Down The Rabbit Hole: Music & Technological Innovation

How the Recorded Music Industry is on the Cusp of Change

GM readers 👋,

Happy 2022! It’s been a while since my last post. 2021 was a busy year for me professionally. Alderbrook’s consulting business grew a lot (huzzah!) 📈. I started angel investing 💸. And I spent a lot of time learning about Web3 and working on crypto gaming projects with the amazing team at Naavik 💪. As a result of this activity, I didn’t write as much as I had hoped. For the rest of this year, I aim to post more frequently 🤞.

A couple other items before diving into the post:

As Alderbrook scales, we are looking for part-time analysts who are skilled writers, financial modelers, presentation designers, and strategic thinkers. This is a flexible, paid role for individuals who enjoy helping companies of various sizes solve challenging problems. Bonus points if you are knowledgeable and passionate about the gaming, music, or Web3 industries. Please reach out to contact@alderbrookcompanies.com if you are interested in learning more.

This blog actually has a name now! After some thought and feedback, I’ve landed on Leveling Up! The name speaks to the process of steadily improving through consistent effort. As a passionate gamer, I’ve spent too many hours (sorry to my wife Hannah!) grinding FIFA Ultimate Team to progress to the “Elite Division”. As an entrepreneur, I’ve had to restart many times working to grow my business. Eventually, things click and I get better. Through writing this blog, I aspire to “level up” my thinking on different topics. And hopefully you are entertained and learn something along the way too. And, if I get lucky 🙂, the blog can help industry participants - whether they be companies, investors, or creators - create more value.

Thanks again for reading. Now, let’s jump in!

Jimmy

PS if you have feedback on the post, as always, please let me know!

Down The Rabbit Hole: Music & Technological Innovation

“We're more convinced than ever that Web3 will be one of the next steps in the evolution of the music ecosystem.” - Stephen Cooper, CEO of Warner Music Group

As most of you know, in The Matrix, Neo is offered the choice of taking a red pill or blue pill. If he takes the red pill, Neo will go down the rabbit hole and learn many potentially unsettling truths. If he takes the blue pill, he will remain in contented ignorance. Technological innovation can cause companies or even entire industries to face a similar choice. That is, embrace the realities of the world around you, even if they require difficult changes, so that you can successfully adapt and win. Or live in blissful ignorance and accept the consequences.

The music industry has arguably chosen the blue pill over the past 20 years. If you are a follower of media industry trends, you may have seen a recent twitter thread from Andreesen Horowitz partner Chris Dixon about how the internet routes around “bad” business models. His prime example, citing work from Matthew Ball, is the divergent paths of the video game and recorded music industries.

From the 1970s to early 2000s, recorded music was a larger market than gaming. Since then, the global gaming market has exploded from $40 billion to $175 billion in 2021. Meanwhile, music contracted (on an inflation adjusted basis) from $40 billion to a nadir of just below $15 billion in the early 2010s. Only with the proliferation of streaming has music once again returned to growth, causing the market to rise back above $20 billion in 2019.

What drove these two markedly different outcomes? Has something fundamentally changed over the past 20 years that causes users to value music less than games? Or is there a way to adjust the economic model so that music’s total pie might catch-up?

In this piece, we’ll try to unpack this divergence for these two media formats. We’ll analyze aspects of each industry’s market composition and the influence this has on technology adoption. Next, we’ll look at how game developers effectively monetize audiences and what music rights holders can potentially learn from free-to-play game best practices. Finally, we’ll explore how a new technological shift brought on by Web3 could help further grow the recorded music pie, and some barriers to future adoption.

Looking to the Past: Recorded Music & the Internet

Before moving forward, it’s important to note that we are focusing our discussion on the recorded music industry. There are three core parts of the music industry:

Recorded Music: focused on the recording and distribution of the master recording to consumers.

Music Publishing: focused on the creation and licensing of musical compositions.

Live Music: focused on producing and promoting live entertainment, such as concerts.

While the other two parts of the industry have been impacted by the emergence of the internet, recorded music took the biggest hit. If interested, I covered the differences between recorded music and music publishing in another post. Now, let’s get to it…

Prior to the web, the music industry benefited from several technological innovations. In 1877, Thomas Edison invented the phonograph, which later evolved into the gramophone, vinyl, cassettes, and CDs. These innovations allowed users to consume content on-demand. And artists could monetize their content at any time, even if they weren’t physically present. Simply put, these innovations allowed music rights holders (musicians, labels) to diversify revenue streams away from live performances and gradually grow into a sizable industry. The shift from vinyl to cassette to CD did not meaningfully deter the gradual upward trajectory of industry revenues.

However, the introduction of the mp3 and the ability to share these digital files via the internet was extremely disruptive. The mp3 allowed users to buy a CD, “rip” the tracks, and store these files on a computer. In addition, users could share these files peer-to-peer all over the world. As a result, music became more and more commoditized. The scarcity associated with owning a physical recording was replaced by the ubiquitous nature of content on the internet. Napster, the pioneering file sharing software service, launched in 1999 and made the process as simple and efficient as possible. The industry lost control of content distribution and scarcity associated with music content, as piracy became rampant.

Let’s quickly define what we mean by “commoditized” since we’ll use it throughout this piece. Pre-internet, physical albums (i.e., music content) could be 1) priced differently by the label or artist that owned the IP and 2) the supply of albums was capped by the number produced by the label. The internet caused this to change. First, music content is now priced more or less the same regardless of who makes it. Second, there is an infinite supply of an artist’s content, which rights holders more or less can’t control. Simply put, commoditization speaks to how music rights holders have lost the ability to control the price and quantity of their music with the rise of the internet.

