Has Hipgnosis Hit the Bottom?

Are Hipgnosis’ latest results the beginning of a comeback story for its stock?

If you’re not already a subscriber to Leveling Up and want to join other curious creators, music industry professionals, investors, and entrepreneurs, enter your email below and you won’t miss out on future newsletters:

GM readers 👋,

Happy July! Hope you’re all staying cooler than we are down here in New Orleans. 🥵

Speaking of heat, the title of this month’s newsletter is on the spicier side. I’ve written a bunch about how music catalog valuations might respond to higher interest rates and Hipgnosis’ potential issues in this environment over the past year or two. As much as I want to focus on other aspects of the music industry, the catalog M&A game and Hipgnosis keep pulling me back in.

According to some smart folks and my former employer, Hipgnosis Songs Fund’s long-term outlook is strong. These observers believe that Hipgnosis’ stock price offers “compelling value.” But if that’s the case, then why is Hipgnosis trading near an all-time low? Clearly investors still have their doubts about rushing to snap up the company’s stock.

So do I think Hipgnosis has hit the bottom? Not quite yet. Can the company still prove my pessimism to be misplaced? Absolutely.

In this month’s piece, we’re going to explore the issues currently facing Hipgnosis Songs Fund. We’ll consider how the company is faring in this regard. And I’ll share my two cents on what I think the company should do to turn its valuations around.

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. I’m not a licensed investment professional and don’t own any Hipgnosis stock. This piece is for informational purposes only. None of this is financial or legal advice. Do your own research!

Now, let’s get after it!

Jimmy

Today’s Leveling Up is brought to you by Royalty Exchange

Back in 2013, I stumbled across Royalty Exchange’s website while researching a project in business school. I was struck by the idea of acquiring cash-flowing royalties associated with some of my favorite songs. And I was intrigued by the relatively high implied cash flow yields. It started me down the rabbit hole of learning how music IP worked. So it feels pretty surreal to have Royalty Exchange become the first sponsor of the Leveling Up newsletter roughly a decade later.

For those unfamiliar, Royalty Exchange is a leading platform that matches entertainment IP creators seeking funding with investors seeking to add cash-flowing, low correlated assets to their portfolios. To date, rights holders have raised over $135M+ across 1,600+ deals on the platform.

Using Royalty Exchange, investors have purchased royalties tied to songs by artists like Jay-Z, Rihanna, The Doobie Brothers, Beyonce, and the Shrek film franchise. Click here to see what assets are available for purchase now.

Has Hipgnosis Hit the Bottom?

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” - Benjamin Graham

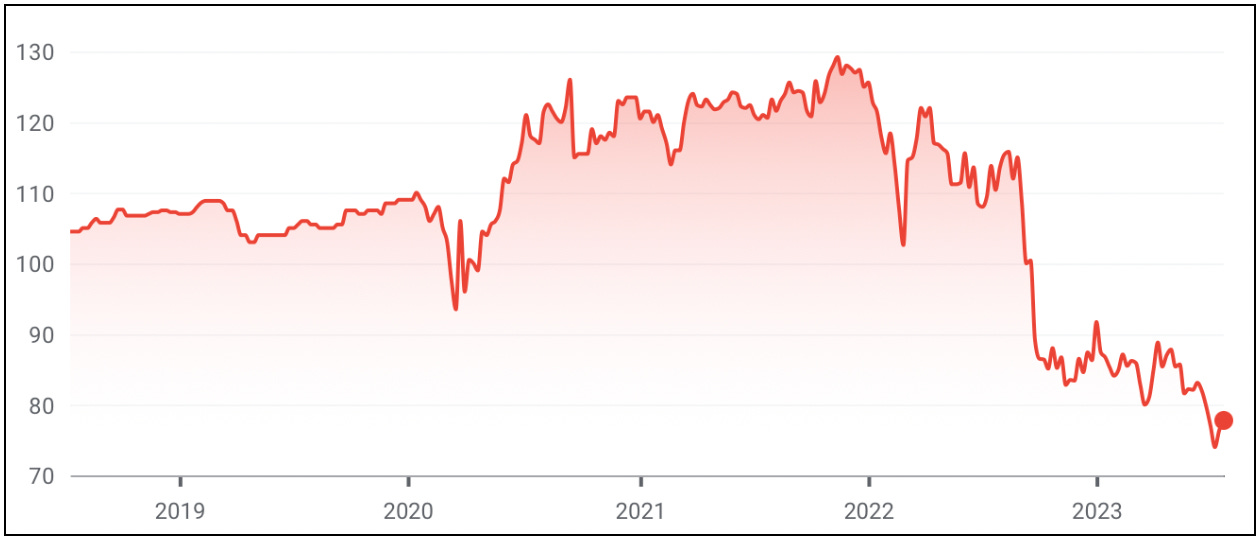

It’s been about 8 months since Leveling Up published a deep dive on Hipgnosis. At that time, I was impressed by the company’s ambition and rapid growth. But I was equally concerned about its financial results. While it’s not fun to criticize one of the industry’s most prominent players, the company’s public fund – Hipgnosis Songs Fund Limited (ticker symbol “SONG”) – performance suggests that concern was warranted. Earlier this month, SONG fell to an all-time low of £0.72 per share after publishing its Annual Report.

