Exploring Africa’s Music Market Opportunity

Western music companies are looking to unlock growth across the continent

GM readers 👋,

Happy belated June!

I was on holiday last week in the Azores. It was amazing (highly recommended!) – a much needed time to step away from work and recharge. But it resulted in less writing and this month’s newsletter is a week late. 😬

While I was away, Spotify announced it was selling music creation platform Soundtrap back to its founders. If you’ve been reading this newsletter, you may recall our recent deep dive on BandLab – a Soundtrap competitor – and my concerns about its current business model. Even though Soundtrap seemed to be struggling (it is behind competitors BandLab and Apple’s GarageBand in most markets), I’m still surprised by this outcome. Why couldn’t Soundtrap leverage Spotify’s 500+ million MAUs to build a seamless ecosystem between creators and fans? Probably a future topic worth exploring…

I also have to plug Juvenile’s recent NPR Tiny Desk performance. I was born and raised in New Orleans. A meaningful part of my childhood was spent watching Juvenile, Lil Wayne, B.G., Turk, and Mannie Fresh music videos on The Box after school. I’d save my allowance and beg my parents to let me buy a Cash Money Records album at our local Sam Goody. From my perspective, this NPR performance is nostalgic and special. It makes me proud to be a New Orleanian. I hope you take the time to watch and enjoy it.

For this month’s newsletter, we’re going to cover one part of the world that is increasingly getting attention as a key driver for future music industry growth – Africa! I learned a lot while researching this one, so I hope you find the piece as interesting to read as I did to write.

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. This piece is for informational purposes only. None of this is financial or legal advice. Do your own research!

One more thing. I’ll be in Los Angeles the week of July 24th. I’d love to catch-up and chat about consulting, investing, partnerships, and more. If you’d like to grab a coffee, please shoot me an email or fill out this form – even if it’s for a quick hello!

Thanks again for reading. If you have any feedback or ideas for future posts, please leave a comment or shoot me an email.

Now, let’s get after it!

Jimmy

PS If you like our work, please consider hitting the heart ❤️ emoji and sharing this article, because it helps more readers discover our writing! And if you’re not already a subscriber to Leveling Up and don’t want to miss out on future newsletters, feel free to enter your email below and you’ll receive new posts directly in your inbox.

Today’s Leveling Up is brought to you by… Royalty Exchange

Back in 2013, I stumbled across Royalty Exchange’s website while researching a project in business school. I was struck by the idea of acquiring cash-flowing royalties associated with some of my favorite songs. And I was intrigued by the relatively high implied cash flow yields. It started me down the rabbit hole of learning how music IP worked. So it feels pretty surreal to have Royalty Exchange become the first sponsor of the Leveling Up newsletter roughly a decade later.

For those unfamiliar, Royalty Exchange is a leading platform that matches entertainment IP creators seeking funding with investors seeking to add cash-flowing, low correlated assets to their portfolios. To date, rights holders have raised over $135M+ across 1,600+ deals on the platform.

Using Royalty Exchange, investors have purchased royalties tied to songs by artists like Jay-Z, Rihanna, The Doobie Brothers, Beyonce, and the Shrek film franchise. Click here to see what assets are available for purchase now.

Exploring Africa’s Music Market Opportunity

“In particular, we believe that Africa presents a significant opportunity over time as device penetration and broadband infrastructure improve, and the middle class expands.” - Goldman Sachs Equity Research, Music In the Air Report (2022 edition)

TL;DR

A recent slowdown in developed market music streaming revenue has driven downward revisions to music industry growth forecasts.

Analysts often highlight emerging market music streaming growth as a potential growth driver for the industry. While China and India are often highlighted among emerging markets, Africa is gaining attention.

Sub-Saharan Africa is the fastest-growing recorded music market and several Western music companies have announced strategic initiatives on the continent. Whether this growth is sustainable is an open question, as tailwinds and headwinds impact the market.

The number of internet and smartphone users in Africa is already large and increasing quickly, even if the penetration rates are lower than the global average. Internet network speeds are also improving throughout the region, enabling more access to music streaming services.