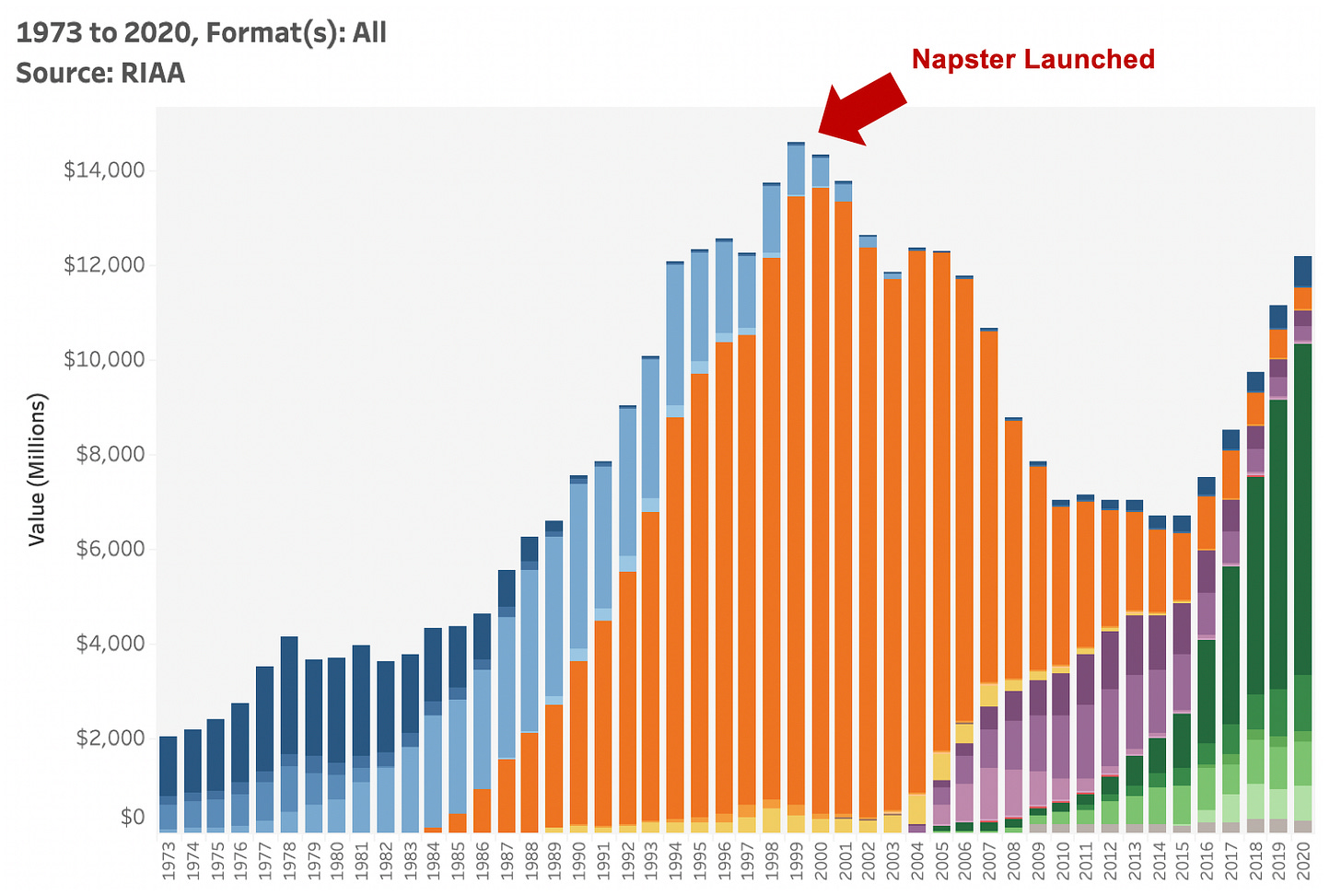

The implications for industry revenues have been severe. Piracy contributed to the nosedive in CD sales, the dominant format by revenue at the time. The RIAA, the trade organization that represents the US recorded music industry, reports domestic industry revenues declined from a peak of $14 billion in 1999 to $6.7 billion in 2014 – an incredible 54% drop! The graph below illustrates this progression (with blue bars indicating vinyl and cassettes, orange bars indicating CDs, purple bars indicating digital downloads, and green bars indicating streaming).

In response, the RIAA and other industry participants (e.g., Metallica) focused their energy on shutting down illegal file sharing. Thousands of lawsuits were filed against platforms and participants (i.e., consumers) with only mixed results. Napster ceased operations in 2001 with other platforms, such as LimeWire, eventually doing the same. But as a Harvard Business Review article published in 2008 points out, the RIAA’s lawsuits only targeted a fraction of a percent of offenders, pitted the industry against its potential customers, and resulted in artists seeing little benefit from legal settlements and judgments. Even today, the IFPI (an international recorded music trade body) reports that music piracy is high, with 30% of music consumers infringing on copyright.

The recorded music industry’s decision to fight – rather than embrace – digital distribution seemed rational at the time. Pre-internet, record labels manufactured CDs – the dominant format at the time – and controlled their distribution to consumers. As shown above, the internet made distribution of CDs much less relevant. This caused the power and influence of record labels to become increasingly threatened. The labels had a strong interest in securing their existing positions, and played a role in the decision to fight technological innovation.

The industry’s consolidated nature also contributed to its response. Academic studies have shown that markets which are dominated by one or a small number of firms can lead to slower technology adoption. For example, in Impact of Competition on Technology Adoption, Adam Copeland and Adam Hale Shapiro studied two different retail markets for personal computers. They found that relative to Apple, producers of PCs – who are in stiff competition – have more frequent technology adoption, shorter product cycles, and steeper price declines over the product cycle. Their study concluded that competition is the key driver of the rate at which technology is adopted.

You can see this in Chris Dixon and Matthew Ball’s comparison of recorded music to the video gaming industry referenced at the beginning of this post. The top three companies by game revenue currently control less than a third of the market. Furthermore, industry thought leader Joost Van Dreunen has highlighted how gaming industry market shares have changed dramatically over the past 20 years (depicted below). Only 4 of the top 10 companies in 2000 remain in the top 10 today. Meanwhile, Chinese firms have grown significantly with Tencent and NetEase firmly in the top 10. Simply put, the video gaming industry is quite fragmented and competitive, with companies struggling to maintain their leadership positions over time.

Meanwhile, the recorded music industry was (and still is) quite concentrated with very little change among the top dogs. Today, the industry has consolidated such that the three “majors” (Universal, Warner, and Sony) own 69% of the market vs. only 53% in 1999.

