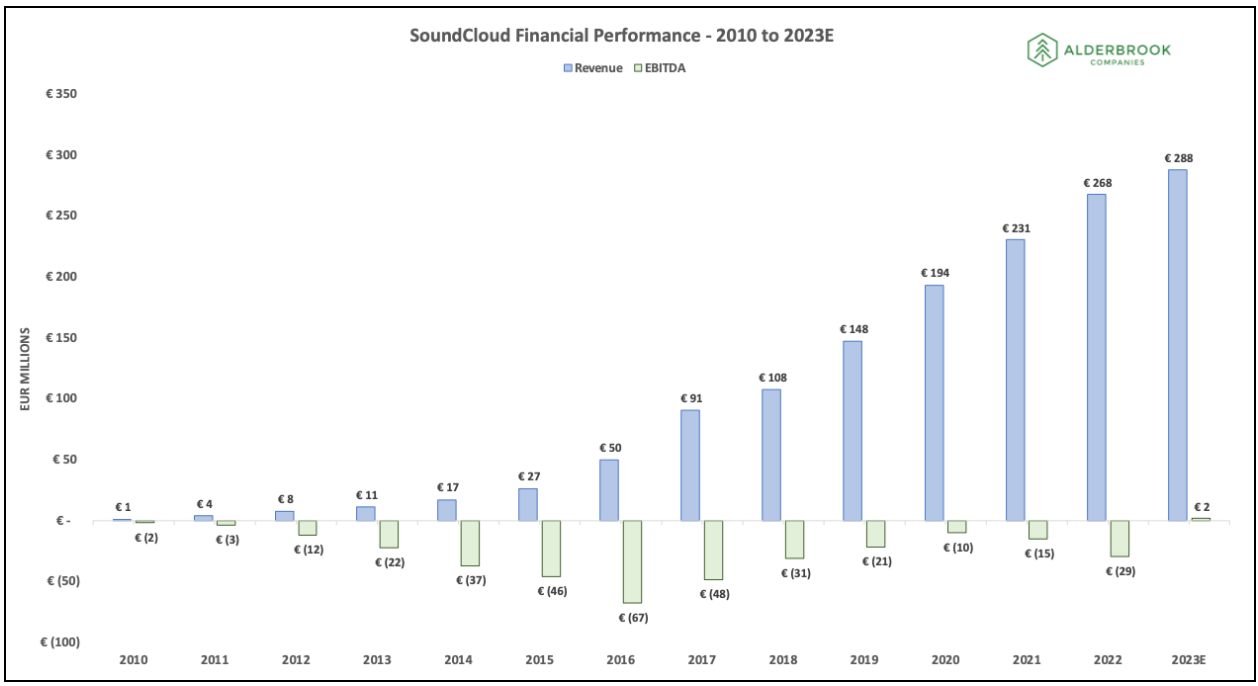

Third, SoundCloud has struggled to become a profitable business, resulting in a ton of capital raised to support its growth. The company’s revenue has grown exponentially from zero in 2007 to just under €300 million in 2023. Nevertheless, SoundCloud has consistently been an unprofitable business, burning a significant amount of cash along the way (depicted below). That said, it’s worth noting that the company expected to achieve EBITDA breakeven in 2023. Hopefully SoundCloud can build upon this achievement going forward!

To fund its growth and operations, SoundCloud has raised over $500M of debt and equity from a number of angels, VCs, and strategic investors, which notably includes Twitter and Sirius XM. That’s a lot of capital and time for a business to reach breakeven. However, this isn’t a unique dynamic among music DSPs. For comparison, Spotify raised $2.7 billion (!) of debt and equity prior to going public in 2018 and is only now becoming a profitable business. That said, Spotify’s annual revenue was ~$12.5 billion (~40x SoundCloud’s revenue) in 2022 and the company’s 2018 IPO enabled its early investors to cash out (whereas SoundCloud hasn’t achieved a major liquidity event for its early backers).