And while SONG’s stock price has recovered a bit to £0.76 per share at the time of writing this newsletter, it remains ~100% below the £1.55 Operative Net Asset Value (“NAV”) per share calculated by the company’s independent valuer, as of March 31, 2023. As we noted in the previous deep dive (and depicted below), SONG’s share price roughly tracked its Operative NAV per share from IPO until March 2022. Since then, there has been a wide divergence between these two values.

Unsurprisingly, Hipgnosis management, SONG shareholders, and the SONG Board of Directors are frustrated and disappointed with this situation. They believe that “the fundamental value and opportunity of [SONG] fails to be reflected in the current share price.” As a result, they are working on a “number of options to enhance shareholder value”. This reportedly includes selling some of the company’s music catalogs.

If that isn’t enough intrigue to spark your interest, let’s throw in the upcoming shareholder vote that could result in the company’s assets being liquidated. In September, SONG will hold its Annual General Meeting. At the meeting, SONG shareholders will participate in a “continuation vote”, which occurs every five years, to determine whether SONG will continue as a going concern or be shut down.

As background, many publicly-listed investment companies – like Hipgnosis Songs Fund Limited – include a continuation resolution provision in their corporate documents (SONG’s continuation provision is listed in their share prospectus on page 72). This is to protect shareholders if the investments of the company mature and/or the manager is persistently underperforming. Nearly 20% of the 156 investment companies launched in the past 10 years have been shut down due to shareholders rejecting continuation. With SONG’s share price lagging and the continuation vote a couple months away, the company’s future appears more uncertain now than at any point since going public five years ago.

Which brings us to the topic of this essay: Has Hipgnosis – more specifically Hipgnosis Songs Fund Limited – hit the bottom? Is now the time for a turnaround?

To answer this question, I’ll cover the following topics:

What drove SONG’s share price into doldrums in the first place?

How is SONG currently faring?

What could drive a turnaround for SONG (in my opinion)?

Grab another cup of coffee and let’s try to learn from this fascinating situation!

Hipgnosis Organizational Structure

Before discussing where SONG is headed, let’s quickly cover the broader Hipgnosis organizational structure. We looked at this in detail in our previous Hipgnosis deep dive. But it’s important to keep the various moving parts in mind.