Amid shrinking industry revenues due to rampant piracy, Apple offered labels and music publishers a solution: iTunes. With Apple’s digital music platform, consumers were able to receive a similar level of convenience to illegal file sharing services, like Napster, without the concern that their download was going to be low quality or infect their computer with a virus. The adoption of iTunes meant rights holders would once again be paid for the use of their intellectual property. Apple CEO Steve Jobs highlighted its key benefits when the iTunes store launched in 2003: “Consumers don’t want to be treated like criminals and artists don't want their valuable work stolen. The iTunes Music Store offers a groundbreaking solution for both.”

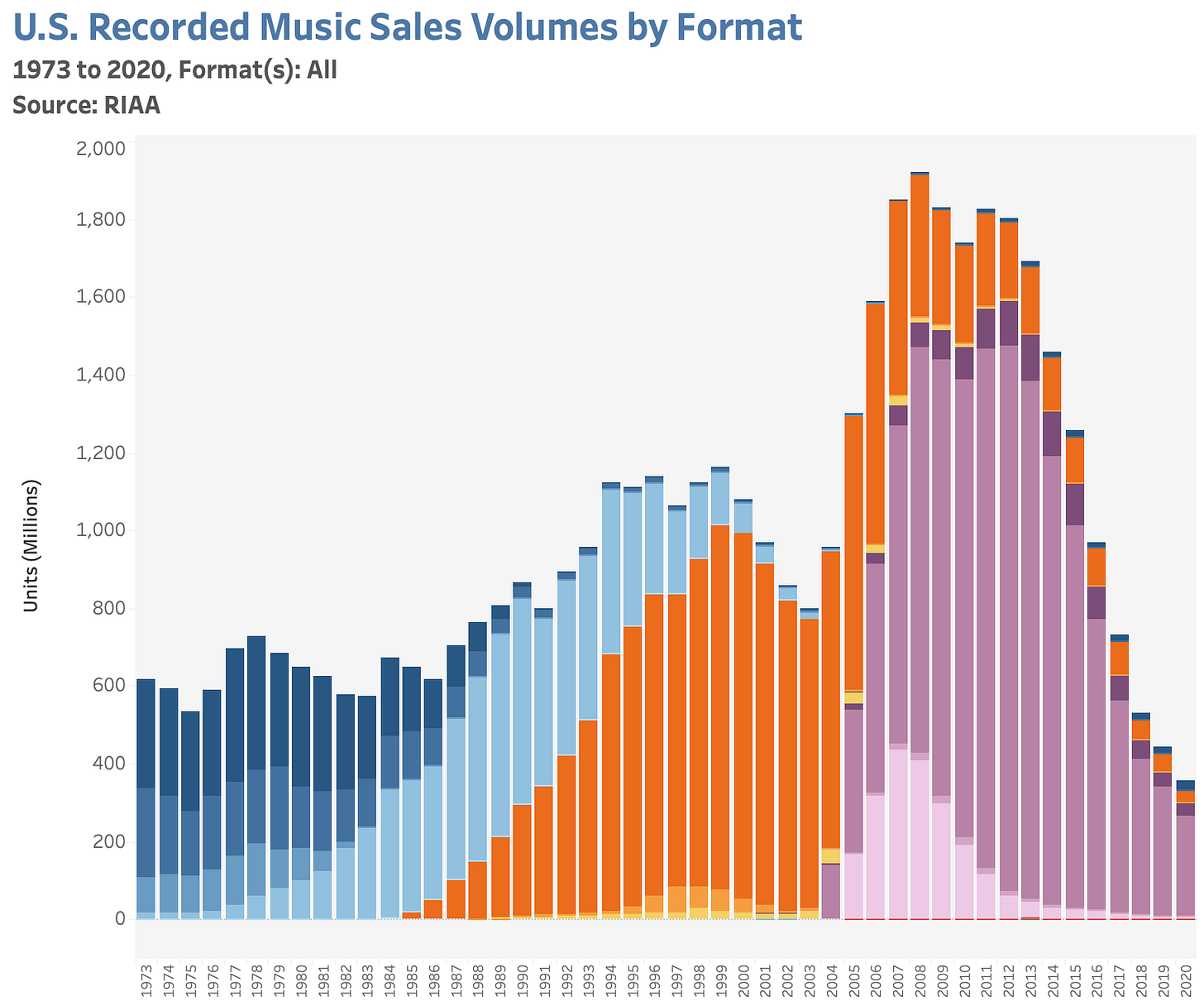

However, by cutting this deal, the music industry handed over a significant amount of power to determine the economic value of recorded music to Apple. iTunes unbundled the physical album and priced every song at $0.99. In doing so, music consumption became more commoditized. Instead of spending $12 on a CD, consumers could pick and choose the 1 to 3 tracks they really wanted to purchase and ignore the rest. The RIAA bears this data out (with blue bars indicating vinyl and cassettes, orange bars indicating CDs, purple bars indicating digital downloads, and streaming not a part of the below graph since it is technically a license as opposed to a purchase).

Listeners actually purchased significantly more music, on a volume basis, but purchased less on a value basis after the introduction of iTunes. I’ve summarized this shift between the industry’s CD sales peak in 1999 and its digital download peak in 2012 in the chart below. Between 1999 and 2012, US recorded music digital download and CD unit sales grew 70% from 939 million to 1.6 billion. At the same time, dollar sales decreased 68% from $12.8 billion to $4.1 billion. All together, the introduction of iTunes’ $1 single (78% of domestic industry sales volumes in 2012) had crushing economic consequences for artists and labels.

The next major economic shift in music consumption was driven by streaming services. Spotify, the poster child of the on-demand audio streaming movement, was founded in 2006 as a reaction to the piracy era. Daniel Ek, Spotify’s co-founder and CEO, has said that Napster’s impact drove the idea behind the company: “Laws can definitely help, but it doesn’t take away the problem. The only way to solve the problem was to create a service that was better than piracy and at the same time compensates the music industry. That gave us Spotify.”

For listeners, what makes on-demand streaming services like Spotify different from iTunes is their “all you can eat” economic model and ownership characteristics. Listeners can access millions of songs for free (with ads) or for a low monthly subscription fee (without ads). In many ways, this is an even better deal than digital downloads – access to an enormous catalog for less than $10 per month. That said, listeners license these songs from a streaming music service as opposed to owning them in a physical or digital download format.