Fourth, SoundCloud’s struggle to become profitable has predictably led to changes in its ownership, leadership, and monetization strategy. By 2017, SoundCloud had just launched its streaming subscription service but was running out of cash. The company was reportedly struggling to either raise additional funding or find someone to buy it. To ensure its survival, SoundCloud laid off 40% of its staff and raised $170 million led by The Raine Group and Temasek. However, in exchange for the funding, SoundCloud’s capitalization table was altered significantly, with the new investor group acquiring control (over 50%) of the company. In addition, founder and CEO Alexander Ljung was replaced by former Vimeo CEO Kerry Trainor.

Today, SoundCloud is led by a talented and experienced team. Collectively, they have music IP, technology, and finance experience, although they haven't worked together at the company for very long.

CEO Eliah Seton, who previously led Warner Music’s independent creator services division, joined in 2021 and became CEO in 2023.

CFO/COO Tom Sansone, who previously served as Kobalt Music CFO, joined in 2024.

Chief Content Officer Tracy Chan, who previously launched Spotify for Artists and led Twitch’s music product, joined in 2023.

Over time, SoundCloud’s leadership has sought to improve the company’s profitability by tweaking its monetization strategy (in addition to lowering its cost structure). In its early days, SoundCloud monetized via artist subscriptions; then it rolled out advertisements; and in 2016 it introduced a listener streaming subscription service. Since the 2017 restructuring, SoundCloud has seemingly tried to strike more balance between its streaming business and its higher margin creator tools and services business. Along these lines, SoundCloud’s Creator Business (i.e., Artist Subscriptions) grew at an impressive ~40% CAGR between 2018 to 2021. As a result, this segment’s share of SoundCloud’s total revenue increased from ~30% to ~40%, contributing to SoundCloud’s gross margin expanding from ~24% to ~35% during the period.

Fifth, SoundCloud has taken varied approaches to executing its growth strategy. The company has mixed internal product development, integrations/partnerships, and more recently bolt-on acquisitions to scale the business and create value. As discussed earlier, Alexander and Eric sought to build an open platform that enabled other development teams to easily integrate with SoundCloud. But more recently, the company has made strategic acquisitions, such as the distributor and artist service company Repost Network and AI data analytics start-up Musiio.

In summary, SoundCloud has seen many peaks and valleys during its first 16 years of existence. With a controlling shareholder base that invested nearly 7 years ago, the company is reportedly weighing its “strategic alternatives,” which could result in a sale. While SoundCloud has scaled its platform from a creator and listener perspective, the unrealized ingredient has been consistent profits. This is the challenge that the company is still working towards. And, as we’ll explain, it’s betting a return to its roots will be key to solving it.

What is SoundCloud’s Value Proposition?

SoundCloud has come a long way from Alexander and Eric’s initial use case of creating a tool for artists to share their tracks more easily. Today, SoundCloud holds a unique position in the music industry value chain. While streaming platforms like Spotify have a direct relationship with fans, they don’t work directly with artists, resulting in substantial content costs. Meanwhile, while record labels have a direct relationship with artists, they don’t have direct access to data on the fans who consume their music and what is resonating. SoundCloud has direct relationships with both artists and fans.

Along these lines, the platform’s value proposition is rooted in its founder’s original vision of connecting artists with their fans. Whereas other digital service providers (“DSPs”) prioritize engaging and retaining listeners, SoundCloud equally emphasizes the needs of artists and their relationship with listeners. And it monetizes this artist/fan connection in a variety of ways.

The graphic below – created by former Spotify Chief Economist Will Page in his excellent SoundCloud analysis on the implications of FPR for artists – highlights several of SoundCloud’s points of differentiation in comparison to other digital audio and video platforms.

In this section, we’ll review what SoundCloud brings to the table for artists and fans. We’ll also look at how the company currently generates revenue from its offering.

How does SoundCloud Deliver Value for Artists?

For artists, SoundCloud provides some of the following benefits over other music streaming platforms:

Convenient and free (up to a point) distribution. SoundCloud has removed nearly all barriers to distributing music online by allowing any creator to upload three hours of tracks to the platform for free. Most other music DSPs, like Apple Music and Spotify, still require artists to work with distributors, which typically charge artists a monthly fee. And while Spotify tested a direct upload program, it discontinued it amidst significant industry criticism. Meanwhile, SoundCloud’s premium artist subscription service (“Next Pro”) allows artists to distribute to third-party DSPs and social networks for a monthly fee.