That said, the cost of mobile data relative to income is prohibitive in many African countries. Cash is still the primary form of transactions and electronic payment solutions largely remain underdeveloped in the region. Additionally, piracy is a problem across the continent.

Adoption will likely be dependent upon how quickly mobile internet and payment infrastructure can be set-up across the region and how cheaply (relative to income) Africans can access smartphones and mobile data plans.

Broadly, African streaming users mostly listen to local content and the region has a rich community of talented artists with global appeal. Meanwhile, the Afrobeats genre and its artists are quickly gaining popularity in many Western music markets, creating new opportunities for rights holders outside the continent.

At the same time, Africa is a very diverse continent. These general macro trends should be taken with a grain of salt and considered further at the country/local level.

While the African music market is relatively small and somewhat nascent at the moment, there is significant room to grow over the long-term as digital payment infrastructure expands and IP rights are recognized and protected. There are potential advantages in being an early mover in developing music rights and building technology for the African market.

Investors love a good growth story. Music streaming – pioneered by technology companies like Spotify – has been the primary driver of the music industry’s growth over the past 10 years. However, streaming’s revenue growth in developed markets is beginning to slow and Wall Street analysts (e.g., Goldman Sachs) are beginning to cut their forecasts on the industry’s future growth prospects.

So why is this a big deal?

As former BMG executive Justus Haerder and I detailed in a prior piece on music catalog valuations, long-term outlooks are important to music catalog and company valuations. Simply put, if the industry has brighter future growth prospects, investors have more confidence paying higher prices for these assets.

In light of this, it’s worth exploring what other growth drivers could be catalysts to improve the industry’s outlook over time. “Emerging market growth” is a term often used in the investment community when talking about future “growth vectors” for the industry. I’m certainly guilty of it. This story typically centers around China – which is still only the 5th largest recorded music market despite being the 2nd largest global video gaming market and the 2nd most populous country – and India – which isn’t a top 10 music market despite being the most populous country. Both China and India have a large number of music streaming listeners, but also have paid penetration rates well below that of developed markets. I agree with analysts who conclude that both countries appear to be a massive opportunity for the overall industry.

But there’s also one part of the world that is increasingly getting more attention for its growth – Africa! In fact, according to IFPI, Sub-Saharan Africa was the fastest growing recorded music market in the world in 2022, increasing ~35% year-over-year.

Meanwhile, over the past few years, a number of Western music companies have announced strategic expansion initiatives on the continent. Here is a brief list:

In 2020, Downtown Music Holdings acquired South African publisher Sheer Music Publishing.

In 2021, DIY distribution platforms CD Baby and TuneCore launched operations in Africa.

In 2021, Spotify increased its presence in Africa by expanding into several new countries, including Nigeria, Ghana, and Zimbabwe.

In 2022, Warner Music Group acquired Africa-based music distributor Africori.

In 2023, Atlanta-based label LVRN raised $25+ million from Matt Pincus’ MUSIC to expand operations across the world with a key focus on West Africa.

In 2023, Steve Stoute’s distribution and artist services company UnitedMasters formed a partnership with Nigerian producer Sarz to “unlock new opportunities for African artists.”

In 2023, Larry Jackson’s new $1 billion backed project called gamma announced that it will be expanding into Africa with operations based in Lagos, Nigeria.

Clearly a growing number of industry players are betting on the continent’s future growth prospects! So let’s try to unpack music’s potential opportunity in Africa in more detail.

The African Music Market

For our analysis, I’ll be focusing on the Sub-Saharan African region due to data sourcing challenges for the whole continent. This region (pictured below) represents 1+ billion people or ~83% of Africa’s total population. Finally, I’ll be analyzing larger macro trends in this essay, so the figures below should be taken with a healthy grain of salt. While it would be interesting to build a more detailed framework and compare countries across key variables for go-to-market purposes, it’s beyond the scope of this month’s newsletter.

Internet Access is Growing

Internet penetration in Sub-Saharan Africa is low on a percentage basis compared to other regions, but high on a numbers basis and growing quickly. The World Bank estimates that 36% or ~436M of a ~1.2B total population currently has internet access. A Gallup poll (depicted below) comparing internet access by region underscores how internet penetration as a percentage of population in Sub-Saharan Africa is currently well below more developed markets. For example, penetration in North America was 94% in 2019. Still, it’s worth highlighting that Africa’s current number of internet users is roughly the same as the US, Canada, and Mexico’s combined total population.

