Into the Void: What’s Next for Hipgnosis?

After recent setbacks, where will Hipgnosis Songs Fund go from here?

If you’re not already a subscriber to Leveling Up and want to join other curious music industry professionals, creators, investors, and entrepreneurs, enter your email below and you won’t miss out on future newsletters:

GM readers 👋,

Happy October!

This past month saw Leveling Up gain a ton of new subscribers! If you’re new around here, welcome! Thank you for spending a bit of your valuable time reading my thoughts. My goal with this newsletter is to learn in public with you and hopefully to have some fun along the way. In other words, I aim to give you an ROI on your time – either via insights or entertainment. Also, if you have any feedback or want to learn more about a specific topic, leave me a note in the comments or reply directly to this email. I’d love to hear from you!

Also, a massive thank you to Bill Werde at Full Rate No Cap (subscribe here!) and Darren Hemmings at Network Notes (subscribe here!) for sharing this newsletter. You’ve both enabled more folks to become aware of Leveling Up. I hope to meet you both one day, but until then, thanks (and a hat tip) for generously sharing our work! 🎩👌🙏

For this month’s piece, we are going to cover a topic that is familiar to regular readers of this newsletter – Hipgnosis. A lot has transpired since we published our last piece on the company in July 2023 (linked here) and our first one in November 2022 (linked here). In July, I was encouraged by how Hipgnosis Songs Fund’s Annual Report suggested that the company may have begun showing signs of a turnaround. But I was also concerned that the company’s stock price had not quite reached bottom, primarily due to its ongoing free cash flow issues.

It turns out that these concerns were warranted. Earlier this month, Hipgnosis Songs Fund announced it wouldn’t pay a quarterly dividend and the stock dropped ~10%, reaching an all-time low. As a result of this and other setbacks (discussed below), some investors intend to vote against the company’s continuation at its Annual General Meeting set to be held in a few days.

With all this uncertainty, it seems like the perfect time for another newsletter speculating on the company’s future. I also wanted to get it out before the continuation vote – it’s no fair (or fun) speculating if you already know the outcome!

So, what’s happened since our last piece? What do I think the company should do to turn its valuation around and what are the implications to the various stakeholders? And finally, what lessons can be learned from this fascinating situation?

Read on and let’s try to figure this one out together!

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. I’m not a licensed investment professional. This piece is for informational purposes only. None of this is tax, investment, or legal advice. Do your own research!

Now, let’s get after it!

Jimmy

Into the Void: What’s Next for Hipgnosis?

“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.” - Warren Buffett

I’m not always the best at business politics. I often have a strong opinion about business decisions and strategies. And I struggle with the inauthentic feelings that bubble up with “going along to get along” or holding back.

My wife Hannah tells me “don’t worry so much about being right.” Other times, she’ll shoot me a knowing look. Her eyes are saying: “Are you really sure this is the right place and the right time for that conversation?”

Difficult conversations are a necessary evil in business. But over time, I’ve learned that how I approach and time these conversations is just as important as what I want to say. And certain situations just aren’t worth the fight in the long-run.

Meanwhile, through my consulting and investing experience, I’ve also witnessed how corporate board rooms – at their worst – can devolve into an endless, dysfunctional “difficult conversation.” If you’re not already familiar, a company’s board of directors – who are elected by shareholders – are meant to approve / make key company decisions (e.g., acquisitions, dividends, executive compensation, etc.), oversee a company’s management team, and protect shareholders’ interests as best they can.

When times are good (e.g., a company’s stock price is performing well), shareholders are typically happy with the company’s board of directors and its management team. As a result, in these environments, shareholders usually approve a board’s recommendations and decisions without much protest.

But when times are bad, when shareholders are losing money, when management teams aren’t performing up to expectations, the game changes. A board’s ability to work effectively to diagnose issues, to use good judgment to make changes, to communicate effectively, and to protect shareholders interests is put under a closer microscope.