For artists and labels, streaming has been an improvement but still is a mixed bag. On the positive side, the recorded music industry is growing again after 15 years of declines (depicted below). Streaming has been the primary driver of this growth, making up 62% of global recorded music sales in 2020. And whereas the industry was decimated by piracy in the early 2000s and did not have an ownership interest in Apple’s iTunes store, the major labels (Universal, Sony, and Warner) and independent label organization Merlin were granted small equity stakes in Spotify, which became very valuable.

On the other hand, there are still challenges with the streaming model and areas where it can be improved. Don’t get me wrong. I love Web2 streaming services. I’m writing this essay listening to John Prine’s back catalog, and Khruangbin’s Mordechai album. It took me less than 30 seconds to find and stream these songs. Like many users, I love accessing the entire history of music for $10 per month. That’s a phenomenal value proposition for the consumer.

First and foremost, music streaming is under-monetizing some users, primarily an artist’s biggest fans. Streaming makes music a commodity and fails to capture the full value associated with that fandom. MiDIA Research highlights this in a recent report:

“Streaming’s second-order effect is to turn much of music listening into sonic wallpaper, making it harder for artists to cut through. While the consumption value is still there, the connection and the commitment are lost. Fandom value is diminished and is progressively harder to convert to remuneration for artists. Getting consumers to ‘listen to songs’ is no longer the most optimal way of generating fans, or monetizing fandom.”

We’ll dive into this dynamic more in the next section, but the impact is that the recorded music market is not as big as it could be. Along these lines, even though recorded music is growing again, 2020 global recorded music revenues were below those realized in 2002 (even ignoring inflation). Creating pathways for digital artist-to-fan interaction, community building, and monetization has been missing from the streaming era.

At the artist level, the current streaming royalty payout model de-emphasizes fandom. Music streaming services like Spotify platforms pay royalties based upon a creator’s total share of all streams on a platform. For example, if Taylor Swift gets 5% of everyone’s streams on Spotify, Swift (and her label) gets 5% of the portion of your Spotify subscription that goes to artists regardless of whether you listen to any of her songs. Some research studies suggest that this benefits certain genres of music over others. Several industry pundits, such as Chris Castle, argue that platforms should adopt a user centric approach to support smaller and more niche creators.

Second, thought leaders like venture capitalist Li Jin have noted how the music middle class is hollow. streaming’s income distribution has been dominated by power laws with the top artists earning most of the streaming revenue. For example, of the roughly 7 million artists on Spotify, 43,000 artists (fewer than 1% of the total recording artists on the platform) make 90% of royalties paid out and just 13,400 (0.2%) make over $50K annually, the equivalent of a median wage worker in the US. Of course, there are other streaming platforms where creators can earn income, but Spotify is currently the most popular audio streaming service, making up 31% of subscribers worldwide. Assuming these 13K artists make the same on other streaming platforms, implies $150K of annual income just from streaming, which may sound somewhat reasonable. However, it’s important to remember that many artists are signed to labels and typically only receive 15% - 25% ($22K - $38K in this example) after labels are paid out. We will discuss this dynamic more below.

What’s more, music streaming services rake a relatively large amount of the income paid by its users. For example, Spotify’s take-rate is roughly 33%, which is high relative to other internet platform take-rates (see chart below).

Furthermore, many artists and songwriters sign label and publishing deals. After the streaming platform is paid, artists and songwriters are subject to a second rake from record labels and publishers. As a result, the majority of income flowing to “rights holders” ends up with labels and publishers, instead of a song’s creator. Goldman Sachs estimates that for every $10 spent on streaming, only $1.70 (10%-20%) ends up with artists and $0.60 (2%-6%) ends up with songwriters. In short, streaming has helped the recorded music industry return to growth, but its distribution of income is still not great for music creators. (For more information on the music middle class, check out my post from last year.)

In summary, the recorded music industry has struggled to effectively monetize the digital landscape over the past 20 years. Prior to the internet, the industry capitalized on technological innovations like the phonograph and its derivatives (e.g., vinyl, cassettes, CDs), which allowed musicians to create copies of their work and sell them in scarce and controlled quantities. However, the internet disrupted this model, introducing a low price and infinite supply for digital music content regardless of a consumers’ level of fandom. Rather than experimenting and embracing new business models that introduced digital scarcity, the industry initially resisted and subsequently acquiesced, entering two decades of decline. Today, streaming has helped return the industry to growth. But its economic model still positions music as a commodity, resulting in an industry that, in my opinion, is smaller than it otherwise could be.

Lessons from Gaming: Whale Hunting vs. Aggregation Theory

Whereas the recorded music industry has struggled to grow revenues amidst technological shifts over the past 20 years, the video gaming industry has gone from strength to strength. According to Newzoo, there are currently 2.7 billion gamers (5x the number of music streaming users) and the industry generates $175 billion annually (8x that of the global recorded music industry). Whereas IFPI estimates global streaming revenue per paid subscriber at only $30 per year, the average gamer spends $65 per year. There aren’t many $100+ billion industries capable of growing 10%+ annually. To that, gaming says “watch this.”

The growth in gaming over the past 10 years has been driven by mobile gaming, which increased at a 25% CAGR between 2013 and 2019. The majority of games on mobile with substantial revenues implement a free-to-play (“F2P”) revenue model. Before the internet, video games, like music, were primarily sold as boxed products. The introduction of smartphones and mobile app stores allowed F2P games to take hold. This flipped the traditional gaming model on its head. Rather than an upfront purchase for content, gamers can download and play a game for free with developers monetizing via advertising and in-app purchases (“IAP”) of virtual items.

It has taken years for F2P best practices to solidify, with game economists and designers constantly managing these economies to generate as much revenue as possible from players. Along these lines, game designer and industry analyst Jon Radoff has written about “The Live Games Trinity”. This framework describes how F2P games attract, retain, and monetize users.

Content Train: the importance of building community through regular content updates

Live Events: engaging community by delivering scarce, real-time events

Monetization: converting community attention into purchases

This F2P flywheel is centered around concepts including digital scarcity, community building and management, and ongoing user monetization. This revenue model focuses on turning attention into revenue. It works so well for several reasons, including:

It maximizes the number of users who will try the game since it’s free

It designs moments of scarcity to incentivize purchasing

There is no cap on the amount a user can spend

It fosters community so that users have less of an incentive to churn

What’s interesting about F2P games is that a small number of users account for the lion’s share of F2P gaming revenue. According to Wappier, fewer than 2% of mobile F2P users actually make in-app purchases with some so-called “whales” spending upwards of $35 - $70 per day.