Ability to easily identify and communicate with top fans. SoundCloud has built tools that let artists easily message their fans directly. It also provides artists with detailed analytics on who their biggest fans are. Other major DSPs, like Apple Music and Spotify, haven’t rolled out similar features… at least not yet.

Opportunity to access funding from SoundCloud, which can enable more creative control. In 2022, SoundCloud announced its “Roster” program designed to provide successful independent artists – including Lil Pump, Nigerian singer-songwriter Tekno, and Atlanta-based rapper MadeinTYO – with funding (e.g., advances, artist marketing, etc.) to further their career. In this way, SoundCloud is offering similar services to a record label – a line other large DSPs like Spotify have seemingly been careful not to cross. According to SoundCloud, the Roster deals are structured as licenses enabling artists to keep their master copyrights and maintain creative control. To support the initiative, the company has signed a number of joint ventures with artist management companies and indie labels, such as Foundation Management, Third & Hayden, and IIIXL.

Option to be paid based on a user-centric royalty payout system. More recently, SoundCloud has pioneered a new payout system, which the company calls “fan-powered” royalties or “FPR”. Most other DSPs follow some form of a “pro rata” royalty payout system, where artists’ payouts are based upon their percentage of the total streams on a platform. This means that every stream within a pricing tier counts the same regardless of how many times a given listener may listen to an artist. Let’s consider an oversimplified example of FPR’s implications. Say I only listen to a band called Pintopia 10 times and Taylor Swift 0 times in a given month. Meanwhile, another listener on the platform streams Pintopia 0 times and Taylor Swift 90 times in the same month. Under FPR, Pintopia would receive 100% of my payouts or ~$7.00 (after the platform’s 30% take-rate). Under a pro rata system, Pintopia would only receive 10% of the platform’s total payouts or $1.40. According to SoundCloud, an FPR payout structure benefits independent artists over megastars. In short, SoundCloud’s remuneration model aims to prioritize the artist / fan relationship as opposed to the rights holder with the largest market share.

In summary, SoundCloud provides artists with an easy and cheap way to distribute their music on the internet. It also offers tools for artists to analyze their listener base and identify their biggest fans. To that end, artists can opt-in to a remuneration model in which they are paid by their specific listeners. In addition, the successful SoundCloud artists can access funding from the platform enabling them to maintain greater control than the average major label deal.

How does SoundCloud Deliver Value for Fans?

For listeners, SoundCloud offers a streaming service and social tools. Industry pundits describe the SoundCloud high-intent listening experience as “lean forward” whereas other DSPs offer a “lean back” one. To that end, more than one research study shows that 80% of SoundCloud subscribers in major markets regularly use more than one music streaming service. This suggests that SoundCloud offers consumers something different than and complementary to other DSPs.

From my perspective, some of SoundCloud’s points of differentiation for listeners include:

A larger song catalog. As mentioned, SoundCloud has 375 million tracks uploaded to its platform, which is almost 4x larger than Spotify’s 100 million track catalog. Its catalog leans heavily on user-generated audio content, making it a unique experience for listeners looking to find something different, like a remix or cover of their favorite track.

A place to discover new artists and genres. According to SensorTower, 1 in 4 artists on SoundCloud are also using Spotify for Artists, suggesting there are many creators unique to the platform. The fact that there are 40+ million creators on SoundCloud versus ~8 million on Spotify further supports this data point. For music lovers looking to discover their next favorite artist or genre, SoundCloud is a differentiated platform. As mentioned earlier, several of today’s stars started their careers uploading music to SoundCloud. Unsurprisingly, A&R executives have used the platform to find new talent. For example, Ron Perry (CEO of Columbia Records) first heard Lorde on SoundCloud and rushed to sign her.

An opportunity to communicate directly with artists. SoundCloud’s “Fans” tool allows artists to directly message their biggest fans. Currently no other major streaming services offer this, although Spotify is rumored to be working on a feature called “Superfan Clubs” that sounds somewhat similar.