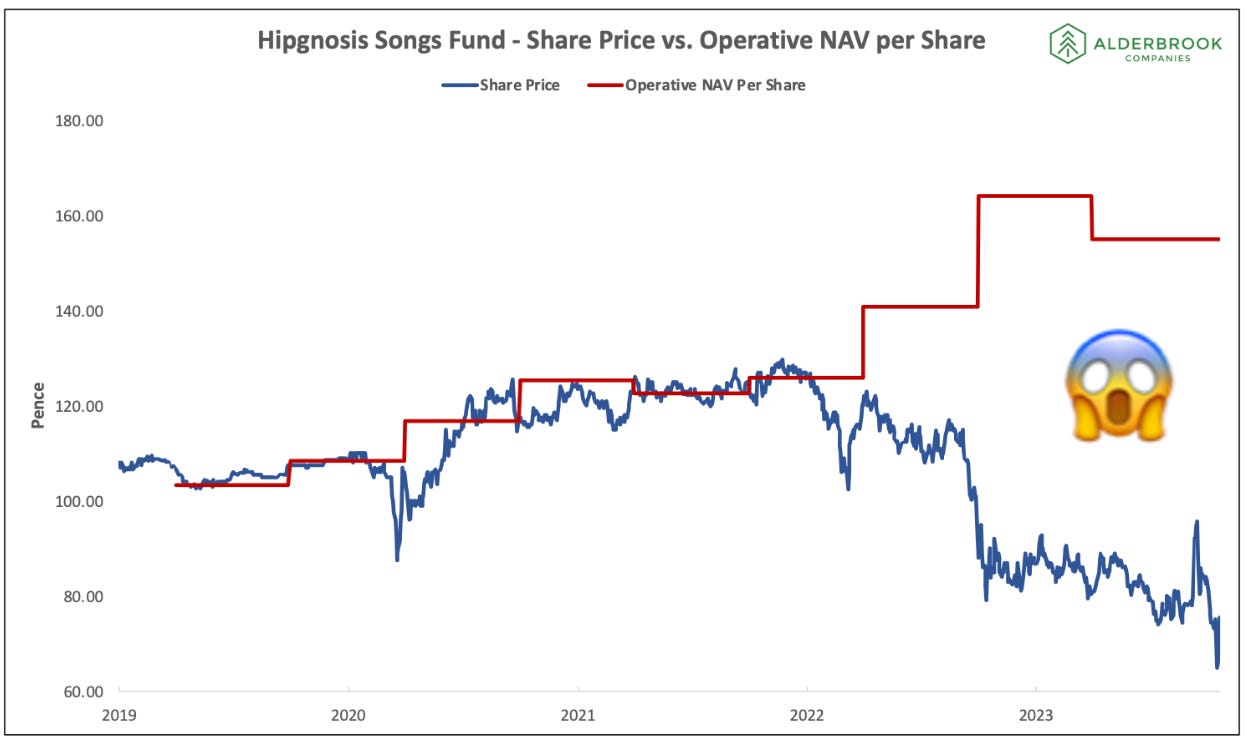

That’s where Hipgnosis Songs Fund (“SONG”) is today. Shareholders have seen the company’s share price decline ~40% over the past 2 years. SONG’s stock price remains ~50% below the £1.55 Operative Net Asset Value (“NAV”) per share calculated by the company’s independent valuer as of March 31, 2023.

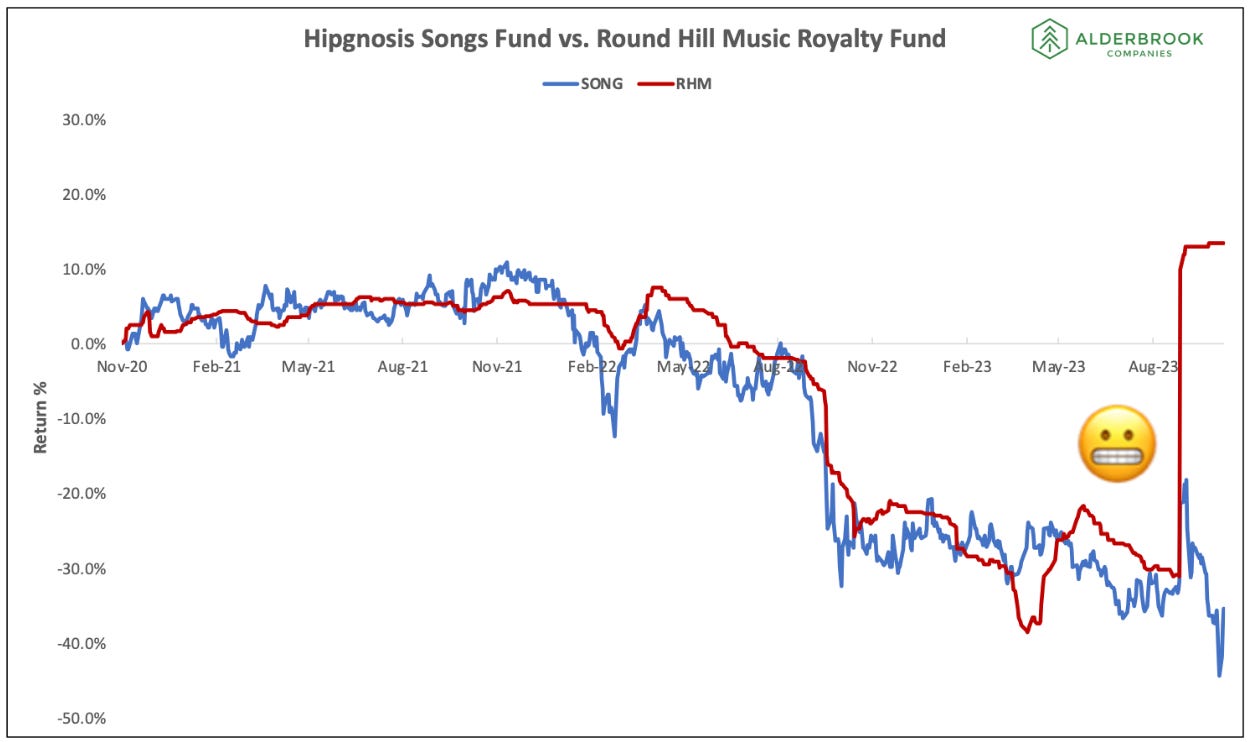

To add insult to injury, SONG’s primary competitor on the London Stock Exchange – Round Hill Music Royalty Fund Ltd – recently announced that its shareholders had agreed to an acquisition by Concord Music at an all-time high share price. The relative performance of SONG and RHM’s share price since November 2020 (when RHM went public) is depicted below.