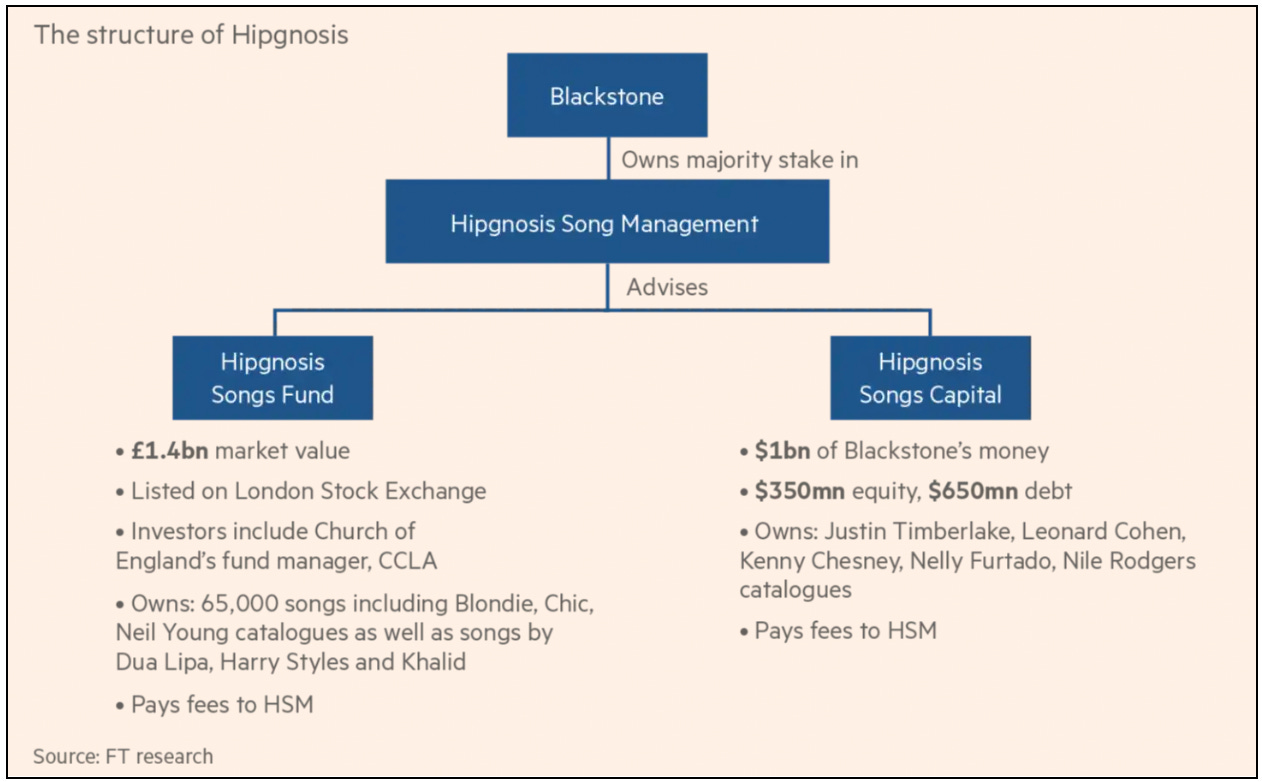

Hipgnosis is structured similarly to an investment management firm. As depicted in the diagram above, Hipgnosis’ structure includes three main entities:

Hipgnosis Song Management (“HSM”, formerly known as The Family (Music) Ltd.) is an investment advisor run by CEO Merck Mercuriadis and his team. In addition to HSM’s management team, the company has an advisory board of successful music industry experts (e.g., songwriters, artists, and executives) who help HSM source new investment opportunities. HSM sources new catalog deals and provides buy/sell recommendations to Hipgnosis Songs Fund (“SONG”) and Hipgnosis Songs Capital (“HSC”), described below. HSM also manages the music IP portfolios owned by SONG and HSC, which includes managing royalty collection and developing strategies to increase royalty income by placing them in movies, video games, viral TikTok videos, etc. In exchange for these services, HSM is paid an advisory fee and performance fee (when applicable) by SONG and HSC. In October 2021, Blackstone acquired a majority stake in HSM with two of three HSM directorships now held by Blackstone team members.

Hipgnosis Songs Fund (“SONG”) is the public investment company listed on the London Stock Exchange. It’s owned by public equity investors and was the first company advised by HSM. It has acquired over 140 catalogs and 65,000 songs, and has deployed over $2 billion of equity and debt capital. It pays HSM fees in exchange for HSM providing advisory services.

Hipgnosis Songs Capital (“HSC”) is the private investment fund capitalized by $1 billion from Blackstone. It reportedly has acquired ~$300 million of catalog in 2022 from creators, including Justin Timberlake, Kenny Chesney, and the Leonard Cohen estate. It pays HSM fees in exchange for HSM providing advisory services.

Before moving on, it’s worth noting the potential conflicts of interest existing in Hipgnosis’ organizational structure. For asset purchases – with Blackstone owning a majority of the management company – HSM may be incentivized to give preferential deal access / treatment to HSC (the Blackstone fund) over SONG (the public fund). HSM has tried to mitigate these concerns by instituting a conflicts of interest policy, which offers new opportunities to both funds, with SONG having co-investment rights to participate in 20% of any catalog purchase.

Similarly, for asset sales, there is concern that HSM has a contractual right of first refusal with SONG in the event SONG decides to sell any assets. How will HSM – which is now majority owned by Blackstone – balance its fiduciary duty to SONG shareholders with its potential incentive to strike a favorable deal for HSC or a new investment vehicle advised by HSM?

With these basics covered, let’s now turn our attention to the factors driving SONG share price into the doldrums and how the company is currently faring.

What caused SONG’s stock price to decline?

In our previous piece on Hipgnosis, we highlighted several issues facing Hipgnosis Songs Fund Limited. From my perspective, here are the key factors driving the share price slide:

1) Rising interest rates. Global interest rates began rising sharply in early March 2022. As depicted in the chart below, SONG’s share price began to decline materially in September 2022 when the US Treasury yield rose above 3%. Despite rapidly rising interest rates, Citrin Cooperman Advisors (SONG’s independent valuer) hasn’t increased the discount rate used in calculating the company’s Operative NAV per share.