A direct means to support artists. With artists who opt-in to fan-powered royalties, fans know their streams are going directly to artists. And as we’ll discuss later, SoundCloud is seemingly building more products to enable an artist’s biggest supporters to make purchases that support their career.

In short, SoundCloud offers listeners with a much larger catalog than other music streaming platforms. Similarly, fans can find DIY and emerging artists whose music isn’t posted on other DSPs. Finally, it provides users with features unique among streaming platforms, such as the ability to communicate directly with their favorite artists.

How does SoundCloud Monetize?

SoundCloud takes a “freemium” approach to monetization. To that end, it offers artists and listeners a free tier with more limited value to lower the barriers to adoption. Then it aims to convert users to its paid subscription tiers which provide added features and benefits.

For artists, there are two main revenue models today:

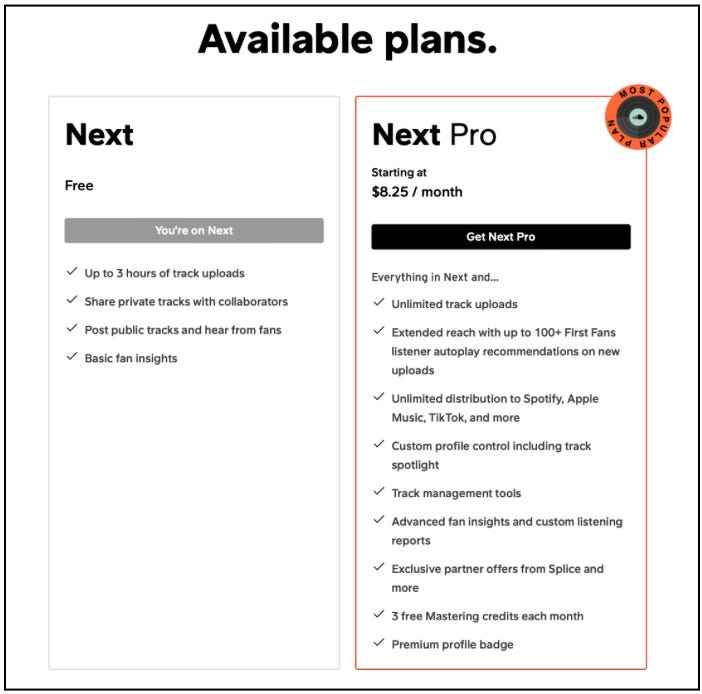

Artist subscriptions: Under its Next Pro subscription, creators pay $99 per year to have unlimited track uploads, distribution to various streaming platforms, advanced listener insights, and other benefits.

Source: SoundCloud Artist services: SoundCloud continues to add to its artist service offerings. This ranges from tools used in the music creation process – such as mastering for $4.99 per track – to financing services – such as the advances and marketing support in exchange for a percentage of future royalties – provided to artists in its “Roster program.”

For consumers, there are two main revenue models today:

Advertisements: Listeners who don’t subscribe to SoundCloud’s streaming service have access to a smaller catalog and listen to advertisements between tracks. The company takes a percentage of this revenue and shares the remainder with rights holders.

Streaming subscriptions: SoundCloud has two tiers – 1) SoundCloud Go and 2) SoundCloud Go+ – of ad-free streaming subscription tiers. Under SoundCloud Go, listeners pay $60 per year and have access to a limited catalog and can save tracks for offline listening. Under SoundCloud Go+, listeners pay $120 per year and have access to the full catalog, high-quality audio, and can save tracks for offline listening. Like advertising, SoundCloud takes a percentage of this revenue and passes the remainder through to artists.

How is SoundCloud Faring?

Now that we understand SoundCloud's value proposition and revenue models, let’s take a look at how its approach has been working. SoundCloud is a private company, so we don’t have a tremendous amount of data provided by the company. That said, we can observe a few data points from the company’s annual financial filings and third-party sources. Putting these pieces together suggests that the company is currently seeing mixed results.