Another positive tailwind is that internet access is growing quickly. According to the World Bank, Sub-Saharan Africans with internet access as a percentage of total population has increased from less than 1% in 2000 to 36% today. This 18% CAGR over the period is quite impressive, though the World Bank estimates that $100B+ of investment are required to improve infrastructure across the continent to reach close to full internet penetration.

In addition, internet access in urban areas is much higher than in rural areas. According to the International Telecommunication Union, 50% of Sub-Saharan Africans living in cities had access to the internet in 2020. In fact, the urban-to-rural internet access ratio in the region was 3.3x, much higher than the 1.9x global average. Access also varies significantly from country to country in the region. For example, 72% of South Africa’s population has internet access whereas only 10% of Uganda’s population has access. Simply put, not all Sub-Saharan African countries can be viewed equally in regards to internet access.

Smartphone Penetration and Download Speeds are Improving

Most of Africa’s internet traffic comes from mobile devices, and smartphone penetration is becoming a larger share of the installed base. According to Statista, ~73% of Africa’s web traffic comes from mobile phones, 25% from PCs, and 1% from tablets. Meanwhile, according to mobile phone trade organization GSMA, smartphones are estimated to account for 49% of mobile connections in Sub-Saharan Africa. GSMA projects that smartphone penetration in the region will grow to 61% by 2025. This is good news for music streaming services, as most audio streaming in countries like the US happens via smartphones.

Meanwhile, internet users in Africa are increasingly shifting from 2G and 3G broadband networks to using 4G and 5G. According to GSMA, 86% of mobile users in the region are expected to be connected to 3G or 4G networks by 2025. For streaming music, 3G and higher networks typically provide sufficient download speeds. However, it’s worth noting that Sub-Saharan Africa’s internet speeds vary significantly by country and are still below the global average. According to the World Economic Forum, internet outages and shutdowns can also impact access.