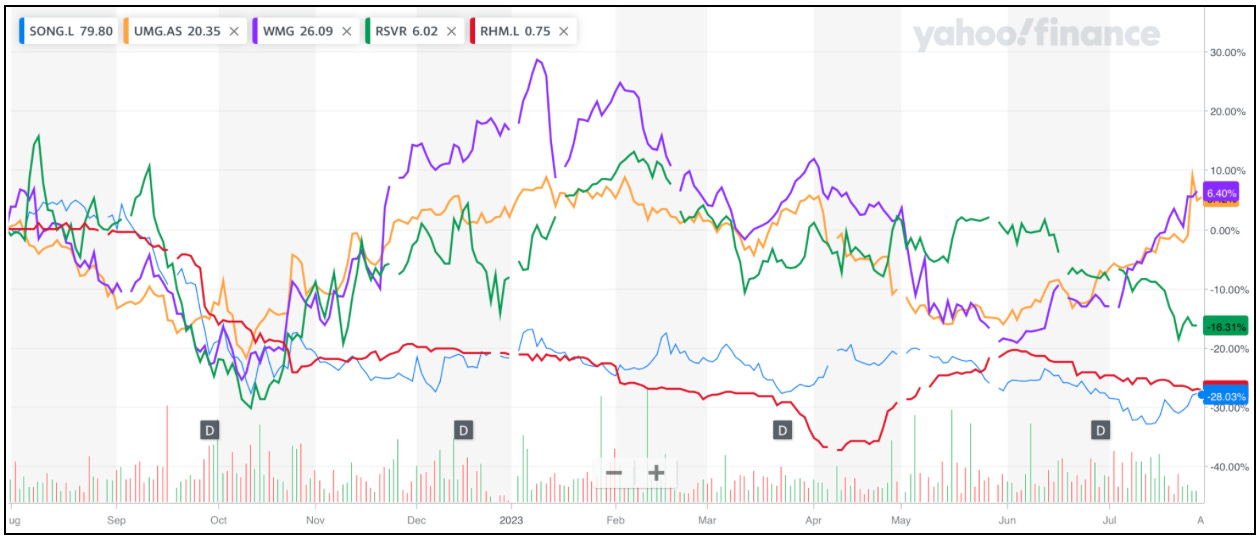

It’s worth noting that SONG wasn’t the only publicly traded music company to be impacted by rising interest rates. The chart below shows how other music IP companies also saw their share prices begin to decline in September 2022. That said, traditional labels and publishers have significantly outperformed SONG and other catalog aggregators since then. This performance dispersion is something that I anticipated in our newsletter on music catalog valuations published in April 2022 (the former long/short hedge fund analyst in me will go ahead and pat himself on the back now 😜).