In short, a project’s most profitable users, while small as a % of total users, can contribute a meaningful amount to total revenue. The below chart is illustrative and represents spending in one F2P gaming project. 5% of players spent 50% of the money and 20% of players spent 75% of the money.

While mobile F2P’s impact on gaming industry revenues has been significant, it’s important to note that F2P games, in several instances, have been criticized for implementing predatory, gambling-like mechanics to monetize the small percentage of paying users. There is at least some difference between creating a fun game that incorporates mechanics to monetize user’s love of the experience and creating a manipulative game that incorporates mechanics to exploit users’ psychological tendencies.

Regardless, the F2P business model has expanded beyond mobile with many traditional publishers adopting F2P monetization practices for their key franchises and acquiring mobile F2P companies to take a share of this fast growing market segment. Indeed, the sale of virtual items has been extended to premium titles too, resulting in the percentage of game revenues derived from virtual items growing from 20% in 2010 to 75% in 2020.

The emergence of the F2P gaming business model is fascinating, especially when juxtaposed to that of music streaming. In my opinion, music streaming platforms have attempted to run an aggregator playbook. Media and technology industry analyst Ben Thompson defines Aggregation Theory as companies that have the following characteristics:

Direct Relationships with Users: This may be a payment-based relationship, an account-based one, or simply one based on regular usage. For music streaming, a user creates a streaming account and then logs in each time (or remains logged in).

Zero Marginal Costs for Serving Users: The goods sold by aggregators incur zero marginal or distribution costs. Transactions occur automatically through credit card payments or automatic account management. These are true of music streaming with the exception of marginal costs (royalties paid to music rights holders), which are significant. We’ll address this in more detail shortly.

Demand-driven Multi-sided Networks with Decreasing Acquisition Costs: Digital goods allow for infinite supply, meaning users reap the most value from discovery and curation. As a result, aggregators typically place their focus on content discovery. Then, once an aggregator has gained a large number of users, suppliers begin coming onto the aggregator’s platform on the aggregator’s terms, effectively commoditizing suppliers. Additional suppliers then make the aggregator more attractive to more users, which in turn draws more suppliers, in a virtuous cycle.

Indeed, like other aggregators, music streaming platforms have designed their product to attract and retain as many users as possible. Once users are aggregated, these platforms aim to leverage their direct relationship with a large number of users to enable a lower cost of supply (e.g., content owned by labels and artists) and higher advertising revenues and/or subscription fees. The aggregation playbook is different from that of F2P. Whereas F2P mobile games design economies to monetize a few “whales”, music streaming platforms are designed to appeal to and assemble as many users as possible.

Along these lines, Spotify has sought to provide the best value possible to its users and it has worked. Monthly active users have increased 2.3x to over 400 million since 2018 while the average monthly revenue per premium subscriber has declined 7% to €4.40. Part of the decline in ARPU can be attributed to Spotify’s expansion in emerging markets. Still, to grow their user bases, streaming platforms have focused on lowering subscription prices, providing access to massive amounts of recorded music content, investing in exclusive podcast content, and developing user-focused playlists, among other things. This trend has been a point of tension between streaming services and the industry, with artists and labels often speaking out about streaming undervaluing their work. Despite Taylor Swift and Kanye West’s prior beef, they both, at some point, have agreed that streaming undervalues the value of music. Swift famously pulled her music off Spotify in 2014. West recently launched his own audio hardware device, Stem, and announced his next album, Donda 2, will be featured solely on the device (at least for some time): “Today artists get just 12% of the money the industry makes. It’s time to free music from the oppressive system. It’s time to take control and build our own.”

In the context of running an aggregation playbook, the strategy by streaming services makes sense. However, Ben Thompson has pointed out that there is an inherent problem applying Aggregation Theory to the music industry. The importance of recorded music back catalogs, controlled primarily by the three largest record labels, to end users enables record labels to retain meaningful leverage during royalty rate negotiations with streaming platforms.

“Spotify is in one sense an aggregator, in that it increasingly controls access to music listeners, and to the company’s credit, it has demonstrated the ability to exercise power via its control of music discovery and popular playlists…. Being a true aggregator, though, means gaining power over supply; Spotify doesn’t have that — the company doesn’t even have control over its marginal costs — and it’s hard to see where the profits come from.”

That said, music streaming services, like Spotify, still command a relatively high take-rate relative to other internet marketplaces. Regardless, there are signs that music streaming services are acknowledging the opportunity of monetizing super fans. For example, Spotify CEO Daniel Ek talked about the addition of 20 features in his 2Q 2021 letter to shareholders, aiming to turn more “listeners into super fans”. The company also recently launched the Open Access Platform that allows podcasters (but not musical artists yet) to launch paid individual subscriptions for their content. On the company’s 4Q 2021 earnings call, Ek went even further on his plans to hunt music’s “whales”:

“But I think the evolution here will be about unlocking through superfans. That's where the real dollars come in. And that was always the music business to begin with. And when we unlock that, I think we'll unlock the next wave of growth in the music economy. So for me, that is the #1 thing that I'm focused on unlocking, more flexibility, more ways for creators to use their assets, videos, engage with people, have their content show up in new unexpected ways.”

In short, Chris Dixon’s Twitter thread highlights the fact that gaming figured out how to monetize digital fandom at scale and (so far) music hasn’t. The F2P gaming industry successfully created digital scarcity, built communities, and monetized the biggest spenders. Unlike gaming, the music industry has struggled to successfully adapt to recent technological disruption with industry revenues remaining below the 20-year-old peak. The major music streaming services have failed to unlock the promise of digital super fans. But the winds appear to be changing. Platforms, like Spotify, are finally acknowledging the importance of fandom. At the same time, another era of tech innovation is unfolding with the emergence of Web3, and unlike last time, music rights holders and the broader music industry are more engaged.

What could Web3 mean for the Recorded Music Industry?