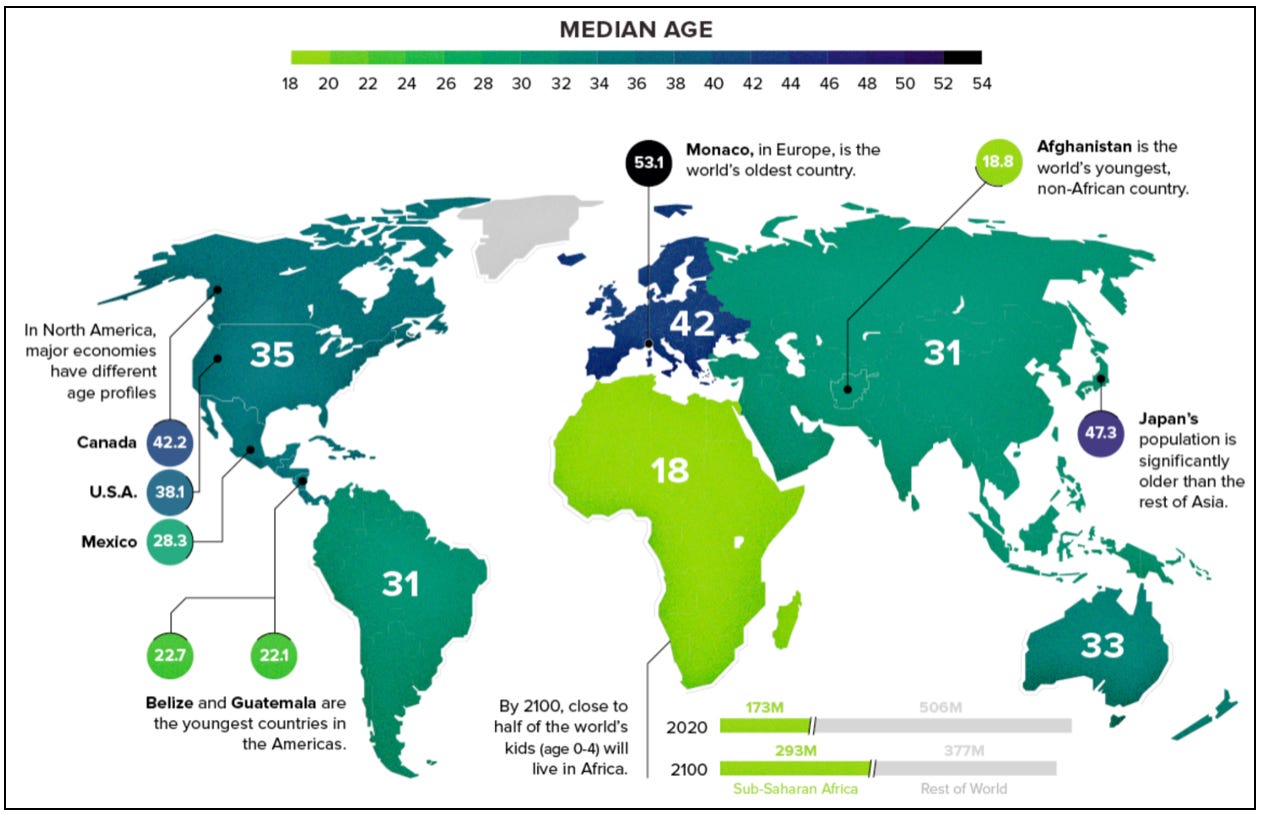

Demographic Trends are Mixed

Another major tailwind for the continent’s future digital music consumption is its age. Africa is the youngest continent in the world with a median age of 18 years old. Meanwhile, its population is growing at ~3% per year versus the global average of ~1%. The World Economic Forum expects the continent’s urban population to triple by 2050.

A massive, growing population of young people is a huge opportunity for the music industry. After all, over 80% of users on major streaming services like Spotify and Apple Music are under the age of 45. As more young Africans come online via smartphones, music consumption on the continent is likely to increase.

On the other hand, Sub-Saharan Africans have a lower income than the global average. According to the World Bank, Sub-Saharan Africa’s average annual GDP per capita is $1,690 vs. the global average of $12,703 (depicted below). For context, the region’s average income is about 30% below that of India. It’s also worth noting that GDP per capita varies significantly by country.

In addition to paying for music streaming, mobile data on the continent isn’t cheap everywhere relative to GDP per capita. For example, 1 gigabyte of mobile data, which is estimated to be equivalent to 8 to 24 hours of music streaming, costs anywhere from $0.61 in Ghana (significantly less than 1% of annual GDP per capita in the region) to $15.55 in Botswana (~1% of annual GDP per capita). You can do the math – the current cost of mobile data relative to average incomes is a problem for music streaming’s growth in several Sub-Saharan African countries.

Simply put, Africans need to view music streaming as affordable, so relatively low incomes and high mobile data costs are a hurdle. GDP per capita will be an important metric to track if the industry hopes to sustain revenue growth on the continent.

Regulation is Another Hurdle for Industry Growth

Broadly, the regulatory environment across the region is challenging. The World Justice Project and The Index of Economic Freedom both rank countries within Sub-Saharan Africa low in categories such as judicial effectiveness, property rights, government integrity, and so on. The heat map depicted below gives you a sense of how the continent compares to the rest of the world in this regard.

Along these lines, The Economist ranks Sub-Saharan Africa as the second lowest region in the world (after the Middle East and North Africa) on its Democracy Index. Again, the rankings vary significantly by country in the region.

Given these regulatory concerns, it’s probably no surprise that piracy is a major issue in Sub-Saharan Africa. According to an IFPI report, there were 59.2 million visits to music piracy sites in Kenya last year. In a recent interview, an executive at Nigeria-based music streaming service Boomplay underscored piracy’s threat to industry revenues, “Our greatest competition is piracy, actually. It’s not each other as DSPs (digital service providers). Most of the continent, they get their music for free, so [they think] ‘why should I buy music when I can get it for free from illegal sites?’”

Piracy is currently a problem for both music rights holders and service providers operating on the continent. Rights holders rely on property rights protections to get paid. Streaming services depend on the rule of law discouraging illegal services from operating without concern of repercussions.