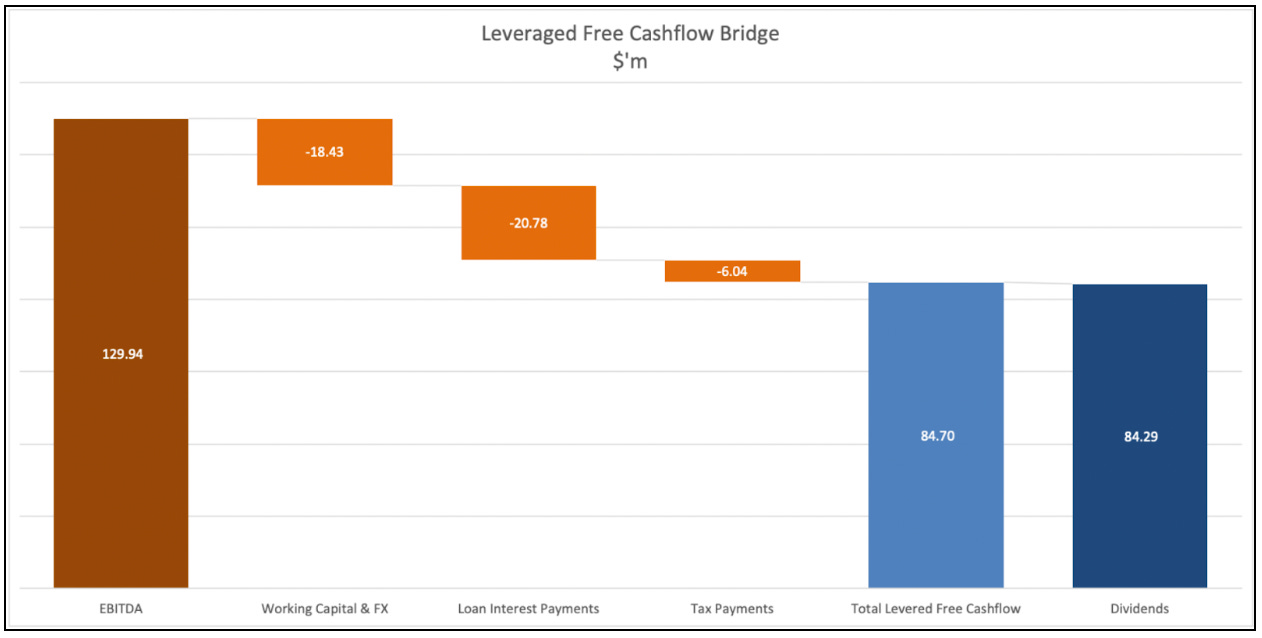

2) Concerns about cash flows covering dividend payments. SONG pays its investors a quarterly dividend and many SONG investors rely on this dividend being consistent (and hopefully growing) over time. However, the future sustainability of SONG’s dividend appeared concerning upon a closer review of its fiscal 2022 financials. Last year the company reported $84.7 million of levered free cash flow, barely enough to cover its $84.3 million of dividend payments. Meanwhile, its interest expense, which is tied to a floating interest rate, was set to rise significantly as interest rates rose. At the time, it looked like the company would be burning cash and facing some hard choices to avoid a liquidity crunch.

To management’s credit, the company took several steps to mitigate these risks. SONG entered into a new $700 million debt facility (accessing $100 million of additional borrowing capacity) and locked in fixed interest rate swaps at ~5.7%. In short, SONG’s debt refinancing bought it time to realize growth in catalog cash flows. But the company’s ability to consistently fund and grow the dividend from operating cash flows was a key concern.

3) A questionable M&A process. SONG’s underwriting assumptions – a version of which were published in 2021 – seemed to be more aggressive than its actual results. The company was estimating low- to mid-single digit royalties growth for the average 10+ year catalog in its portfolio, but its fiscal 2022 results suggested that these older catalogs royalties were roughly flat vs. growing.

Meanwhile, about half of its catalog was less than 10 years old. This cohort was expected to decline for the foreseeable future. So at the time, it was unclear where growth would be coming from in the near-term. SONG management attributed its slower than expected fiscal 2022 results on COVID-related lockdowns that impacted its performance income. Still, many investors likely wanted to see operating performance improve before actively buying shares in the company’s stock.

4) Possibility of accounting revisions. A significant portion of SONG’s revenues are estimated prior to receiving an actual royalty statement. While this is a similar approach as other publicly listed music rights holders, the proportion of estimated royalties was concerning. For example, SONG booked $86 million of revenue (51% of total net revenue) in fiscal 2022 based on estimated future royalties that the company had not received statements for yet. Second, a meaningful percentage of net revenue is one-time in nature. In fiscal 2021 and 2022, SONG booked $29 million (21% of total net revenue) and $14 million (8% of total net revenue), respectively, in one-time income associated with acquisitions as revenue. Both of these accounting treatments introduce more uncertainty into how sustainable SONG’s reported revenue really is.

5) Too much reliance on floating rate debt to fund acquisitions. SONG used a growing amount of bank debt to fund acquisitions. Bank debt is typically one of the cheapest sources of capital but its interest rate fluctuates. In early 2022, global interest rates were low and SONG was borrowing for 3.25% to 3.75%. But as Central Banks around the world raised interest rates to fight inflation, SONG’s bank facility interest rate – which is tied to SOFR – more than doubled to 7%+. In response, the company locked in a fixed interest rate swap at ~5.7% to avoid the full impact of rising borrowing costs. A higher interest expense makes it more difficult for the company to cover/grow the dividend and build a cash balance to pursue more acquisitions.

Unsurprisingly, all of the above points have contributed to SONG’s share price declining precipitously over the past 10 months. A turnaround is usually a complex process and many of these points are out of the company’s control. However, broadly speaking, how is Hipgnosis performing on each of these fronts now that its fiscal 2023 Annual Report has been released? And what needs to happen to realize a bounce back in the stock price?

How is Hipgnosis performing?

My review of Hipgnosis’ 2023 Annual Report shows that Hipgnosis Songs Fund Limited is rowing in a much better direction. At the same time, the company still appears to be in a bit of a pickle contending with variables either outside of its control or requiring hard decisions. Let’s look at each of the drivers listed above to unpack what I mean in more detail.

1) Rising interest rates. I have no idea what interest rates will look like in the next 12 to 24 months. However, the market (shown below), on average, currently thinks that short-term interest rates will remain above 5% through the end of 1Q 2024 and above 3% through 2026. Again, SONG’s share price began to slide meaningfully when interest rates broke above 3%. SONG obviously can’t control the path of global interest rates. Hopefully the market is wrong and rates decline in the near future; it’s a positive that the market expects rates to eventually decline. Still, elevated interest rate expectations for the next few years aren’t great for SONG’s share price, all else equal.