As discussed, the recorded music industry has struggled to adapt its business model to technological change, especially relative to other media categories like gaming. And while streaming has helped industry revenues return to growth, the recorded music market size remains well below that of 20 years ago on an inflation adjusted basis. This is in no small part due to the commoditization of digital music. I don’t think music streaming is going anywhere; after all, it’s an amazing value proposition for consumers. But music’s failure to successfully create digital scarcity and monetize fandom at scale may be changing. If successful, the recorded music industry pie will expand, providing more income for labels and artists.

First off, the industry is getting its arms around more potential digital use cases. Record labels are forming partnerships with and making investments in gaming and other successful Web2 companies. For example, Warner Music Group’s investment in Roblox came shortly after one of its artists, Lil Nas X, performed a virtual concert in video game platform Roblox that generated over 30 million views. Meanwhile, Sony has invested in Epic Games, the maker of Fortnite, after Sony distributed artist (via Epic Records) Travis Scott performed a concert in Fortnite that generated over 45 million views. As a result of these strategic moves, labels are starting to generate more income from “alternative” digital platforms, such as TikTok, Peloton, Facebook, Fortnite, Roblox, and others. Along these lines, Warner recently announced $235 million annualized revenue from these platforms, equating to ~4% of Warner’s total annual revenues. Applying Warner’s 16% market share to this number implies these alternative platforms are potentially contributing $1.5 billion per year to industry revenues.

But the real promise for the industry, especially music creators, may lie with the emergence of blockchain technologies and Web3. To understand why, let’s quickly unpack what we mean by Web3 for those who aren’t already familiar. Decrypt’s Web3 explainer defines it as “the next major iteration of the Internet, which promises to wrest control from the centralized corporations that today dominate the web.”

For context, the early internet or Web1 allowed users to “surf” and browse content easily. Web1 was decentralized (powered by regular computers), open-source (anyone could build on it freely), and read-only (very few people had the technical skill to publish on it). In the mid-2000s, websites such as Facebook and YouTube emerged. These Web2 companies allowed anyone to publish content online regardless of their technical skill. However, whereas the hallmark trait of the internet and Web1 was its decentralization and democratization of information, Web2 companies have sought to run aggregator playbooks.

As a result, information in Web2 is increasingly siloed and controlled by a handful of large tech companies. For example, a select few companies have an outsized share of the world’s cloud infrastructure market with over 65% controlled by Amazon, Microsoft, and Google. Shifting from data storage to web traffic, Facebook has 2.9 billion monthly active users, equivalent to more than 60% of the world’s 4.7 billion active internet users. Simply put, a few companies effectively control what people see and do on the web. This centralization results in several issues, including:

Economic issues – Value accrues to intermediaries (i.e., aggregators) and by extension a small group of individuals (e.g., management, employees, and shareholders) rather than users or creators. Meanwhile, many intermediaries, such as music streaming services, charge their participants high take-rates, as we highlighted earlier in this piece

Societal issues – Web2 companies typically monetize user data. This can lead to user privacy and data privacy issues. Putting this together, in Web2, trust is largely in the hands of the largest technology companies. For example, Facebook has been accused of putting engagement ahead of user well-being and ethical considerations.

Distribution issues - In Web2, aggregators control distribution and how users connect with their friends. For creators whose businesses sit on top of these platforms, this can have significant implications. For example, mobile video streaming app Meerkat was effectively banned from Twitter, because it competed with Periscope, a similar app that Twitter had recently acquired.

Ultimately, these issues boil down to trust. In Web2, users and content suppliers place trust in the hands of large technology companies.

Among its proponents, Web3 is seen as a decentralized evolution of the internet, where the decentralized and community governed aspects of Web1 are combined with the modern functionality of Web2. It’s an effort to “fix” the trust issues associated with Web2, by building applications on a system architecture that allows for transactions to be recorded in a decentralized, open, and secure manner.

The main difference between Web2 and Web3 are Layers 0 through 2. The idea is that this architecture allows users to own and control their data; provides a secure and verifiable public record of what users own (a blockchain); and allows users to take what they own with them wherever they go on the web.

The conditions of this system allow for true digital ownership to be layered on top. Whereas Web2 aggregators generate most of the value and this money flows to its shareholders, Web3 seeks to move money to the people who create, use, and maintain the network. In short, Web3 reduces the aggregator’s importance in the system and the implications of where value can accrue are profound.