At this very challenging moment for the company, SONG is set to hold its Annual General Meeting later this week (October 26th). At the meeting, SONG shareholders will participate in a “continuation vote”, which occurs every five years, to determine whether SONG will continue as a going concern or potentially be shut down. Ahead of the continuation vote, SONG’s chairman of the board of directors and another member of its board announced that they would be “retiring” – possibly as a result of shareholder pressure. Along these lines, several shareholders are demanding changes to the company’s governance. For example, Asset Value Investors Limited (“AVI”), which owns 5% of SONG’s shares, wrote a letter to shareholders (linked here) urging them – among other things – to vote against continuation, so that a new board of directors can be appointed. Similarly, Metage Capital, another SONG investor, wrote a letter (linked here) to shareholders asking for their support in replacing certain board members. Yikes!

To put it mildly, SONG’s future remains more uncertain than ever. Given this backdrop, I thought that it would be a perfect time to dive back into analyzing the situation. Is now really the time for governance changes? Or are certain shareholder concerns overblown?

In our third installment on Hipgnosis, we’ll try our best to answer this question by covering:

What happened since our last Hipgnosis piece in July?

Where is SONG headed?

What are the lessons to be learned from the company?

Grab a cup of coffee and let’s run it back one more time on a fascinating company!

What’s Happened Since Our Last Update?

Before covering what’s happened since our last Hipgnosis newsletter published in July 2023, let’s remind ourselves of Hipgnosis Songs Fund’s mission. Back in 2017 and 2018, Hipgnosis founder Merck Mercuriadis (“Merck”) pitched original SONG investors on a high-level vision (detailed on Hipgnosis Songs Fund’s website) that boils down to three goals:

Give Investors Direct Access to Music IP. Hipgnosis wants to give investors access to proven songs by culturally important artists.

Use its Financial Standing to Advocate for Better Songwriter Economics. The company wants to leverage its “financial clout” to change the way that the music industry works by advocating for songwriters to be paid more.

Prove Music IP is an Investable Asset Class. The company wants investors to recognize music IP as an uncorrelated asset class with attractive returns…”as valuable as gold or oil.”

In our first piece on Hipgnosis, we noted that SONG had – more or less – accomplished its first two goals. But to accomplish its third goal and establish music IP as a valuable asset class over the long-term, the most important thing would be delivering returns to its investors.

Since its IPO, much has happened. Merck and his team successfully raised ~$1.7 billion of equity capital from public shareholders to build an impressive portfolio of evergreen songs. In doing so, Hipgnosis has been recognized as a leader in the music catalog “gold rush”. Nevertheless, SONG’s share price is currently down ~30% since its IPO in 2018. As a result, Mr. Mercuriadis and his team still have plenty of work to do in order to deliver on their third goal of proving music IP is an attractive asset class.

I’ve shared my view on the drivers of SONG’s share price decline in Leveling Up’s prior two Hipgnosis newsletters. In my opinion, they include i) rising interest rates; ii) concerns about cash flows covering dividend payments; iii) a questionable M&A process; iv) accounting revisions; and v) too much reliance on floating rate debt.

But one important thing has changed since our July 2023 Hipgnosis piece. SONG shareholders have become much, much louder about their displeasure with the company’s board of directors and its investment manager – Hipgnosis Song Management (“HSM”). As discussed previously, more than one SONG shareholder has written and publicly urged other shareholders to replace members of the board and to consider terminating the company’s agreement with HSM.

Here is a timeline of how investors’ lack of confidence in SONG’s leadership seemingly accelerated over the past few months:

July 2023:

July 11: The Financial Times reports that some of SONG’s largest investors want it to sell a portion of its song catalogs to demonstrate that its share price is undervalued.

September 2023:

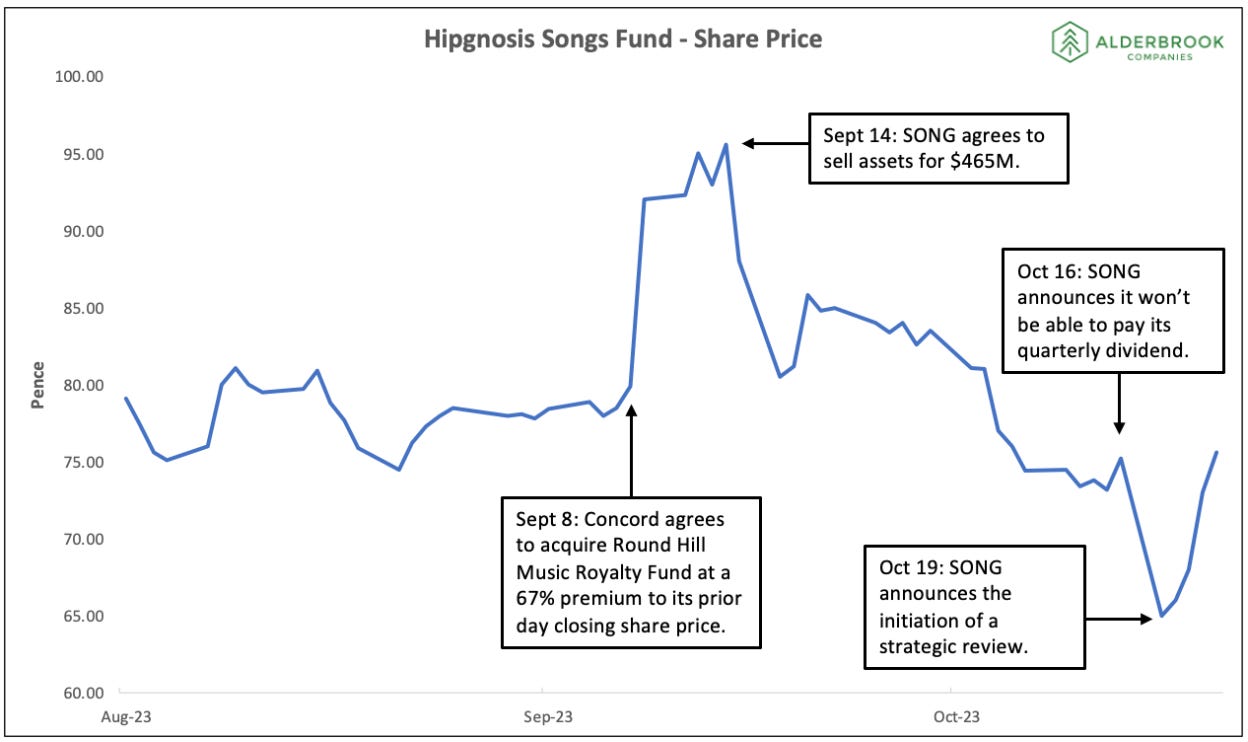

September 8: Concord Music announces that it has agreed to acquire Round Hill Music Royalty Fund – Hipgnosis’ primary publicly-listed competitor – for a 67% premium to its previous day closing share price or at an implied ~18x Enterprise Value (“EV”) to 2022 Net Publisher Share (“NPS”) multiple (based on my estimates). In response, SONG’s share price pops 19%, as investors hope SONG’s song portfolio will be similarly valued.

September 14: SONG announces that it has agreed to sell 29 catalogs to Hipgnosis Songs Capital (“HSC”) and certain other songs to a third party for $465 million or at an implied ~18x EV to 2022 NPS multiple, according to SONG. In response, SONG’s share price sinks ~16%, as some investors are disappointed in the transaction’s price, terms, and structure for reasons we’ll discuss below.

September 28: Andrew Sutch, chairman of SONG’s board, and Andrew Wilkinson, another SONG board member, announce they will retire from the board.

October 2023

October 16: SONG announces that it won’t be able to pay its 4Q 2023 dividend to shareholders as a result of overestimating royalty payments. In response, SONG’s share price declines ~14% to reach an all-time low.

October 16: AVI, a shareholder with a ~5% stake in SONG, publishes a public letter to other company shareholders asking them to vote against the asset sale to HSC and against the continuation of the company in order to restructure the board of directors.

October 19: Metage Capital, another SONG investor, publishes a public letter to shareholders asking them to vote against the re-election of three members of SONG’s board.

October 19: SONG’s board of directors announces that it has initiated a strategic review, which includes potentially terminating its agreement with HSM as the investment advisor. However, the press release notes that “for the avoidance of doubt, the Strategic Review does not envisage any offer for the Company, recommended or otherwise.” In response, SONG’s share price rises ~10%.

October 24: SONG’s board of directors announces that it does not receive a “Superior Offer” as a part of the go shop process in the potential sale of 29 catalogs for $440 to HSC. In response, SONG’s share price declines ~3%.

What a volatile three months!

Going back to Hipgnosis’ goal to prove music IP is an investable asset class, the plan was always to provide investors with a profitable, reliable, and stable investment. As Merck said in interviews when he was initially pitching SONG to investors, “Proven songs are predictable and reliable in their income streams…it is as good or better than gold or oil.” Juxtapose that vision with accounting restatements, a sudden withdrawal of the dividend, an asset sale with disappointing terms, the retirement of multiple board members without any obvious replacements, and a turbulent share price. I imagine that early Hipgnosis Songs Fund investors, who have supported the company since its IPO, didn’t sign up for this.

Looking at the timeline above, it’s quite clear to me that Hipgnosis has not realized its “Prove that Music IP is an Investable Asset Class” vision for SONG – at least not yet. As a result, it’s unsurprising that trust among SONG’s shareholders, its board of directors, and its investment advisor has seemingly eroded, with activist investors now growing louder and pushing for changes to SONG’s leadership.

Where is SONG Headed?

“Trust is like the air we breathe – when it's present, nobody really notices; when it's absent, everybody notices.” - Warren Buffett

With all of the above context, the key question is what’s next? How can Hipgnosis unlock a turnaround and deliver on its vision for SONG shareholders going forward?

Given where things currently stand, a turnaround will likely be driven by achieving one or more of the following, in my opinion –

Implementing a sustainable financial strategy

Ensuring a talented and independent team is in place

Exploring a sale of the company

For regular readers of this newsletter, these may look familiar because we touched upon them in our previous Hipgnosis piece. But I want to go into more detail now. Let’s dive in!