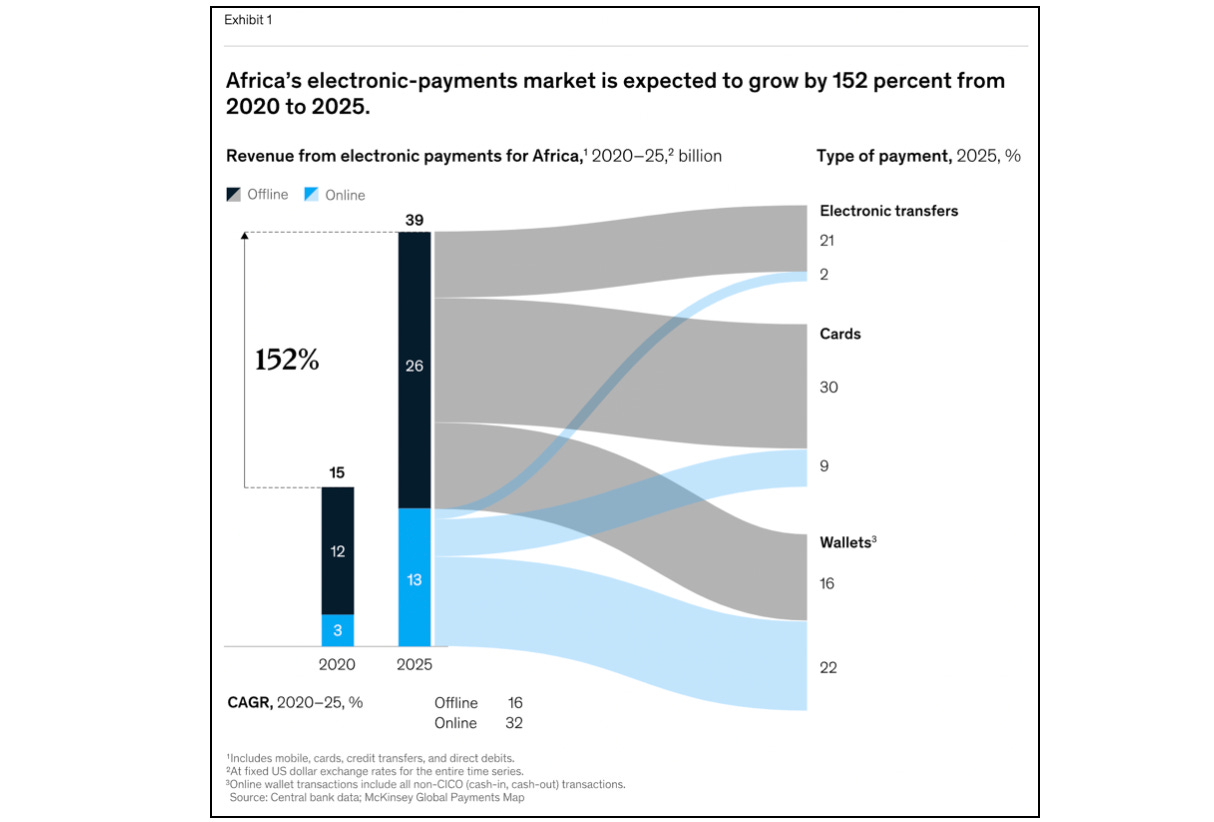

Payment Infrastructure Remains Underdeveloped

The overwhelming majority of Africans still use cash to transact. A McKinsey study estimates that only 5% to 7% of all transactions on the continent were made via electronic or digital channels! Meanwhile, according to the World Bank, only 55% of Sub-Saharan Africans over 15 years old have an account at a financial institution or mobile money service provider. This compares to 89% in China, 78% in India, and the global average of 76%. Given that cash remains king on the continent, there is an inherent headwind to monetizing digital music via subscriptions and one-time purchases.

Despite the current state of payments in the region, analysts expect digital penetration to grow significantly over the next five years. The same McKinsey study forecasts the electronic payments market to grow by 150% from 2020 to 2025. It also notes that some countries – like Nigeria, Ghana, Kenya, and South Africa – have transitioned to digital payments faster than others. Simply put, further development of Sub-Saharan Africa’s payment infrastructure and the availability of digital options will be an important driver of future music streaming growth.