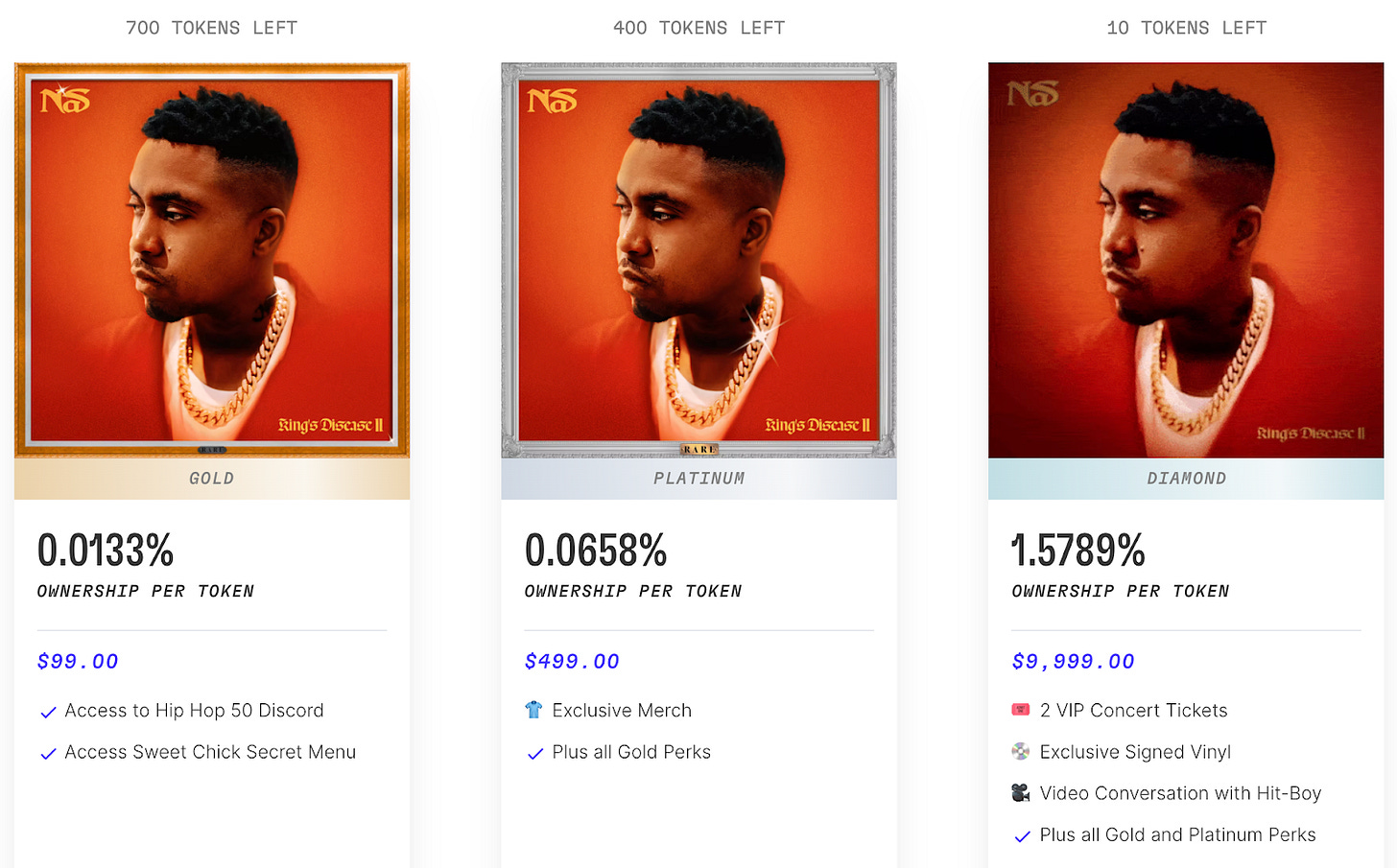

The value created in Web3 accrues to tokens (as opposed to equity). For music, non-fungible tokens (“NFTs”) are especially important because they prove authenticity, ownership, and scarcity of digital assets. This is a major unlock for the music industry because it finally opens up the possibility for digital scarcity. Whereas the internet created an environment where music content is priced the same and in infinite supply, NFTs allow music rights holders to create digitally scarce assets.

To be clear, I don’t think Spotify and Apple Music are going anywhere. I think revenues associated with music NFTs can be complementary – as a means to monetize fandom – to streaming. As a result, rights holders can capture more value per fan. And this new revenue stream has the potential to drive significant future industry growth.

In addition, there could be implications for recorded music’s existing power structure. As artists are able to monetize their 1,000 true fans (i.e., whales), the dependence on record label advances may decrease with leverage in contract negotiations increasing in creators favor. As a result, artists can not only earn a new Web3 revenue stream via NFTs but also achieve better revenue splits with their record label on streaming, vinyl, CD, etc. income. Simply put, Web3’s economic model can potentially give artists a better shot at earning a living wage.

Before going further, it’s important to mention that there are several strong critiques of the Web3 vision. Among other things, these (thoughtful) critics point out that Web3 projects are often centralized with regards to ownership and technology reliance. These critics argue that trust – the fundamental benefit of Web3 – is just moving to new parties, instead of being decentralized and thereby returned to users and creators. If you haven’t already, it’s worth reading thought leader Packy McCormick’s piece rebutting these criticisms. In it, McCormick argues that Web3’s open data allows users to choose which platform to use. So even if a platform is more centralized, its moat is less secure than in Web2 and is dependent upon continued community buy-in.

The value of token assets, in general, grew exponentially in 2022. According to DappRadar, NFT sales volumes hit $25 billion in 2021, compared to $95 million in 2020. For music NFTs specifically, it is still a relatively small category within the broader NFT space. For example, NFTGO reports a total value across music NFT assets of $69.2 million compared to $2.2 billion for collectibles and $8.4 billion for profile picture projects. That said, there have been several promising developments over the past 12 months. They include:

Electronic music artist 3LAU sold 33 NFTs in an auction for $11.7 million.

Kings of Leon became the first band to release an LP as an NFT, generating $2 million.

Veteran DJ and producer Steve Aoki sold an NFT for ~$900K and said that he has earned more from his NFT drop than 10 years of music advances.

Music NFT platform sound.xyz has helped over 50 independent artists raise over $500K from more than 750 unique collectors / fans.

Rapper Nas sold ~$500K of NFTs that entitle owners to merchandise, perks, and a share of royalties in two of his songs, Rare and Ultra Black.

Web3’s music ecosystem is growing rapidly. Whether it’s NFT collectibles (e.g., Catalog, Zora, Sound.xyz, Royal), streaming services (e.g., Audius), music-focused research organizations (e.g., Water & Music), or even labels (e.g., Good Karma Records), Web3 music projects are spinning up quickly. And the potential impact of these projects, especially for lesser known independent artists, can be massive. For example, artist Daniel Allan launched an NFT collection on sound.xyz and raised $11K – the equivalent of 2 to 4 million streams depending upon the prevailing per stream rate – in under thirty seconds. This type of outcome is unthinkable in the current streaming economic model for an artist like Allan, who has less than 5k Twitter followers and 130K monthly Spotify listeners. It’s an exciting time. Infrastructure, tools, talent, and capital are all needed to improve the economic value of digital music and provide artists more direct access to their biggest fans.

At the same time, the recorded music industry’s incumbent players are not sitting idle. On a recent earnings call, Warner Music Group CEO Stephen Cooper emphasized this promise: “We're more convinced than ever that Web3 will be one of the next steps in the evolution of the music ecosystem.” For example, Warner has announced partnerships with music NFT platform OneOf and blockchain gaming company Splinterlands to make games for its roster of artists. It has also invested in NFT avatar platform GENIES with Universal Music. Going a step further, Universal has announced its intention to start an NFT music group after purchasing Bored Ape Yacht Club NFTs. Meanwhile, Sony Music invested in NFT platform MakersPlace, which facilitated the $69 million sale of Beeple’s digital art piece EVERYDAYS: THE FIRST 5000 DAYS. Clearly, the major record labels see the opportunity for an exciting new growth driver. And unlike the Napster days, they appear much more willing to embrace this technological change.