1) Implementing a Sustainable Financial Strategy

I’ll need to dust off my Microsoft Excel skills to effectively walk through my reasoning for this initiative. But in general, ensuring that the cash generated from a business’ operations (i.e., its free cash flow) can cover its ongoing financial obligations (i.e., its interest expense and dividends) is important. In SONG’s case, the company is in a tough spot.

Based on the company’s 2023 Annual Report, SONG is making progress on growing the drivers of free cash flow. For example, its catalog royalties increased 12% and its ongoing operating costs declined 21% to ~$30 million. For the latter, SONG reduced its legal and professional fees, aborted deal costs, and restructured its leadership team and its administration company HSG. This is good stuff!

But even with these improvements, SONG’s free cash flow still isn’t growing. The company calculates its fiscal 2023 levered free cash flow at ~$82 million vs. ~$85 million in fiscal 2022. This is primarily due to the year-over-year increase in its borrowing costs from ~$20 million in fiscal 2022 to $34 million in fiscal 2023.

Furthermore, SONG suggested that its 5.25 pence per share annual dividend was covered 1.08x by its free cash flow. However, the company’s calculation of free cash flow excluded $9.9 million of loan interest payable (page 146 of Annual Report). When this expense is included, free cash flow falls just shy of covering the dividend.

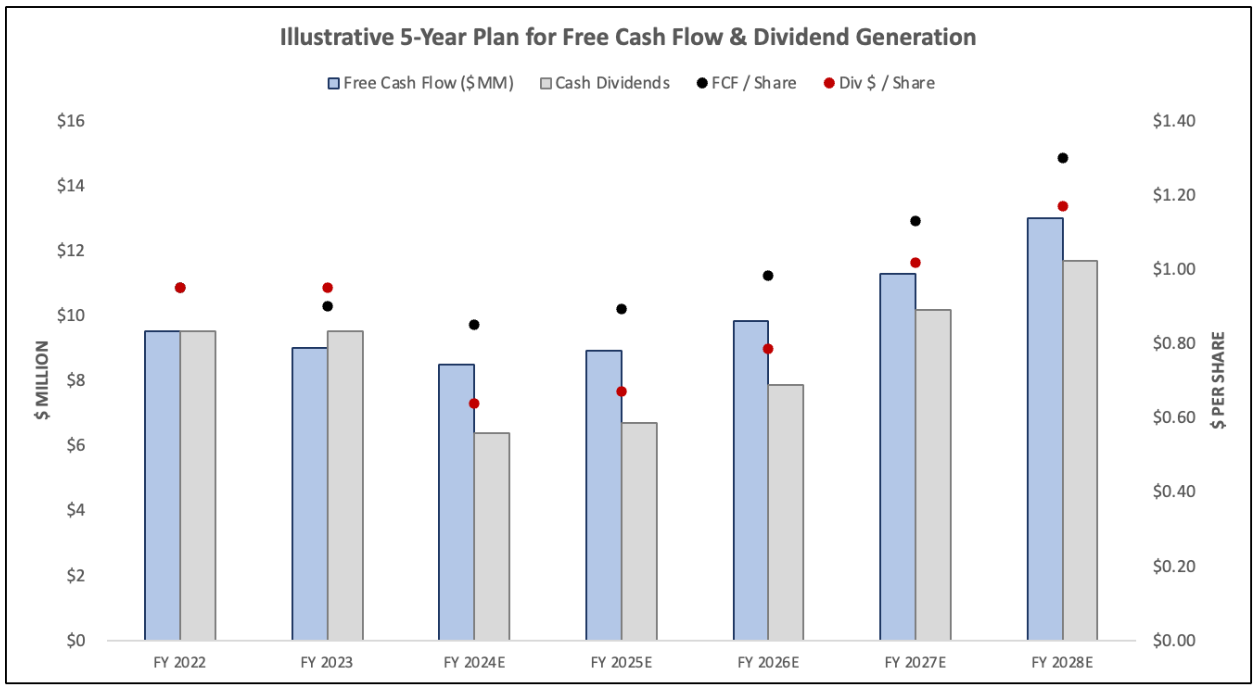

Along these lines, when I run the numbers for SONG’s go-forward free cash flow (depicted below), I see the company being unable to cover the dividend. Simply put, SONG is still working to sustainably fund its ongoing interest expense to lenders and its current dividend payments to shareholders out of its ongoing operating cash flows.

From my perspective, it’s important for free cash flow to grow to a level that comfortably covers SONG’s interest and dividend payments. There are several ways to potentially solve this problem. In previous Hipgnosis pieces, I wrote about a few of them:

Place a greater emphasis on cash flow metrics (e.g., free cash flow per share growth, dividend per share growth, free cash flow to dividend ratio) when judging the company’s performance.

Shift away from a fixed dividend policy to a variable one. Universal Music Group currently sizes its dividend payments to shareholders in a similar way.

Lay out a five-year plan to shareholders that shows why the short-term pain of resetting the dividend is worth it. Of course, the trade-off here is that laying out this plan sets a bar to beat. But in my opinion, it is necessary to effectively communicate the long-term value of the underlying assets once the company’s dividend is reset. The table below shows a hypothetical example of a five-year plan.

I admit that this plan won’t be an easy sell. Most existing shareholders probably won’t appreciate having their dividends reduced. But given recent events including the sudden dividend cancellation, this seems like the right time to make necessary changes so that the company can be positioned on a sustainable path going forward. With the information available, I see it as the best path to unlock future growth and eventually share price appreciation.