2) Concerns about cash flows covering dividend payments. Based on the 2023 Annual Report, SONG is making progress on growing the drivers of free cash flow. For example, its catalog royalties (which we’ll discuss in the next bullet) increased 12% and its ongoing operating costs declined 21% to ~$30 million. For the latter, SONG reduced its legal and professional fees, aborted deal costs, and restructured its leadership team and its administration company HSG. This is good stuff! And continuing this trend – higher royalties and lower operating costs – will be important to growing the share price over the long-term.

Even with these improvements, SONG is in a tough spot, because its free cash flow still isn’t growing. The company calculates its fiscal 2023 levered free cash flow at ~$82 million vs. ~$85 million in fiscal 2022. This is primarily due to the year-over-year increase in its borrowing costs from ~$20 million in fiscal 2022 to $34 million in fiscal 2023. As a result, the company is still barely covering its financial obligations to shareholders from its ongoing operating cash flow. For example, SONG suggested that its 5.25 pence per share annual dividend was covered 1.08x by its free cash flow. However, the company’s calculation of free cash flow excluded $9.9 million of loan interest payable. When this expense is included, free cash flow falls just shy of covering the dividend. Simply put, SONG is still working to sustainably fund its ongoing interest expense to lenders and its current dividend payments to shareholders out of its ongoing operating cash flows.

If you’re not a finance nerd like me, this may sound confusing. As an analogy, you could potentially think of this situation as a pickle / rundown in baseball. SONG is the runner, the bases are cash flow sustainability, and the other team is SONG’s interest and dividend commitments. Right now, it feels like SONG is trying to avoid being tagged out until it can reach a base safely (i.e., consistently fund its interest and dividend obligations from operating cash flow).

From my perspective, it’s important for free cash flow to grow to a level that comfortably covers SONG’s interest and dividend payments. In that world, SONG will be able to use the excess cash to purchase more catalogs, pay down debt, and/or return even more cash to shareholders. There are two ways to get from here to there: either operating cash flow grows or payments to debt holders and/or shareholders are reduced.

In my previous deep dive on Hipgnosis, I suggested shifting away from a fixed dividend policy to a variable one. This is a similar approach to how Universal Music Group currently sizes its dividend payments to shareholders. The potential benefit to SONG is resetting the dividend payout to an appropriate size relative to its operating cash flows. That said, I acknowledge that some SONG shareholders may view this move unfavorably in the short-term and sell their shares.

3) A questionable M&A process. As mentioned in the previous bullet, catalog royalties grew strongly last year. Importantly, catalogs younger than 10 years – which are typically expected to decline – actually grew 13% year-over-year! Meanwhile, catalogs older than 10 years grew 11% year-over-year. Looking at catalog performance by royalty type, synchronization income increased a whopping 25%, suggesting that Hipgnosis' Song Management strategy is working. Streaming income growth – its largest income stream – remained solid at 15%. These are terrific results and more in-line with SONG’s underwriting assumptions than those from the prior year. Hopefully this trend continues.

Going forward, Hipgnosis should benefit from the CRB III decision to increase mechanical streaming rates for songwriters and publishers. The company has accrued $16.1 million of revenue related to retroactive royalties due from the decision and $5.6 million of accruals related to current year accruals. Simply put, SONG’s cash flows will benefit from these royalty rate increases in the future.

4) Possibility of accounting revisions. My concerns about possible accounting revisions were realized in the company’s 2023 Annual Report. Even though royalties received increased, fiscal 2023 revenue declined year-over-year due to a ~$36 million decrease in estimated usage of the catalog and another ~$14 million decline in one-time right-to-income revenue associated with acquisitions. In addition, SONG unexpectedly recognized ~$44 million of expenses associated with future bonus payments to catalog sellers. These are triggered by SONG’s catalog achieving certain performance thresholds after acquisitions. Of the total, ~$12 million is likely to be paid in the next 12 months. While SONG’s accounting methodology adds more uncertainty to its financial results, my sense is that the majority of the bad news here is now known and should be priced into the stock. Of course, I could certainly be wrong about this point.

5) Too much reliance on floating rate debt to fund acquisitions. SONG has already mitigated much of this risk by hedging $540 million of borrowings at a blended rate of 5.75% through January 2026 at the earliest.

In summary, SONG’s latest Annual Report shows that the company is making progress. The seeds of a turnaround story are being planted – catalog royalties are growing strongly, operating expenses are being pruned, the accounting revisions have been acknowledged, and floating interest expense exposure has been hedged. These are steps in the right direction to enable the company’s share price to begin a comeback. But is it enough? Is SONG about to turn a corner and close the gap between its share price and its third party valuer’s Operative NAV per share?

Is Hipgnosis turning a corner?

From what is known publicly today, my opinion remains that these improvements alone aren’t enough to get the share price to more closely reflect the Operative NAV per share.