On the user side, SoundCloud does not regularly report its number of creators and consumers. However, we can look at Google Trends, Similarweb, and data.ai to get a rough estimate of how things are trending. In general, the third-party data suggests that SoundCloud’s user results have been mixed over the past 5 to 10 years. On the positive side, the company’s website traffic appears to be derived primarily from a young demographic (i.e., ~65% aged 18-34) based in wealthier nations (e.g., US, Germany, UK, France, Canada). Meanwhile, its installed base has remained relatively consistent at 100 million devices. However, on the negative side, the company’s web search traffic, mobile downloads, and mobile MAUs have declined from the highs witnessed in 2015 - 2017 around the rise of the SoundCloud Rap movement. That said, the mobile downloads and mobile MAUs should be taken with a grain of salt, because many users (including me) only interact with the platform on their desktops.

So as not to view SoundCloud’s trajectory in a vacuum, let’s compare it to that of Spotify. As the charts below show, Spotify’s web search trends and MAUs have continued to grow over a similar period.

SoundCloud’s leadership is well aware of these issues. Take this quote from a 2022 interview with former Chief Content Officer Lauren Wirtzer-Seawood: “We have a good amount of work to do to help strengthen the brand in a way that helps make it as relevant as it was years back when everybody was consuming on SoundCloud first. How we message the brand, how we appear in the marketplace, how we talk about how SoundCloud matters, how we make SoundCloud more relevant to younger consumers, how we globalize the brand in ways that can be translated across many different cohorts of users — all those things are really important, and we’re really focused on that.” With the emergence of platforms like TikTok – which has become a key song discovery platform – SoundCloud’s influence as the first place fans go to discover music has become less secure over time. In short, it doesn’t appear that user growth and retention is playing out the way the company would like to see. This will likely continue to be a key area of focus for SoundCloud if it hopes to sustainably scale the platform going forward.

On the financial side, the picture isn’t perfect but it looks much better. The data suggests that the company’s new monetization strategies are working. SoundCloud has grown revenue consistently over the past 16 years and expects to be EBITDA profitable for the first time in its history. In addition, by shifting its revenue mix to the “Creator Business” (i.e., Artist Subscriptions and Services), it is generating higher margins. One negative is that revenue growth is expected to decelerate from 15% - 35% over the past five years to the high-single digits in 2023. In the current environment, for SoundCloud to make a credible case for a $1+ billion valuation, it will likely need to convince investors that 1) growth can accelerate and 2) profitability can continue to improve.

And finally on the engagement side, its mobile engagement appears to be stable. According to data.ai, users spent ~45 minutes per month, on average, on the SoundCloud app in 2023. This was an increase of roughly 8% year-over-year. Increasing engagement is certainly a positive signal for the platform’s ability to monetize users in the future.

Overall, SoundCloud’s high-level business metrics look mixed based on the data available. While the company’s user growth appears to have stagnated, SoundCloud is making solid strides in its ability to monetize existing users. The question is whether SoundCloud can maintain – and ideally grow – its user base, while continuing to grow the average revenue per user?

Where is SoundCloud Headed?

Given all the above context, we can now hit on SoundCloud’s strategy to unlock future growth. After all, this is the vision they will need to deliver on to justify a $1+ billion sale price or attract new investment at a comparable valuation.

At Web Summit 2023, SoundCloud’s CEO Eliah Seton shared an overview of the platform’s plans. Watching this interview for the first time, I felt like that Leo DiCaprio meme from Once Upon A Time In Hollywood.

The conversation hits on several themes Leveling Up has written about in the past, including the potential upside from monetizing music super fans and the importance of creation / distribution platform’s retaining creators who generate exclusive tentpole content.