Even if SONG doesn’t follow this plan, it would likely be smart for the company to communicate a detailed long-term financial vision to shareholders. How will it sustainably cover dividends going forward? Does it intend to grow its cash balance so that it can acquire more catalogs and grow cash flows? If so, how? Absent a sale of the company, I have to believe that we’ll see an updated financial plan for shareholders in the months ahead. Hopefully leadership crafts a sustainable one!

One last important note on this topic. It’s worth considering how SONG’s potential $465 million asset sale impacts our math. When I run the numbers (illustrated below) on the sale, I do see improvement on leverage metrics. But I only see a slight improvement on the company’s free cash flow problem. In other words, this sale alone doesn’t appear to put SONG on a financially sustainable path, based on my math.

Of course, small tweaks to our assumptions can change the conclusions here. For example, if SONG’s share price rises as it buys back stock, then the potential dividend savings will be lower. Conversely, if SONG’s market capitalization declines considerably, then the estimated ongoing charges may actually be lower. Nevertheless, I still think that the asset sale solution is a band-aid and likely won’t solve the main problem – ensuring that cash flows can grow and cover future dividend payments.

2) Ensuring a Talented and Independent Team Is In Place

Did I mention that business politics isn’t always a natural strength of mine 😅!? Putting that aside, I’ll do my best to share my thoughts on a difficult situation as it relates to incentives at the broader Hipgnosis group.

In both prior Hipgnosis pieces, I’ve explained how the Hipgnosis organizational structure (depicted above) is ripe for conflicts of interest. Here are a couple of apparent issues:

For asset purchases, with Blackstone owning a majority of HSM (SONG’s investment advisor), HSM may be incentivized to give preferential deal access / treatment to HSC (the Blackstone sponsored fund) over SONG (the public fund). HSM has tried to mitigate these concerns by instituting a conflicts of interest policy, which offers new opportunities to both funds, with SONG having co-investment rights to participate in 20% of any catalog purchase.

For asset sales, HSM may be incentivized to give HSC preferential treatment in the event SONG decides to sell any assets. As a reminder, Hipgnosis founder Merck Mercuriadis is the CEO of HSM and is a minority shareholder of HSC. He spent a significant amount of time, effort, and social capital building SONG’s portfolio. I’d imagine that he and the HSM team are highly focused on keeping SONG’s portfolio within the broader Hipgnosis orbit. And it’s likely why Merck ensured that HSM has an option to purchase SONG’s portfolio of songs in the event SONG terminates its investment advisory agreement with HSM.

Importantly, when Merck and the Hipgnosis team started the company, SONG had the right to approve the addition of any new HSM clients, such as HSC. In other words, a lot of the current conflicts arguably stem from SONG’s current board signing off on HSC’s formation. Whoops!

Notably, the terms associated with SONG’s potential asset sale to HSC illustrates these related party concerns. First, SONG appears to have negotiated directly with HSC to set the terms, rather than running a competitive process from the start. Second, HSC has the opportunity to match any subsequent high offer received on the assets, thus eliminating the potential for a bidding war. On top of all that, if SONG accepts a superior proposal to that of HSC, it has to pay HSC a $6.6 million termination fee. It’s great to be HSC, but I’m not confident any of that is best practice! I have other concerns with the deal terms, but I’ll leave it there for now.

From my perspective, the proposed transaction terms and sale process underscore the potential preferential treatment given to Hipgnosis-related companies at the potential expense of SONG shareholders. It’s entirely possible that HSC is paying the highest price for this asset. But the deal structure certainly appears to put any potential third-party competitors at a disadvantage. Going forward, it’s important to ensure that the team (i.e., the board of directors and investment advisor), making decisions and advising on behalf of SONG shareholders, is independent.

How to ensure greater independence among SONG’s leadership team is the tricky part. If shareholders want change, it’s likely going to be a messy process.

For making changes to the board of directors, SONG shareholders can vote against the re-election of board members at the company’s upcoming Annual General Meeting on October 26th. Shareholders can also vote against continuation at the Annual General Meeting, which requires SONG’s current board of directors to put forward proposals for “the reconstruction, reorganisation, or winding up of the Company to Shareholders for their approval within six months following the date on which the relevant Continuation Resolution is not passed. These proposals may or may not involve winding-up the Company or liquidating all or part of the Company’s then existing portfolio of investments and, accordingly, failure to pass a Continuation Resolution will not necessarily result in the winding-up of the Company or liquidation of all or some of its investments.” Simply put, I would recommend restructuring SONG’s board of directors to ensure strategic and financial decision making improves and potential conflicts are avoided going forward.

For changing the investment advisor, there is no obvious solution, based on my review of SONG’s February 2021 prospectus, which contains (potentially outdated) terms between the company and HSM. Along these lines, I don’t see a path to terminating HSM as the investment advisor without triggering the call option for HSM to purchase SONG’s assets. It’s worth noting that SONG’s board did ask HSM to waive this call option and it refused. Perhaps the easiest path – at least for now – is to restructure the board of directors and continue with HSM as the investment advisor. Otherwise, fighting this provision could result in a costly legal battle or a disappointing sale price to an HSM advised entity. Neither of these options appear attractive. As I’ve noted in the prior Hipgnosis newsletter, SONG’s recent financial results have improved, so there is some hope that HSM’s involvement in SONG’s operations (i.e., via licensing and administration) can benefit shareholders. However, there is undeniably a perverse incentive for HSM to make things worse at SONG, so that it can ultimately acquire the company for a cheaper price. (I’ll highlight here that I’m not a lawyer and am obviously not suggesting that anything improper has occurred!)