Let me be clear though. Based on my back of the envelope math, Hipgnosis Songs Fund Limited’s share price does look objectively “cheap” today. I calculate its Enterprise Value (including its contingent bonus payment provision) to Net Publisher Share (“NPS”) at 13.7x. This is below the average multiple paid for “iconic” music catalogs (illustrated below). Given the high quality of SONG’s catalog, I could definitely see a larger traditional label/publisher or catalog aggregator (including Hipgnosis Songs Capital which can leverage Hipgnosis Song Management’s right of first refusal on SONG) being interested in purchasing the company at a premium to its current price. The buyer would likely be able to streamline SONG’s cost structure quickly and wouldn’t have the pressure of maintaining the current dividend.

However, it’s hard to imagine that these potential buyers will be willing to pay a price in-line with SONG’s third party provided Operative NAV at ~21x NPS. And it’s my sense that SONG shareholders are anchored on the Operative NAV per share valuation as being “fair.” So while I could be wrong, I don’t think that a sale of the whole company is a likely outcome right now.

You may be wondering how I can think that SONG’s current share price is “cheap” but also think it isn’t due for a turnaround quite yet? Good question. The short answer is that, in my view, SONG still must sort out its free cash flow issue to move forward with a turnaround. And to do that, it probably has to make hard decisions (i.e., upset existing shareholders). Let me explain…

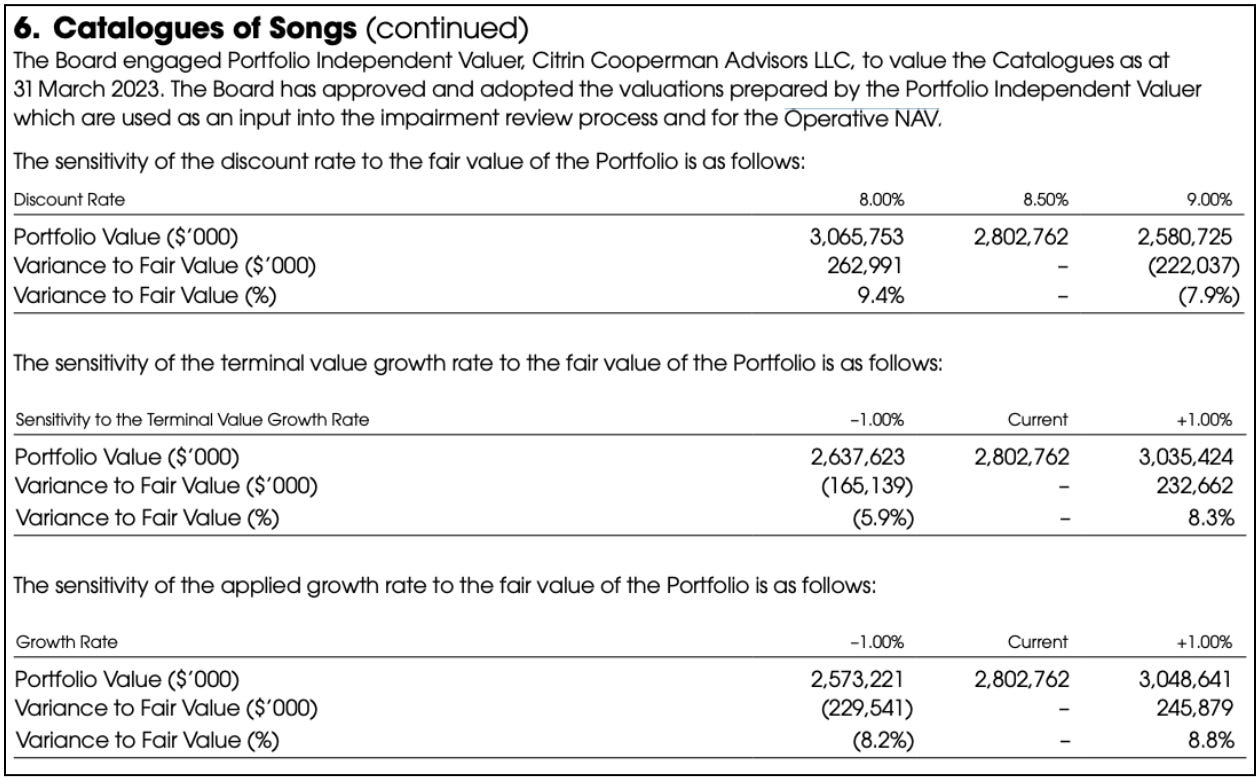

Per the 2023 Annual Report, SONG’s board of directors says that “the most relevant metric” for shareholders to gauge financial performance is the Operative NAV. From my perspective, there are several issues with this. First, it’s a metric built on a number of assumptions about the future. Second, its value can vary wildly from small tweaks in said assumptions. For example, changing the discount rate used in calculating Operative NAV by a mere 0.5% can change its value by ~10% (see below).