Going forward, I’d bucket SoundCloud’s plans for key future growth vectors into two categories:

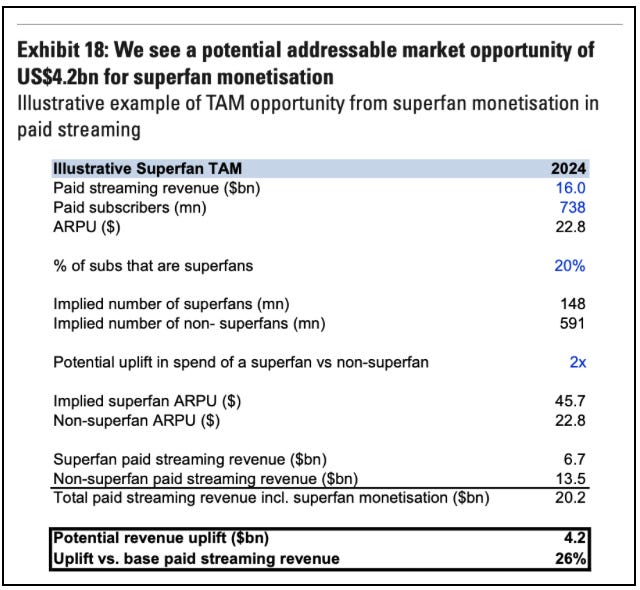

Creating a vibrant artist / “super fan” economy. Music streaming platforms currently don’t segment users by willingness to pay beyond a simple freemium model. Users typically pay $10 per month and then receive all of a platform’s available content. Juxtapose music streaming’s monetization model to free-to-play video games, where the majority of revenue comes from in-app purchases with some of gaming’s biggest spenders shelling out $35 to $70 per day. According to Goldman Sachs, during the iTunes era, the biggest spenders spent 3x more on music downloads than the average listener. As a result, the investment bank estimates that music’s “super fan” opportunity could be worth up to $4.2 billion, assuming that 20% of subscribers are super fans. The size of the opportunity for SoundCloud will ultimately depend on how they design the unit economics of their super fan economy. But there are already early examples of the potential power of the super fan economy on SoundCloud. For example, Lil Uzi Vert generated 70%+ of his July 2022 earnings from just his top 6.5% of fans! According to SoundCloud’s CEO, the company expects to start rolling out more products (e.g., subscriptions, virtual merchandise, physical merchandise, exclusive content, etc.) around this super fan initiative in the next 12 to 18 months. While there is less competition for this opportunity today, well-funded competitors, such as HYBE’s WeVerse app (~10 million MAU) and Spotify (~600 million MAU), are also building products to monetize the artist / super fan relationship. Overall, I am hopeful about SoundCloud’s efforts with building out their artist / fan economy, especially given its proprietary fan-powered royalty data which should more easily enable the platform to identify artists’ biggest fans. That said, I’m concerned about competitors like Spotify who have a larger, global user base and access to larger pools of capital if they choose to pursue the same opportunity. It will be interesting to see if SoundCloud seeks out partnerships with major labels on this front or if it tries to partner with artists directly. Net-net, it’s still too early to make concrete conclusions about whether SoundCloud will be successful here.