3) Exploring a Sale of the Company

I noted in the previous Hipgnosis newsletter that Hipgnosis Songs Fund Limited’s share price looks objectively “cheap”, from my perspective. That’s still the case today.

I calculate SONG’s Enterprise Value (including its contingent bonus payment provision) to Net Publisher Share (“NPS”) at 13.4x. This figure is 25% - 50% below the average multiple paid for “iconic” music catalogs (illustrated below) and the multiple RHM received in its sale to Concord.

Given the quality of SONG’s catalog, I could definitely see buyers being interested in purchasing the company. Who might be interested other than HSC and have the financial resources ($2+ billion of equity/debt) to make a competitive offer?

A large pension fund or insurance company. Pension funds and insurance companies value the characteristics – long duration, high yielding, uncorrelated – of music royalty assets to meet their liabilities. For example, Concord is primarily owned by the Michigan Retirement Systems (“MRS”). Meanwhile, these types of investors are often the ones purchasing the tranches of music asset-backed securitizations (“ABS”) sponsored by private equity firms like Hipgnosis. Rather than accepting a lower yield and less control in an ABS transaction, perhaps a larger pension fund or insurance company will follow the MRS playbook and partner with an experienced management team to acquire these rights directly via a SONG acquisition.

A major record label. For example, UMG has a market capitalization of ~$48 billion, implying SONG is only ~4% of UMG’s total equity value. While UMG has $463M of cash on hand at the end of June 2023, it trades at a premium multiple to SONG across most valuation metrics, according to Capital IQ. This suggests that a potential UMG acquisition of SONG financed with equity could be quite accretive to UMG’s financial metrics, even before any synergies are realized. That said, I haven’t yet done a detailed analysis of a potential transaction. It’s also quite a large bet for any major record label to make, especially one that appears strategically focused on streaming economics and AI initiatives.

A private equity fund. A competitor to Blackstone could certainly be interested in acquiring SONG, but I have trouble seeing one competing on price.

A large technology company with exposure to music. Would it be obvious for a company like Spotify or Apple to acquire SONG? Not really. But this could be an opportunity for a larger tech company to pursue an accretive transaction with strong cash flows, which also has the benefit of lowering the content costs on their music streaming service – at least on the margin.

From my perspective, a sale of the company appears to be the cleanest and quickest way for SONG shareholders to maximize the value of their holdings. Of course, receiving an attractive bid is largely outside of the company’s control. Nevertheless, my interpretation of SONG’s documents doesn’t lead me to see any major downsides to running a process. After all, the company doesn’t have to sell if an attractive offer doesn’t emerge. And while HSM may be able to match a competing offer due to its preferential call option, I have to imagine a Blackstone-backed entity would have a higher cost of capital than several of the potential buyer types listed above (assuming one is actually interested).

Along these lines, if HSM’s call option requires it to purchase SONG’s assets – rather than the company’s equity – HSM will likely have a fiduciary duty to bid materially higher than competitors. The logic here is that sellers are typically taxed more highly in asset sales than stock sales. So in order for the after-tax proceeds received by shareholders to be equal, HSM’s offer will likely need to be higher.

All in all, it would be worthwhile for SONG’s board of directors to get advice from a law firm (if it hasn’t already) on any potential issues with or ramifications from the company hiring an advisor soliciting third party bids. For example, will this act automatically trigger HSM’s call option? If there aren’t any meaningful risks to running a sale process, then engaging an advisor to explore a potential sale seems like a prudent step given SONG’s current share price performance as well as RHM’s recent share price reaction to the Concord sale.

What Lessons can be Learned?

After devoting three Leveling Up newsletters to Hipgnosis, let’s wrap-up with some of the lessons that the industry can potentially learn from the company.

Conflicts of interest should be avoided at all costs. When things are going well, the risk from conflicts of interest usually goes unnoticed. But when there is a problem, and Hipgnosis has one today – the incentives stemming from these conflicts can create major issues. Even if a company like Hipgnosis acts with good intentions, is transparent, and puts in place conflicts’ policies, it’s still very hard to avoid this risk entirely.

The UK investment trust structure may not be the best fit for music IP assets. I’d argue that a structure requiring a continuation vote every five years isn’t the best way to manage music catalog assets. While this structure protects shareholders in some ways and provides managers with access to public market investors, it definitely has trade-offs, including potentially fostering shorter-term decision making.

Placing too heavy a weight on one performance metric can be dangerous. Hipgnosis Songs Fund Limited appears to have consistently focused on its Operative Net Asset Value per share as a “north star” metric for performance. From my perspective, there are other performance metrics that should receive at least equal weight, including free cash flow per share growth, dividend per share growth, and the ratio of free cash flow to dividends.