Finally, based on my experience, I’d argue that no single metric is a perfect north star for predicting stock market performance. For example, some research studies suggest that cash flow growth is predictive of stock returns over time. Along these lines, I’d prioritize three additional metrics: 1) free cash flow per share growth; 2) dividend per share growth; and 3) the ratio of free cash flow to dividends paid in each period. Based on its Annual Report and slides, SONG does appear to track these metrics; I’d suggest that they be prioritized to the same degree as Operative NAV per share.

Why? Because right now levered free cash flow per share isn’t growing, dividends aren’t growing, and free cash flow (once all interest expense is included) isn’t covering dividends. To truly unlock a turnaround, the dividend needs to be fully reset in a way that is more than covered by free cash flow. This will enable further free cash flow growth via additional acquisitions. If done well, the dividend per share can then grow over time. If I were SONG, I’d lay out a five-year plan to shareholders that shows why the short-term pain of resetting is worth it. Of course, the trade-off here is that laying out this plan sets a bar to beat. But in my opinion, it is necessary to effectively communicate the long-term value of the underlying assets once the company’s dividend is reset.

I’ve included an illustrative example with hypothetical numbers reflecting what this might look like below. To summarize, the chart forecasts free cash flow per share and dividend per share over time. While dividend per share declines in fiscal 2024, it slowly recovers. Eventually, dividend per share exceeds the current one by fiscal 2027 due to continued operating improvements, new acquisitions, and the roll-off of bonus contingency payments. Again, these numbers are made-up but hopefully demonstrate what a turnaround plan might look like.

I admit that this plan likely won’t be an easy sell. I’m sure there will be near-term pain, and for that reason I’d be somewhat surprised if this plan is actually implemented. Several existing shareholders probably won’t appreciate having their dividends reduced; if stock sales follow, SONG’s price will decrease further. Still, with the information available, I see it as the best path to unlock future growth and eventually share price appreciation.

Are there other potential options that aren’t as painful to existing shareholders? One option reportedly being considered is selling some of SONG’s assets to demonstrate that the company’s shares are currently undervalued. When I run the numbers on a potential sale with proceeds used to repay debt and/or buyback stock, I don’t see a meaningful improvement on the free cash flow problem, barring the sale of a significant portion (i.e., 30%+) of SONG’s catalog with very favorable terms (a 20x+ NPS multiple and structured in a way that no taxes are paid).

As a result, it appears that selling a small portion of the catalog is taking a band-aid approach. It’s like sticking your finger in a flooding dam. Selling assets at a premium to its current share price may cause the price to increase for a short time. But it still doesn’t solve the issue of growing cash flows and covering future dividend payments given the publicly available data that I’ve analyzed.

Closing Thoughts

Hipgnosis Songs Fund Limited seems to be making progress on its turnaround efforts. Like we discussed in the previous deep dive, the company's strategy has shifted from aggressive growth to a focus on operational efficiency and prudent financial management. However, to truly set itself up for success over the long-term, I’d argue that it needs to prioritize, reset, and plan around cash flow metrics going forward. By doing this and continuing to build on the operational and financial changes that drove strong results in 2023, it should be in a much better position to compress the difference between its share price and Operative NAV per share over time. Until there is greater clarity on its cash flow situation, my gut is that Hipgnosis has not hit the bottom quite yet.

Again, this isn’t investment advice or a bet against the company’s ability to grow and create value from here. I write these pieces to learn in public, so please reach out with alternative takes! It’s entirely possible that the SONG team will come up with a win/win solution that I haven’t even considered in this piece. I’m certainly rooting for that possibility, because right now it appears that there are likely some ongoing difficult conversations and decisions between management, the board, and shareholders in the weeks leading up to Hipgnosis Songs Fund’s Annual Meeting in September. I’m looking forward to seeing what this group of operators and investors comes up with!

Thanks to Hannah, Adam, and Nicholas for the feedback, input, and editing!

Alderbrook Consulting & Investing

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with record labels, music publishers, music technology companies, and investors on a wide-range of projects.

Our experienced group of consultants provide services across four main categories, including: 1) market research and strategy; 2) investment and M&A due diligence; 3) capital raising support; and 4) financial planning & analysis.

In addition to the above services, we also have a growing venture portfolio of 20+ early-stage investments. Our primary focus is backing founders who we believe in and whose vision we are aligned with. While we are industry agnostic, our preferred sectors are media, software, and government technology.

If you need help on a project or are raising capital, please reach out and we’ll be in touch!

Great and informative read, as usual!