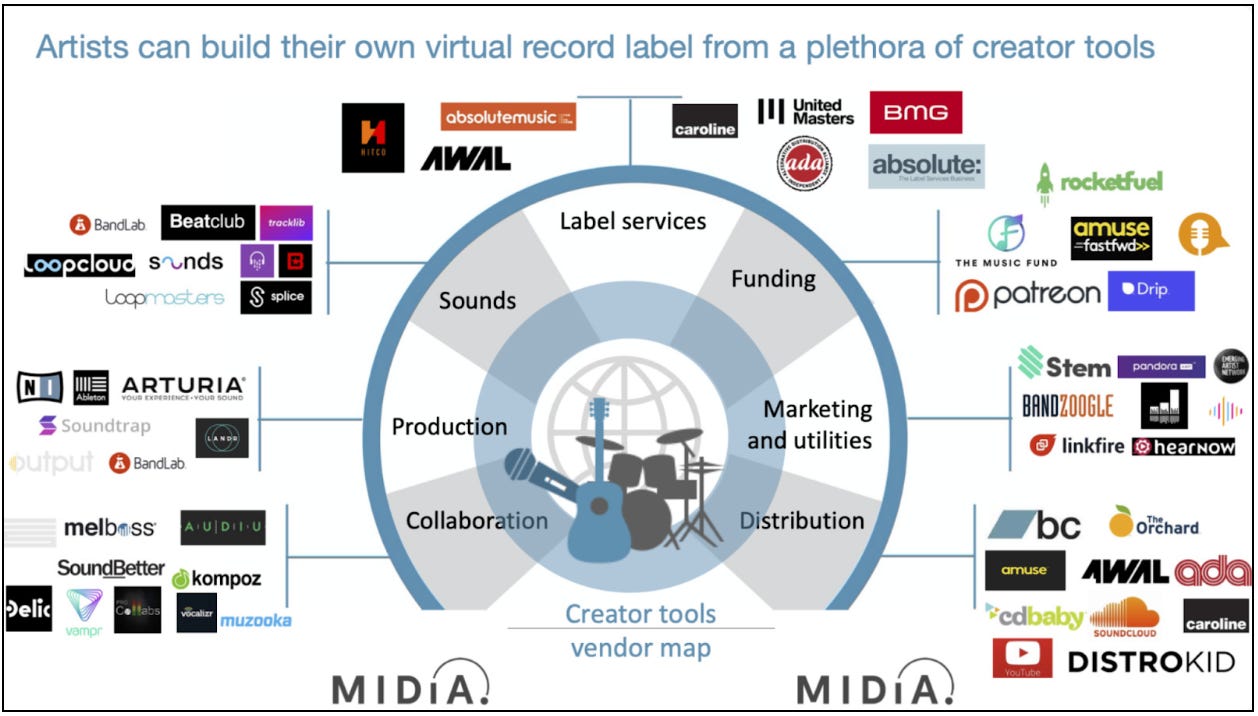

Building out tools and services to ensure creators continue engaging with SoundCloud after becoming “successful”. MIDiA estimates that the size of the independent artist (“artist direct”) sector was $1.8 billion in 2022 and grew ~3x faster than the broader recorded music market. As discussed, SoundCloud has helped many independent artists launch their careers and grow their fanbases. Of course, the problem has been that once an artist is “discovered”, they have more options to continue growing their careers. Instead of spending more time on SoundCloud, they are currently more likely to sign a record deal and seek to dedicate an increasing share of their time away from the platform. As a result, the key for SoundCloud is finding new ways to extend the time “successful” artists spend on the platform. In other words, this means giving artists more products, tools and services as they progress through their career. To reference MIDiA’s amazing graphic below, SoundCloud’s current offering – ignoring third-party integrations and partnerships – focuses on Distribution, Collaboration, Funding, and Label Services via their “Roster” program. While the company partners with other services across the creator stack, I could easily see SoundCloud look to vertically integrate further by acquiring companies in new areas (e.g., Sounds, Production, and Marketing & Utilities) too.

Source: MIDiA. Along these lines, the illustrative graphic below shows how the vast majority (99%) of artists on Spotify make very little from streaming. As a result, these artists, which are the most likely to actively engage on SoundCloud, have less monetary value to share with the platform. However, as these artists progress in their careers, their content attracts more listeners and more wallet share. As a result, SoundCloud’s CEO, who previously led Warner Music Group’s independent creator services division, appears focused on turning SoundCloud into something akin to a platform-based label / artist services company. In my opinion, extending SoundCloud’s role in an artist’s career is a smart move, and I’m excited to see how this initiative plays out.

But will these potential opportunities combined with SoundCloud’s business today be enough to garner a $1+ billion valuation either via acquisition or investment? In short, probably not quite yet.

As a disclaimer, I didn’t go deep on SoundCloud’s valuation. The purpose of this piece is strategy-focused and the publicly available data provided by the company is limited. Nonetheless, I analyzed SoundCloud’s closest public peers across one valuation metric (Enterprise Value to LTM Revenue) and one operating metric (Revenue Growth %). As a reminder, SoundCloud expected to generate €288 million or $309 million at current exchange rates. In other words, the company needs to garner a 3.2x or higher revenue multiple to achieve a $1+ billion valuation.

My analysis suggests that this is unlikely given where publicly-listed music streaming and distribution companies trade. The chart below illustrates this dynamic. Spotify, arguably the music streaming leader, trades at a 3.1x LTM revenue multiple. Keep in mind that Spotify has 5x+ more active users and is growing faster than SoundCloud. Meanwhile, SiriusXM trades at 3.3x, but unlike SoundCloud, it is quite profitable.