Preference for Local Content with Global Reach

The next question is what types of music do Sub-Saharan Africans listen to? The answer is typically content created by African artists. According to Boomplay, 70% of plays on the platform are from African artists. Spotify’s data also bears this out. In 2022, the top 20 most streamed songs in Nigeria and in Ghana were all from African artists.

This preference for local content among Africans isn’t unique. Researchers Will Page and Chris Dalla Riva recently published a paper that found local music dominated streaming listening trends in 10 European markets. They call this dynamic “glocalisation” where streaming led to an absolute and relative increase in the domestic share of top 10 songs and artists.

Based on the above data, the natural conclusion for rights holders, platforms, and service providers expanding from Western markets into the region is that a localized content strategy will be important. Popular music in the US or UK likely won’t become the most in demand among local streamers in Africa – at least right now.

On the other hand, African music is growing in global popularity. Artists like Burna Boy, Wizkid, Fireboy DML, Tems, Asake, and Black Sherif are becoming global stars. In Page and Dalla Riva’s paper, they show how Nigeria-based artists held a 1% to 5% share of Top 100 songs in the 10 European markets studied (depicted below).

The researchers note that Nigeria was one of nine countries outside of the home countries with a meaningful share of artists. They attribute this to the popularity of Afrobeats – an umbrella term used to describe popular music from West Africa. Spotify has an entire interactive webpage dedicated to the genre, and Spotify CEO Daniel Ek has tweeted about the genre’s incredible growth on the platform, including in countries outside of Africa. According to Ek, Afrobeats music was streamed 13 billion times in 2022. If we assume that each stream generated $0.003, that’s ~$45 million on Spotify alone!

My point is that Africa’s music opportunity isn’t just local: it includes promoting the continent’s rich talent base in markets outside the continent, where there is clearly already demand. Along these lines, while researching this piece, I watched Burna Boy and Tems’ NPR Tiny Desk sets over and over again. They are amazing and highlight the crazy high level of talent originating from the region. I recommend checking out the performances linked here and here.

Current Market is still Nascent

Now that we have a basic understanding of the macro trends impacting the African music market, let’s discuss monetization. According to IFPI, Sub-Saharan Africa’s recorded music market generated $70.1M in 2021. Meanwhile, research firm Dataxis estimates that Africa’s music streaming revenues were $93M in 2021 and are forecast to grow to $315M in 2026. Taking into account these two estimates above, Spotify’s data on Afrobeats, some assumptions for publishing revenues, and some margin of error, I’d guess that Africa’s music market is somewhere between $90M - $150M currently. For context, Goldman Sachs estimated that China and India’s market sizes are ~$1.1B and ~$219M, respectively. Simply put, monetization is still relatively nascent but should continue to grow.

Closing Thoughts

Africa seems destined to become a meaningful growth driver for the broader music industry. The question seems to be more one of “when,” not “if.” To accelerate this timeline, several macro shifts that we’ve discussed will likely need to occur, including:

Mass adoption of the internet and smartphones

Cheaper access to mobile data plans relative to local income

Stricter enforcement of copyright laws

Growth of cashless, mobile-first payment infrastructure

Continued emergence and promotion of African-based artists

For the African market to realize its full potential, some of these barriers will be easier to overcome than others. Regardless, I’m excited to watch the continent develop into a larger slice of the overall music pie.

Thanks to Hannah and Adam for the feedback, input, and editing!

Alderbrook Consulting & Investing

Since 2017, Alderbrook has consulted with numerous companies across various industries and stages. This includes working with record labels, music publishers, music technology companies, and investors on a wide-range of projects.

Our experienced group of consultants provide services across four main categories, including: 1) market research and strategy; 2) investment and M&A due diligence; 3) capital raising support; and 4) financial planning & analysis.

In addition to the above services, we also have a growing venture portfolio of 20+ early-stage investments. Our primary focus is backing founders who we believe in and whose vision we are aligned with. While we are industry agnostic, our preferred sectors are media, software, and government technology.

If you need help on a project or are raising capital, please reach out and we’ll be in touch!