How labels fit into the Web3 ecosystem – other than providing Web3 projects’ capital and access to its existing catalog – remains to be seen. Labels typically offer artists access to distribution, capital, and marketing. In the streaming era, the distribution piece has lost its importance. And if decentralized applications are more widely adopted, artists will seemingly have easier access to capital. On the same earnings call, Warner CEO Stephen Cooper argued that labels can help artists implement Web3 best practices to optimize revenue and to avoid the myriad of scams that currently exist. This makes some sense and exists today in gaming with blockchain service companies like Forte, Venly, and others helping developers stand up projects on the blockchain. However, these are crypto-native projects and teams; not legacy gaming companies. In my opinion, music will follow a similar path, with crypto-native music projects (rather than legacy labels) providing a suite of services & tools to major label and independent artists. For example, sound.xyz, Royal, and other music NFT platforms already help educate artists as well as mint tokens. Meanwhile, fungible token projects, like Rally.io, already offer artists assistance with launching their token economies. Simply put, if blockchain user adoption really takes off, it would not be surprising to see major record labels acquire or take larger stakes in blockchain music service companies.

What are the Barriers to Adoption?

Web3 gives the recorded music industry a lot to be excited about. But it is still early. There are several barriers to greater blockchain music adoption. They include:

Politics and regulations: In the U.S., lawmakers are increasing their focus on cryptocurrencies with the Biden administration reportedly preparing a government wide strategy. Regulatory uncertainty will likely keep some artists and users on the sidelines for now. And increased regulation could impact future adoption rates.

Intellectual property laws: Industry participants will have to navigate IP laws and figure out how to manage copyrights in new use cases. The rights associated with NFTs differ by collection, but generally grant the buyer a right to the token itself and not the underlying IP. Artists and their teams will need to make sure that any tokens minted are avoiding infringement issues.

Few superstar projects: There have been a handful of music superstar projects. But so far, most projects have been launched by independent or emerging artists experimenting in the space to date. If/when more stars launch projects, there is a greater chance for more users to enter the Web3 ecosystem.

Need for greater artist and user education: The Web3 rabbit hole is deep and requires educating both artists and their communities on its potential benefits. As a cautionary tale, the gaming space has seen a lot of push back from users who oppose the introduction of NFTs in gaming franchises. Some gaming projects have even walked back NFT announcements entirely after fan outcries. Music NFTs have seen relatively less hate, with the Verge writing a great article that attributes this, in part, to music positioning NFT sales as helping artists versus a gaming company. It is also likely that a lack of familiarity with digital scarcity is at play on the music side. Sure, gamers listen to music too, but in the streaming era, no one is really used to scarce digital music content. It reminds me of the episode of The Office where Michael Scott visits NYC from Scranton and goes to his “favorite New York pizza joint” – a Sbarro. If you’re a gamer (New Yorker), you may view gaming NFTs as just another ploy by publishers to introduce scarcity to extract value (chain pizza place). But if you’re a music fan (Scrantonite), you probably aren’t used to the monetization of digital scarcity, so it seems novel and exciting (a New York Sbarro slice!). Regardless, for music rights holders, the focus should be on building a long-term community rather than on short-term value extraction.

Complex user experience: The user experience of buying NFTs is often complex and time consuming. Set up a Coinbase account, buy some ETH, set up a Metamask account, transfer the ETH from Coinbase to Metamask… and I haven’t even included the extra steps to transact on a lower cost Layer-2 blockchain like Polygon. Some platforms, like Royal, are introducing credit card purchases. As it becomes easier for users to onboard and for the complexities of blockchain to occur behind the scenes, adoption of music NFTs and fungible tokens should benefit.

High and volatile transaction costs: Given throughput constraints, popular blockchains, like Ethereum, can experience high transaction fees (called “gas fees”) when throughput is high. High gas fees disincentivize the buying and selling of lower priced music NFTs as any potential profits are eliminated.

Fragmented Distribution: Unlike music streaming (Spotify and Apple Music), the distribution of music NFTs is fragmented creating more friction for users who want to discover and purchase a new NFT collection.

Environmental Impact: Popular blockchains, such as Ethereum, currently use a proof of work system to verify transactions, which requires significant energy usage. Ethereum has announced it will transition to proof of stake this year in order to improve its environmental footprint (amongst other benefits), but we’ll see if this general launch date is met. Regardless, the large environmental impact of proof-of-work blockchains is partially mitigated by the emergence of alternative blockchains (both Layer-1 and Ethereum Layer-2 chains) that use more environmentally friendly consensus mechanisms to approve transactions.

In summary, there are numerous barriers that must be overcome before we see widespread adoption of music NFTs. These include macro issues with regards to politics and IP laws; infrastructure issues with regards to complex user experience, high transaction costs, and environmental concerns; and a general lack of education among users and creators. Nevertheless, I believe many of these issues will be overcome with time and rights holders will eventually be able to realize a greater amount of the value associated with music fandom.

Final Thoughts

The recorded music industry has experienced two decades of watching their art become commoditized on the internet. To date, large technology companies – that design the products and systems driving the growth of the recorded music industry – have prioritized the aggregation of users at the expense of optimizing the monetization of each individual artist’s fans. However, the recorded music industry may be on the cusp of change. The financialization of digital assets could unlock a valuable new revenue stream for music rights holders. An artist’s 1,000 true fans may finally be able to express how valuable they find that artist’s digital content. NFTs – whether they be art, gaming, collectibles, or music – are quickly becoming a large asset class, but there are still only a small subset of participants. Coinbase has 73 million verified users. Metamask, a popular crypto wallet, has just over 20 million users. Meanwhile, there are 2.7 billion gamers and over 440 million paid music streamers. Again, it is too early to know if mass adoption of decentralized Web3 technologies will be realized. In the coming decades, recorded music industry revenues could benefit greatly from this trend. At the same time, the existing industry economic model could be altered and tilt in favor of creators.

Returning to how we started this piece, we’ll exit with the exchange between Neo and Morpheus after the truth of the Matrix is revealed:

Neo: “I can’t go back, can I?”

Morpheus: “No. But if you could, would you really want to?”

Thanks to Hannah, Adam, and Tomas for the feedback, input, and editing!

sbarro slice reference was super niche

Jimmy- congratulations on an in-depth and edifying piece!