Given this context, I think that there are two likely outcomes from the current sale process. First, a buyer or equity investor acquires or invests in SoundCloud at a valuation lower than $1 billion. Or second (and perhaps more likely), the company raises one last round from its existing investors to execute on the strategies discussed above and then pursues a sale / recapitalization at a $1+ billion valuation. Regardless of the outcome, I expect that the company will still seek to pursue the above strategies. However, SoundCloud’s liquidity / access to funding will likely determine how aggressively it can pursue growth investments.

Closing Thoughts

SoundCloud’s story is one of the more interesting music technology case studies I’ve come across. Over its first 5 to 10 years, the platform experienced tremendous creator and consumer growth. The value proposition has particularly resonated with artists, as witnessed by more than one music superstar acknowledging the platform’s contribution to their success. Despite SoundCloud’s user growth and the brand’s cultural value, it has struggled to deliver sustainable financial results for its shareholders.

As a result, the company has introduced new monetization strategies and tried to restructure its cost base more than once over the past 5+ years. Over that period, monetization has improved but user growth and the company’s cache amongst industry professionals appears to have lost steam. It remains to be seen if the company can regain its earlier momentum.

Still, I feel like SoundCloud may be at a turning point. After researching this article, I’m walking away impressed by SoundCloud’s leadership team’s intelligence, savvy, and vision for the company’s positioning going forward. Importantly, SoundCloud is more than just a music streaming service. Its approach to marrying a DSP with the tools and services necessary for independent artists to build their careers – at each stage of stardom – isn’t common in the industry. Even if the company can’t garner a $1+ billion valuation this year, I currently am cautiously optimistic on SoundCloud’s ability to accelerate revenue growth from here.

Either way, my sense is that SoundCloud is overlooked in industry circles today. From my perspective, this is a business to watch closely over the next few years.

Thanks to Hannah and Adam for the feedback, input, and editing!

Leveling Up’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. In addition, our work may feature entities in which Alderbrook Companies, LLC or the author has invested and/or has provided consulting services.

📚 Music Business, Tech, and Investing Content Worth Consuming

Here is some of the best content that I consumed over the past month or so –

Music and AI Report (Goldmedia: link)

Inside The Music Industry’s High-Stakes AI Experiments (New Yorker: link)

PLAY - Music’s Next Chapter (MIDIA: link)

Luminate’s 2023 Year-End Report (Luminate: link)

The Past, Present, and Future of Music Games (Naavik: link)

Spotify’s New Revenue Model Has Arrived – Here’s A Hard Look at the Potential Revenue Consequences (Digital Music News: link)

Roblox: Business Overview and Future (GameMakers: link)

TikTok’s Biggest Headache in its Fight with UMG is UMG’s Publishing Catalog (MBW: link)

Could HYBE’s Weverse Offer a Template for UMG’s courting of ‘Super Fans’ in 2024? (MBW: link)

🤝 Want to Work Together? Get in touch!

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with record labels, music publishers, music technology companies, and investors on a wide-range of projects.

Our experienced group of consultants provide services across several categories, including: a) market research; b) corporate strategy; c) investment and M&A due diligence; d) capital raising support; and e) financial planning & analysis. Need help on a project? Reach out via the link below!

In addition to the above consulting services, we also have a growing venture portfolio of 20+ early-stage investments. Our primary focus is backing founders who we believe in and whose vision we are aligned with. While we are industry agnostic, our preferred sectors are media and government technology.

Finally, reach out to us about opportunities to sponsor Leveling Up’s newsletter. Our readership includes music technology entrepreneurs, executives at major labels, Grammy award-winning creators, investors and bankers at large financial institutions, and more. Share what you’re building with them!

To get in touch, you can either reply directly to this email or click the link below to fill out our contact form. We’ll be back in touch soon!

📭 Share Leveling Up with a friend!

If you enjoy Leveling Up, please consider sharing it with friends and colleagues (link to share)!

great one! super interesting company. good luck to those entering the King Cake raffle!