It’s better to “underpromise and overdeliver” than the opposite, especially when it comes to financial accounting and forecasting. Hipgnosis Songs Fund Limited has struggled – at times – to account and forecast its financials, leading to more than one restatement and an unexpected dividend cut. Along these lines, I was surprised that the company was using a third party valuation firm’s estimates for retroactive royalty payments rather than taking a more measured view for its internal forecast.

Financing acquisitions with floating rate debt can create cash flow issues in a rapidly rising rate environment. Higher interest rates have greatly impacted Hipgnosis Songs Fund Limited’s business model. The company eventually made the smart decision to hedge its interest rate exposure. But higher interest rates have made it much more difficult for the company to meet its promised dividend per share. Of course, Hipgnosis isn’t the only company that has confronted this obstacle recently.

Music IP is still an attractive asset class. Despite all of SONG’s setbacks, its most recent financial results underscore just how attractive music royalties can be. As discussed, the company’s royalties are paid consistently and have been growing at an impressive rate over the past year.

Closing Thoughts

What Hipgnosis has sought to build required a series of aggressive bets. As a reminder, these included:

Spending billions of dollars on iconic music catalogs in a short period of time.

Focusing its initial capital raises to execute its acquisition strategy on the public markets (meaning its execution is under closer scrutiny).

Being outspoken about how it feels the music industry does not properly value songwriters’ contributions.

Throughout my short time following the company, I have been both impressed with its growth and concerned by aspects of its financials and the potential for conflicts of interests to negatively impact SONG shareholders – concerns which appear to have been warranted.

A natural question that emerges from this company case study is: how will Hipgnosis’ struggles impact music catalog valuations more broadly? After all, Merck and Hipgnosis have arguably been the central figure associated with the music IP gold rush.

It’s certainly not ideal that SONG is still a ways off from proving that music is “as good as gold”. As a result, I imagine that public investors will be more wary before backing another music rights company looking to go public. That said, I don’t think that SONG is currently in danger of “blowing up” (as some acquaintances tracking the company have emailed me). I also don’t think that private investors will write off the asset class based on what’s happening to SONG. Simply put, while Hipgnosis’ setbacks may impact valuations on the margin, I personally believe that higher interest rates will have a greater impact on music IP valuations in the near-term. Of course, I could be wrong about this!

If I were to recommend one takeaway from this article, it would be this – the recent wave of publicly expressed disappointment with SONG’s share price performance is understandable. Yet, SONG shareholders still own iconic and valuable music catalogs. The weeks/months ahead will require delicate and strategic maneuvering by shareholders to balance a desire for a more independent leadership team with the constraints of contractual obligations to the investment advisor. Along these lines, while the desire to terminate the investment advisory agreement is unsurprising. Electing a new board of directors who can implement a sustainable financial strategy and pursue a sale process with third party companies may prove to be easier, cheaper, and, ultimately, generate greater upside. (Again though, I’m a guy who writes this newsletter on nights and weekends, so feel free to take my thoughts with a shaker of salt). Wherever things land with Hipgnosis Songs Fund Limited over the next few months, I’ll be paying close attention and hoping for a good outcome for all stakeholders.

Thanks to Hannah and Adam for the feedback, input, and editing!

Leveling Up’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. In addition, our work may feature entities in which Alderbrook Companies, LLC or the author has invested and/or has provided consulting services.

📚 Music Business, Tech, and Investing Content Worth Consuming

Here is some of the best content that I consumed over the past month –

What Should the Music Industry Learn from Video Games and E-Sports? (MBW: link)

WMG Boss Robert Kyncl on AI, Why Labels Exist, and 2 Other Things We Learned from his Q&A at the Code Conference (MBW: link)

Our Principles for Partnering with the Music Industry on AI Technology (Youtube: link)

Universal and Deezer’s ‘Artist-Centric’ Model Isn’t Shocking. It Emulates Tech’s Most Successful Titans (MBW: link)

We Tried to Make a Hit Song with AI – And It Got Messy (The Verge: link)

How to Make Artist Centric Artist Centric (MIDIA: link)

Ghostwriter, The Mastermind Behind the Viral Drake AI Song, Speak for the First Time (Billboard: link)

Strauss Zelnick - Playing to Your Strengths (Colossus: link)

Industry Vet David Schulof talks investing in the music biz (Crain Currency: link)

🤝 Want to Work Together? Get in touch!

Interested in working together? Here’s a reminder that Alderbrook would love to work with you!

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with record labels, music publishers, music technology companies, and investors on a wide-range of projects. Our experienced group of consultants provide services across several categories, including: a) market research; b) corporate strategy; c) investment and M&A due diligence; d) capital raising support; and e) financial planning & analysis.

In addition to the above consulting services, we also have a growing venture portfolio of 20+ early-stage investments. Our primary focus is backing founders who we believe in and whose vision we are aligned with. While we are industry agnostic, our preferred sectors are media and government technology.

Finally, reach out to us about opportunities to sponsor Leveling Up’s newsletter. Our readership includes music technology entrepreneurs, executives at major labels, Grammy award-winning creators, investors and bankers at large financial institutions, and more. Share what you’re building with them!

To get in touch, you can either reply directly to this email or click the link below to fill out our contact form. We’ll be back in touch soon!

📭 Share Leveling Up with a friend!

If you enjoy Leveling Up, please consider sharing it with friends and colleagues (link to share)!

Jimmy- another in-depth article- very well done!